What's Affecting Markets Today

Asian markets mostly lower

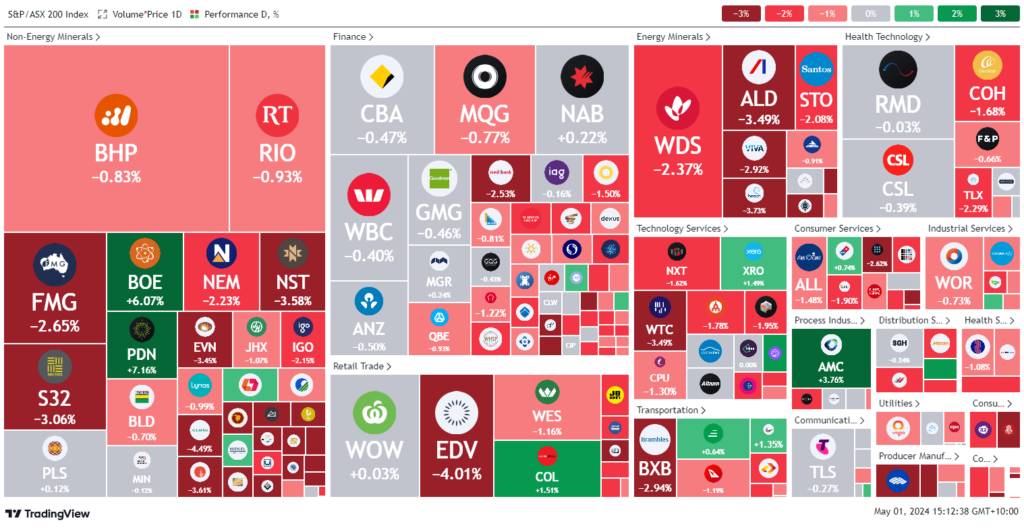

Asian and Australian stock markets declined on Wednesday, with investors cautiously awaiting the U.S. Federal Reserve’s interest rate decision expected early Thursday in Asia. The Australian S&P/ASX 200 fell by 0.85%, while Japan’s Nikkei 225 marginally decreased by 0.1%, and the Topix dropped 0.29%. Market activity in Asia was subdued overall due to the Labor Day holiday closures across several countries.

Attention also remains focused on the Japanese yen, which experienced early-week volatility and suspected market intervention, with the currency trading at approximately 157.7 against the U.S. dollar.

In the U.S., concerns over inflation were heightened following the release of wage data that exceeded expectations. The Labor Department reported a 1.2% increase in the employment cost index for the first quarter, surpassing the anticipated 1%. This led to a rise in Treasury yields and contributed to a downturn in U.S. stock indices; the S&P 500 fell 1.57%, the Dow Jones Industrial Average dropped 1.49%, and the Nasdaq Composite decreased by 2.04%.

ASX Stocks

ASX 200 - 7,586.9 (-1.0%)

Key Highlights:

Australian stocks fell sharply on Wednesday, with the S&P/ASX 200 Index closing down 0.9%, or 68 points, at 7596.3 by mid-afternoon. This downturn reflected broader market concerns, as all 11 sectors finished in the red, tracking a significant 1.6% drop in the U.S. S&P 500—its sharpest decline since January. The tech sector, sensitive to interest rate fluctuations, was particularly hard hit, with industry leader WiseTech’s shares falling by 3.2% and NextDC losing 2%.

The market’s unease was exacerbated by U.S. labor cost data, which rose by 1.2% last quarter, exceeding expectations and indicating persistent inflationary pressures. This has heightened anxieties around the Federal Reserve’s upcoming rate decision, with markets bracing for potentially higher sustained rates.

In other financial news, Rabobank adjusted its forecasts for the Reserve Bank of Australia, now expecting two rate hikes in the latter half of this year, with no cuts anticipated through 2025. This shift is partly due to predictions of Donald Trump’s re-election and potential inflation-driving policies.

Energy stocks also suffered, declining by 1.8% as oil prices continued their fall amid Middle East ceasefire prospects, with Brent crude nearing $85 a barrel. Major players Woodside and Santos each dropped over 2%.

On the corporate front, Woolworths edged up 0.4% after selling a 5% stake in Endeavour Group, while Qantas faced challenges with a potential security breach in its mobile app. BHP saw a 0.9% decline amid ongoing developments in its bid for Anglo American.

Leaders

MSB Mesoblast Ltd 11.11%

DYL Deep Yellow Ltd 6.70%

PDN Paladin Energy Ltd 6.66%

WA1 WA1 Resources Ltd 6.55%

CU6 Clarity Pharmaceuticals Ltd 6.43%

Laggards

EMR Emerald Resources NL -7.49%

CRN Coronado Global Resources Inc -7.43%

RED RED 5 Ltd -6.11%

RMS Ramelius Resources Ltd -5.98%

RRL Regis Resources Ltd -5.63%