What's Affecting Markets Today

USDJPY hits 160 then reverses

The Japanese yen weakened significantly against the U.S. dollar, hitting a low of 160.03, the weakest since April 1990. By midday, it recovered slightly to 156.5. This movement comes amid expectations of the Japanese Ministry of Finance releasing intervention statistics soon, with no confirmed interventions reported yet. Market volatility is attributed to low liquidity, with no expected comments from Japanese officials due to a public holiday. Despite prior warnings from Japanese authorities about excessive yen movements, there have been no official steps to bolster the currency, even as it surpassed the critical 155 level. The yen’s weakness continues as the U.S. dollar strengthens, influenced by delayed expectations of Federal Reserve rate cuts and recent U.S. inflation data. The Bank of Japan maintained its rates and adjusted its inflation outlook slightly upwards, continuing to monitor the currency’s impact on the economy. Speculators anticipate possible intervention post-BOJ’s May meeting, although the effectiveness of such measures remains debated.

ASX Stocks

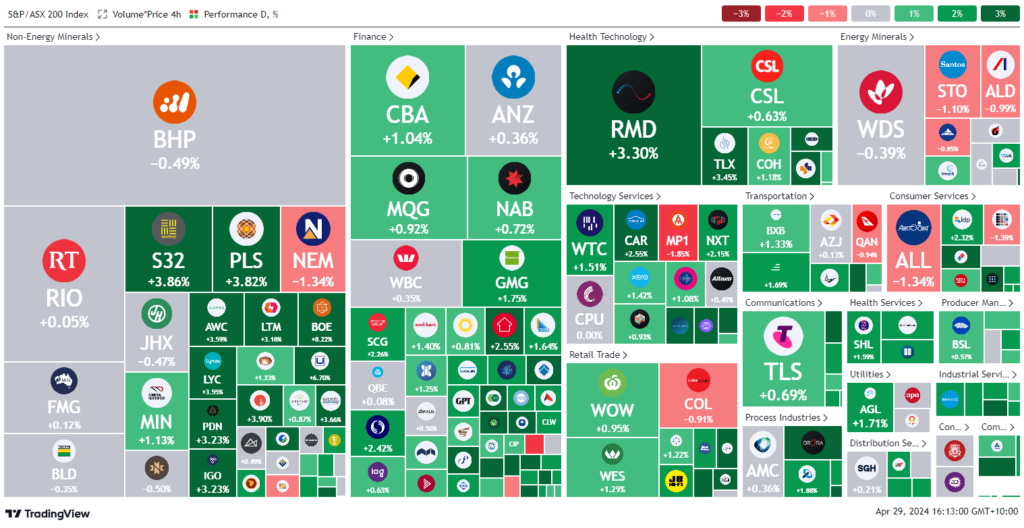

ASX 200 - 7,637.4 (+0.8%)

Key Highlights:

Australia’s S&P/ASX 200 index rose 0.8% to 7611.4, partly recovering from the previous session’s 1.4% drop, with eight out of eleven sectors advancing. The All Ordinaries index also increased by 0.5%. The real estate sector led gains, up 1.5%, reflecting a positive response to Wall Street’s rally driven by robust earnings from Microsoft and Google’s parent Alphabet. Upcoming earnings reports from Amazon, AMD, and Apple are anticipated.

In corporate moves, Perpetual’s shares climbed 3.4% following confirmation of discussions to sell its wealth and trust business to KKR. Boss Energy surged 7.8% after its first quarterly report post-uranium production. The Star Entertainment Group’s stock rose 6.4% after a change in chairmanship, while ResMed reported higher revenue and profits, pushing its shares up 2.9%. Conversely, Megaport fell 5.3% due to disappointing quarterly performance metrics, despite raising its EBITDA outlook. TPG’s stock gained 2.9% after securing an extensive network deal with Optus.

Leaders

MSB Mesoblast Ltd 16.40%

BOE Boss Energy Ltd 8.68%

DYL Deep Yellow Ltd 7.36%

ZIP ZIP Co Ltd 6.93%

LTR Liontown Resources Ltd 6.92%

Laggards

NCK Nick Scali Ltd -3.00%

MCY Mercury NZ Ltd -2.41%

MP1 Megaport Ltd -2.38%

GNE Genesis Energy Ltd -2.36%

SKC Skycity Entertainment Ltd -2.10%