What's Affecting Markets Today

Asian markets weaker

Most Asian stocks fell on Friday as a rally prompted by cooling U.S. inflation data fizzled, while Japanese shares rose following the Bank of Japan’s (BOJ) unexpected decision to maintain its bond buying program. Chinese markets were the worst performers due to new European Union tariffs on major Chinese electric vehicle makers, raising fears of retaliatory measures from Beijing. Despite record highs in the S&P 500 and NASDAQ Composite, broader U.S. stock index futures were muted in Asian trade.

Japanese indices, the Nikkei 225 and TOPIX, increased by 0.7% and 0.3%, respectively, as the BOJ announced no immediate changes to its bond purchases, hinting at a potential reduction plan for late July. This suggested a continuation of Japan’s loose monetary policy, favorable for local stocks. However, doubts remain about the BOJ’s ability to tighten policy due to economic weakness.

Chinese indices, including the Shanghai Shenzhen CSI 300 and the Shanghai Composite, fell 0.6% and 0.4%, respectively, while the Hang Seng index dropped 0.6%, affected by the EU’s steep tariffs on Chinese electric vehicles, with SAIC Motor Corp Ltd hit hardest. Broader Asian markets saw declines, with Australia’s ASX 200 down 0.3% and India’s Nifty 50 futures indicating a flat open. South Korea’s KOSPI rose 0.3% on sustained strength in technology stocks.

ASX Stocks

ASX 200 - 7,724.9 (-0.32%)

Key Highlights:

The ASX drifted lower to end the week after a week of confusing signals and data.

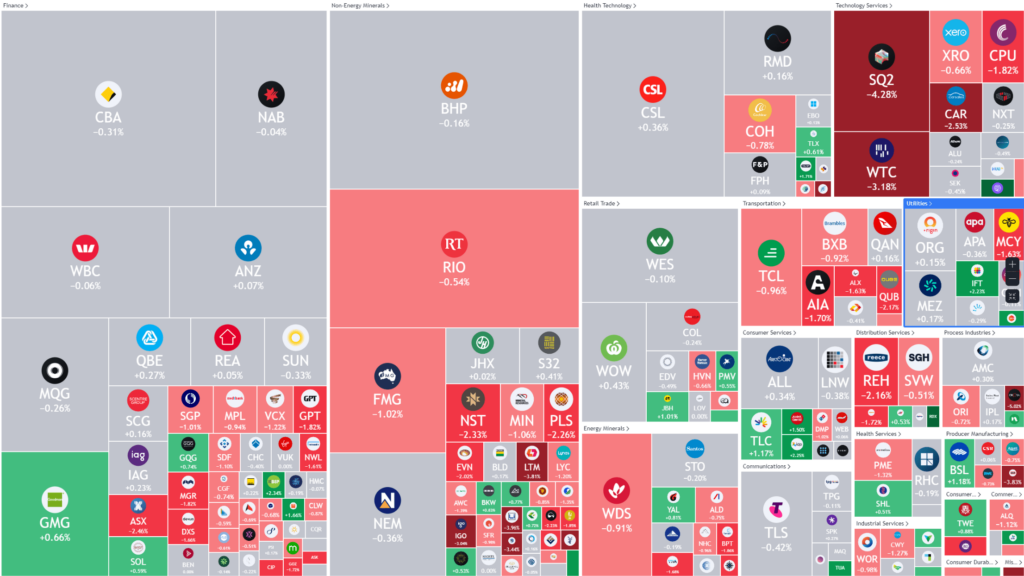

The gold & lithium stocks performed the worst with Northern Star (NST) and Pilbara (PLS) falling around 2%. There was no clear sector winner on the day with individual stock news being the major influence

Tabcorp (TAH) rose 9% as NSW regulators looked to tax their competitors to “level the playing field”

Judo Bank (JDO) jumped 6% on luring APRAs head of banking supervision to the company as Chief Risk Officer.

Uranium stocks had a bounce with Boss energy jumping 4% early on news that its operation in Texas has gone into production

We remain very cautious at these levels as underlying global equity market weakness is being covered up by 2-3 Mega cap AI stocks in the US.

Leaders

TABCORP Holdings Ltd: 9.66%

ZIP Co Ltd.: 8.94%

Life360 Inc.: 6.30%

Judo Cap Holdings: 6.11%

Nuix Limited: 4.79%

Laggards

LRS: Latin Resources Ltd -9.30%

SXG: Southern Cross Gold -7.87%

DRR: Deterra -6.84%

RSG: Resolute Mining -5.45%

ORA: Orora Limited -5.12%