What's Affecting Markets Today

Asian markets mostly lower

Asian stocks gained on Friday, following Wall Street’s climb to all-time highs. Tokyo’s Nikkei 225 rose by 1.7% to 39,850.00, while Hong Kong’s Hang Seng index added 2%. Taiwan Semiconductor Manufacturing Company shares increased by 1.8%, and Hon Hai Technology Group (Foxconn) jumped 2.6% after Apple reported higher-than-expected earnings. Apple also announced a record stock buyback program of $110 billion. South Korea’s Kospi rose by 0.39%, and the Taiwan Weighted Index increased by 1.41%. Meanwhile, stock markets in Japan and mainland China were closed for public holidays. Economists expect 240,000 job gains in the U.S. April nonfarm payrolls report, following March’s 303,000 additions. Investors are closely watching the data after the U.S. Federal Reserve held interest rates steady during its recent meeting. On Thursday, U.S. stocks closed higher, with the Dow Jones Industrial Average adding 322.37 points (0.85%), the S&P 500 gaining 0.91%, and the Nasdaq Composite jumping 1.51%.

ASX Stocks

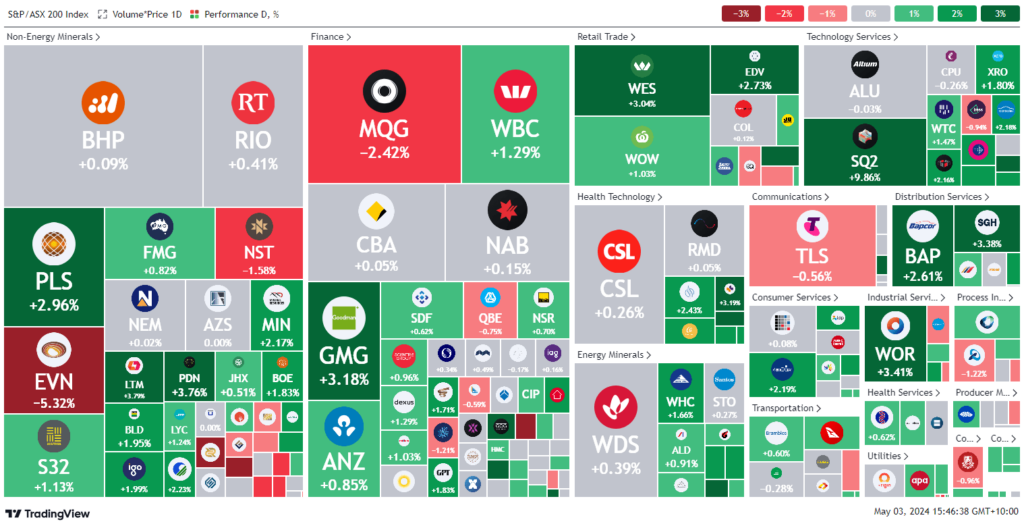

ASX 200 - 7,635.9 (+0.6%)

Key Highlights:

The S&P/ASX 200 index rose 0.5% during lunchtime, driven by a 1.5% rally in the technology sector. Apple’s record-breaking $110 billion stock buyback announcement boosted US equity futures, and local tech companies like Pro Medicus and WiseTech also saw gains. Wall Street responded positively to US Federal Reserve Chairman Jerome Powell’s statement that further interest rate increases are unlikely.

Market focus now shifts to the US non-farm payrolls data, with economists expecting a 240,000 increase in April employment. Afterpay’s parent company, Block, performed well after reporting strong sales and user growth. Gold remained stable, and the Australian dollar strengthened. Macquarie, saw a 32% decline in profits for financial year 2024. Lithium miners, including Pilbara Minerals and IGO, benefited from firming battery metal prices.

Leaders

CU6 Clarity Pharmaceuticals Ltd 12.54%

SQ2 Block Inc 9.89%

TPW Temple & Webster Group Ltd 5.57%

SGR The Star Entertainment Group Ltd 5.49%

AD8 Audinate Group Ltd 5.48%

Laggards

QAL Qualitas Ltd -6.02%

RSG Resolute Mining Ltd -5.75%

EVN Evolution Mining Ltd -5.06%

WGX Westgold Resources Ltd -3.41%

IFL Insignia Financial Ltd -3.31%