What's Affecting Markets Today

Fletcher Building, a prominent construction group, witnessed a significant 11% drop in its stock value following a reduction in its fiscal 2024 earnings guidance. The company attributed this decline to a “notable slowdown” in New Zealand house sales and a faltering property market in Australia.

Similarly, Lendlease, a key player in the property sector, saw its shares decrease by 3.7% after the Australian Taxation Office imposed a $112 million tax bill. This financial hit is tied to an ongoing tax dispute concerning its retirement living operations.

The broader share market also experienced a downturn in the early afternoon, led predominantly by a slump in the energy sector. This sector’s decline contributed to a broader market dip, as investors anticipate the forthcoming federal budget, which might influence the Reserve Bank to maintain high interest rates to address inflation concerns. Treasurer Jim Chalmers is expected to introduce the Labor government’s third federal budget, focusing on cost-of-living adjustments and aiming for a second consecutive budget surplus.

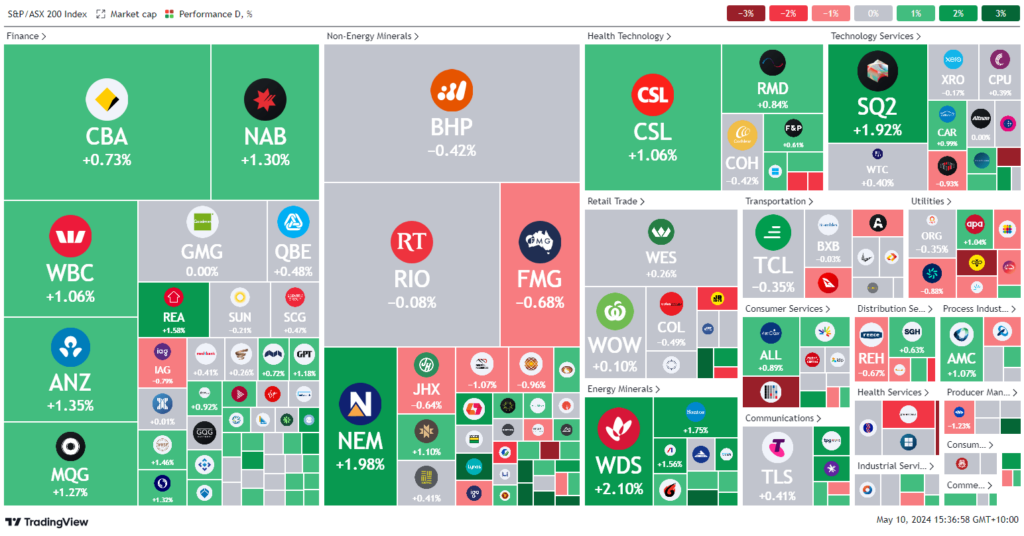

The S&P/ASX 200 index fell by 0.2% to 7730.8, interrupting its recent positive trajectory, despite a 1.6% increase the previous week. The All Ordinaries index also registered a 0.3% decline. Out of the 11 market sectors, seven noted reductions, although consumer discretionary stocks performed well.

Banking stocks displayed varied results; ANZ dropped 3.4% after trading ex-dividend and amidst scrutiny over potential manipulation of government debt sales. Westpac declined by 0.4%, while NAB remained stable, and CBA saw a 0.5% increase.

The mining sector presented a mixed performance, with BHP gaining 0.5%, whereas Rio Tinto and Fortescue Metals declined by 0.5% and 0.7%, respectively. Energy stocks were adversely impacted by falling oil prices, driven by concerns over fuel demand, resulting in declines for companies such as Santos, Woodside, and Whitehaven Coal by 1.2%, 0.8%, and 0.2% respectively.

ASX Stocks

ASX 200 - 7,717.3 (-1.10%)

Key Highlights:

Fletcher Building, a prominent construction group, witnessed a significant 11% drop in its stock value following a reduction in its fiscal 2024 earnings guidance. The company attributed this decline to a “notable slowdown” in New Zealand house sales and a faltering property market in Australia.

Similarly, Lendlease, a key player in the property sector, saw its shares decrease by 3.7% after the Australian Taxation Office imposed a $112 million tax bill. This financial hit is tied to an ongoing tax dispute concerning its retirement living operations.

The broader share market also experienced a downturn in the early afternoon, led predominantly by a slump in the energy sector. This sector’s decline contributed to a broader market dip, as investors anticipate the forthcoming federal budget, which might influence the Reserve Bank to maintain high interest rates to address inflation concerns. Treasurer Jim Chalmers is expected to introduce the Labor government’s third federal budget, focusing on cost-of-living adjustments and aiming for a second consecutive budget surplus.

The S&P/ASX 200 index fell by 0.2% to 7730.8, interrupting its recent positive trajectory, despite a 1.6% increase the previous week. The All Ordinaries index also registered a 0.3% decline. Out of the 11 market sectors, seven noted reductions, although consumer discretionary stocks performed well.

Banking stocks displayed varied results; ANZ dropped 3.4% after trading ex-dividend and amidst scrutiny over potential manipulation of government debt sales. Westpac declined by 0.4%, while NAB remained stable, and CBA saw a 0.5% increase.

The mining sector presented a mixed performance, with BHP gaining 0.5%, whereas Rio Tinto and Fortescue Metals declined by 0.5% and 0.7%, respectively. Energy stocks were adversely impacted by falling oil prices, driven by concerns over fuel demand, resulting in declines for companies such as Santos, Woodside, and Whitehaven Coal by 1.2%, 0.8%, and 0.2% respectively.

Leaders

JMS-Jupiter Mines Ltd (+11.36%)

OMH-Om Holdings Ltd (+8.74%)

BFL-BSP Financial Group Ltd (+8.73%)

CVN-Carnarvon Energy Ltd (+7.69%)

SXE-Southern Cross Elec. Engineering Ltd (+7.41%)

Laggards

NXG-Nexgen Energy (Canada) Ltd (-11.67%)

OBL-Omni Bridgeway Ltd (-11.67%)

FBU-Fletcher Building Ltd (-10.40%)

AGI-Ainsworth Game Technology Ltd (-10.05%)

WTN-Winton Land Ltd (-8.57%)