What's Affecting Markets Today

Asian markets mixed

In Asia-Pacific markets, Japan led the downturn with the Nikkei 225 dropping 1.59% and the Topix falling 1.26%, as regional investors processed earnings reports and anticipated results from industry giants Toyota and Mitsubishi. Meanwhile, despite United Overseas Bank in Singapore surpassing earnings expectations with a first-quarter net profit of SG$1.47 billion, it saw its shares decline by 1.7%, contributing to a 0.91% drop in the Straits Times Index. The region remains focused on upcoming economic releases, including China’s trade data for April and Japan’s salary figures for March, set for release on Thursday.

Hong Kong’s Hang Seng index and mainland China’s CSI 300 also experienced declines, dropping 0.41% and 0.70%, respectively. Conversely, in South Korea, HD Hyundai Marine Solution’s shares surged in their market debut, marking the country’s largest IPO since January 2022, while the Kospi index edged up 0.20%, and the Kosdaq fell by 0.40%.

ASX Stocks

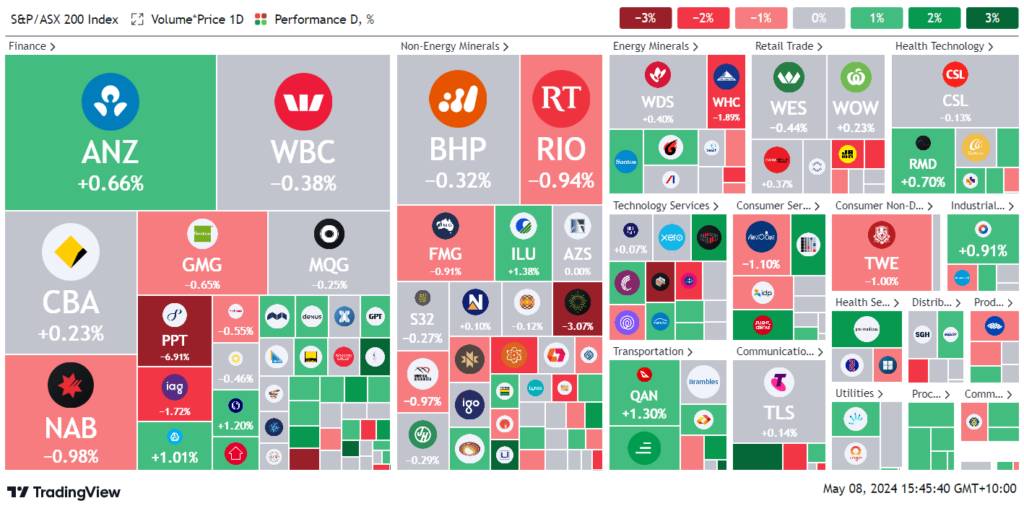

ASX 200 - 7,793.3 (0.0%)

Key Highlights:

Australian equities remained unchanged today after an initial surge of 1.4% on Tuesday, influenced by the Reserve Bank’s decision to maintain steady interest rates and a data-dependent approach to future rate adjustments. In notable corporate news, asset management firm Perpetual has announced an agreement to divest its trustee and advisory segment to KKR for $2.18 billion, planning to spin off its $227 billion asset management business. The transaction is anticipated to close by next February, pending shareholder approval. Despite these developments, Perpetual’s shares declined by 7% to $22.31.

Goodman Group modestly decreased by 0.8%, even after revising its EPS growth forecast for FY2024 to 13%. Elsewhere, after a lackluster performance on Wall Street, where the S&P 500 saw minimal gains, Australian shares of Pinnacle Investments rose by 6.3% following a 6% increase in funds under management, reported at $106 billion for the March quarter. Additionally, IPH Ltd has proposed a takeover of Qantm, and Leo Lithium is set to sell its stake in a Malian mine to Ganfeng for $342.7 million.

Leaders

PNV Polynovo Ltd 8.73%

PNI Pinnacle Investment Group Ltd 6.98%

LIC Lifestyle Communities Ltd 4.98%

MAD Mader Group Ltd 4.75%

MAQ Macquarie Tech Group Ltd 4.11%

Laggards

PPT Perpetual Ltd -7.24%

IMD IMDEX Ltd -5.75%

MSB Mesoblast Ltd -4.26%

VSL Vulcan Steel Ltd -3.83%

MGH Maas Group Holdings Ltd -3.45%