What's Affecting Markets Today

Asian markets continue rally

Asian-Pacific markets saw varied performances on Tuesday, with South Korea leading gains after positive movements on Wall Street fueled by expectations of an imminent U.S. Federal Reserve rate cut. The Kospi in South Korea surged over 2% to reach a one-month high, with significant contributions from industry giants Samsung Electronics and SK Hynix. The Kosdaq also experienced growth, climbing 0.76%.

In contrast, Japan’s Nikkei 225 resumed trading after a holiday to close up 1.29%, while the Topix index modestly gained 0.42%. However, Hong Kong’s Hang Seng index shed earlier gains, falling 0.85%, and China’s CSI 300 slightly decreased by 0.17%.

U.S. markets reacted positively to geopolitical developments, with the Dow Jones Industrial Average marking its fourth consecutive win, up 0.46%. The S&P 500 and Nasdaq Composite also saw significant rises, advancing 1.03% and 1.19% respectively, after Hamas announced on Monday it had accepted a cease-fire proposal mediated by Egypt and Qatar to end conflict with Israel.

ASX Stocks

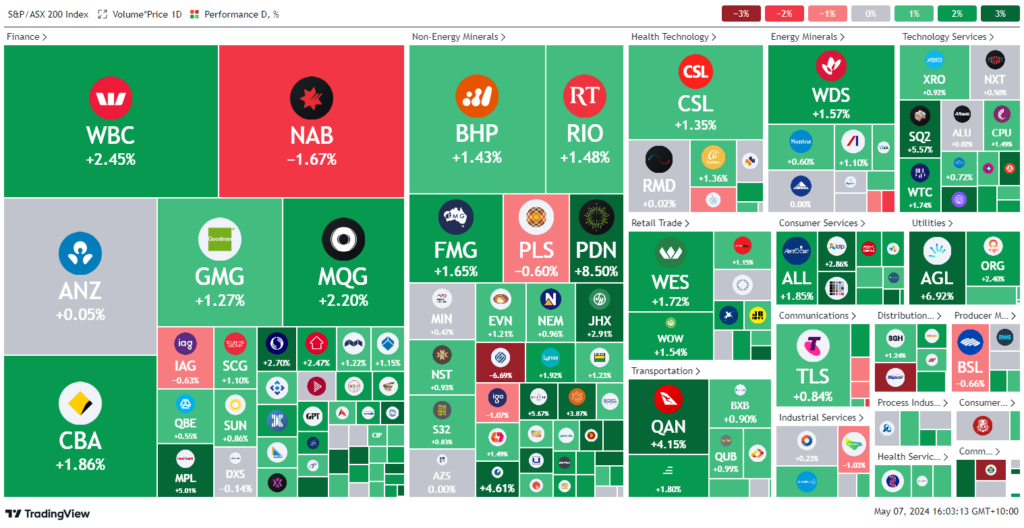

ASX 200 - 7,793.3 (+1.4%)

Key Highlights:

The Australian stock market experienced a significant rally on Tuesday afternoon, following the Reserve Bank of Australia’s decision to maintain the cash rate at a 12-year peak of 4.35%. The S&P/ASX 200 Index surged by 1.4% to 7,793, buoyed by gains across all sectors. Concurrently, the Australian dollar depreciated slightly to US66.10¢.

Despite a hold on interest rates, the RBA revised its inflation forecast upward to 3.8% by year-end, adjusting its unemployment expectation to 4.2%. The utilities sector led the market gains, increasing by 2.6%, with AGL Energy’s shares soaring 6.2% after the company revised its 2024 earnings forecast upwards.

Technology stocks also rose, with WiseTech and TechnologyOne climbing by 1.5% and 1.7% respectively. In the commodities sector, BHP advanced 1.5%.

In corporate developments, ANZ announced a $2 billion share buyback and a dividend of 83¢ per share, despite a 7% drop in cash profit. Louis Dreyfus heightened its takeover bid for Namoi Cotton, which lifted its share price by 1.4%. Conversely, Sims’ shares plunged by 5.8% following a severe profit warning. HMC Capital reported a promising 21% increase in projected earnings per share for FY2024 at a Macquarie conference.

Leaders

PDN Paladin Energy Ltd 8.70%

LOT Lotus Resources Ltd 7.39%

AGL AGL Energy Ltd 6.97%

OML Ooh!Media Ltd 6.93%

HMC HMC Capital Ltd 6.66%

Laggards

SGM Sims Ltd -6.61%

IMD IMDEX Ltd -3.83%

HGH Heartland Group Holdings Ltd -3.72%

BAP Bapcor Ltd -3.56%

CU6 Clarity Pharmaceuticals Ltd -3.40%