What's Affecting Markets Today

Fortescue sinks on $1.9B Block Trade

JPMorgan sought buyers for $1.9 billion of discounted Fortescue stock post-Monday’s close for an undisclosed institutional investor. Bidding was in 5¢ increments from $18.55 to $19.10 per share, an 8.8% to 6.1% discount to the last close, representing 3.2% of the $62.6 billion company. The book closed at 8pm for Asia Pacific investors and 1am for others, with JPMorgan as the sole bookrunner. Speculation pointed to The Capital Group, which sold $1.1 billion of Fortescue stock in June at $21.60 per share. The seller agreed to a 45-day lockup. Institutional investors seem wary of Fortescue due to C-suite issues, rising costs, slumping iron ore prices, and abandoned hydrogen ambitions. Fortescue reported a decline in export volumes and saw several key executive departures. Shares have fallen 30.8% year-to-date.

BHP and Lundin Increase Copper exposure with Filo acquisition

Index heavyweight BHP dropped 1.3 per cent on news the mining giant and Lundin Mining will jointly acquire Toronto listed copper miner Filo Corp. BHP’s total cash payment for the proposed transaction is expected to be $US2.1 billion ($3.2 billion).

Just seven weeks after abandoning his $75 billion takeover of Anglo American, BHP chief executive Mike Henry has resumed his pursuit of copper. The new deal announced on Tuesday is distinct from the Anglo bid, which targeted Anglo’s Quellaveco mine in Peru. Under the new agreement, BHP will invest $US2.1 billion ($3.2 billion) to form a 50:50 joint venture with Canada’s Lundin family. This venture will provide BHP a stake in two prospective copper projects located high in the mountains on the border of Argentina and Chile.

Microsoft and Healthcare Giants Report Earnings Tonight

The worlds biggest company, Microsoft reports earnings on tonight, investors will focus on whether Azure’s growth, expected to remain steady at 31% from April to June, justifies its heavy investment in AI infrastructure. Azure’s AI segment contributed 7 percentage points to its growth in the previous quarter. Microsoft’s capital spending likely surged 53% year-over-year to $13.64 billion, up from $10.95 billion the prior quarter. Concerns linger that the substantial spending on data centers by tech giants may not yield immediate returns, impacting market optimism about earnings growth.

Healthcare giants P&G, Pfizer and Merck all report earnings before the US market open, with investors hopeful that the current hot streak of the sector continues

ASX Stocks

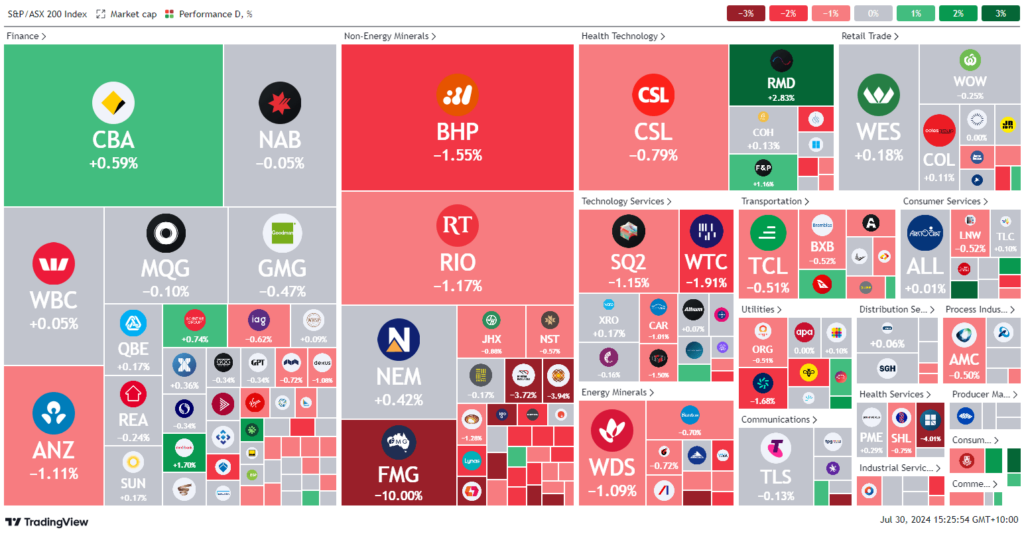

ASX 200 - 7,952 (-0.47%)

Key Highlights:

A sharp sell-off in mining giants dragged the Australian sharemarket lower on Tuesday. The S&P/ASX 200 Index dropped 0.5%, or 37.8 points, to 7951.8 by 4pm, with eight of 11 sectors in the red. The materials sector was the worst performer, sliding 1.8%. BHP fell 1.3% amid news it and Lundin Mining will acquire Filo Corp., with BHP’s cash payment at $US2.1 billion. Fortescue Metals tumbled 9.4% due to a massive block trade reported by the Australian Financial Review.

Energy stocks weakened as Brent crude dipped below $US80 per barrel.

Investors remained cautious ahead of policy decisions from Japan, the US, and the Bank of England, and Australia’s quarterly inflation report. Major earnings reports from Microsoft, Meta, Apple, Amazon, and Rio Tinto are due this week.

Leaders

CCP – Credit Corp Group Ltd (+14.24%)

SLC – Superloop Ltd (+4.71%)

GDG – Generation Deve. Group Ltd (+4.38%)

QOR – QORIA Ltd (+4.35%)

IEL – IDP Education Ltd (+4.23%)

Laggards

ERA – Energy Res. of Australia Ltd (-42.86%)

FMG – Fortescue Ltd (-9.44%)

BRN – Brainchip Holdings Ltd (-8.54%)

PMT – Patriot Battery Metals Inc (-7.69%)

ENR – Encounter Resources Ltd (-7.69%)