What's Affecting Markets Today

Asian markets mixed. ECB hints at rate cuts

Asia-Pacific markets showed mixed results on Tuesday as investors weighed comments from European Central Bank officials hinting at potential rate cuts for the eurozone. Japan’s Nikkei 225 dipped by 0.16%, while the Topix remained nearly unchanged. South Korea’s Kospi saw a slight increase, and the Kosdaq rose by 0.36%. Hong Kong’s Hang Seng index climbed 0.64%, while China’s CSI 300 index fell by 0.26%.

Olli Rehn, ECB governing council member and head of Finland’s central bank, highlighted in a Monday speech that eurozone inflation was decreasing steadily, suggesting that June might be the right time to ease monetary policy and initiate rate cuts. April’s eurozone inflation held steady at 2.4%, marking the seventh consecutive month below 3%. ECB Chief Economist Philip Lane noted there is sufficient evidence to reduce restrictions, ahead of the ECB’s June 6 meeting. Markets now anticipate a likely quarter-percentage-point cut from the current 4% rate.

ASX Stocks

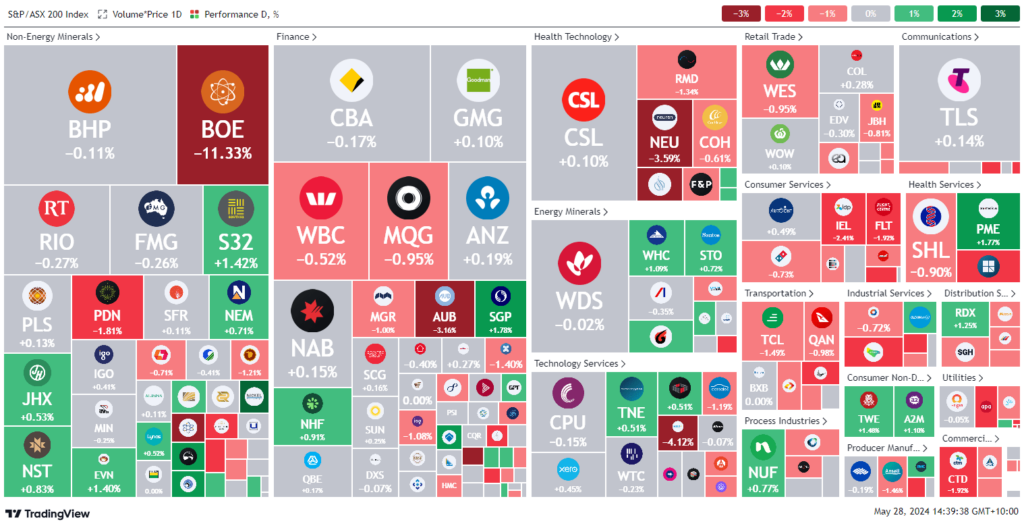

ASX 200 - 7,767.9 (-0.3%)

Key Highlights:

The S&P/ASX 200 fell 0.2% in early afternoon trading as rising prices for oil, copper, silver, and gold boosted the energy and materials sectors. These gains were offset by declines in banking, retail, and healthcare, amid a lack of direction due to Wall Street’s closure for Memorial Day. Australian retail sales for April slightly missed expectations, rising just 0.1% month-on-month.

Gold prices increased by 1.5% to $US2353 an ounce. Newmont Gold gained 0.8% to $63.85, while Evolution Mining rose 1.9% to $4.01. South32 advanced 1% to $3.92. The uranium sector lagged, with Boss Energy dropping 9% to $4.85 following significant share sales by its CEO.

Oil prices rebounded ahead of an OPEC+ supply meeting and the start of the US summer driving season. The Australian dollar rose 0.5% to US66.7¢, buoyed by higher commodity prices and a lift in US equity futures.

Noteworthy stocks included Peter Warren Automotive, down 9.6% to $1.94 on a profit warning, Pro Medicus, up 2.7% to $116.31 with new US contracts, and Playside Studios, up 13.8% to $1.03 after raising its EBITDA guidance.

Leaders

SPR Spartan Resources Ltd 9.03%

MSB Mesoblast Ltd 6.49%

SNL Supply Network Ltd 5.86%

RPL Regal Partners Ltd 3.54%

NIC Nickel Industries Ltd 3.48%

Laggards

BOE Boss Energy Ltd -11.42%

ERA Energy Resources of Australia Ltd -6.12%

CEN Contact Energy Ltd -6.02%

CTT Cettire Ltd -5.34%

HLS Healius Ltd -4.62%