What's Affecting Markets Today

Asian markets tumble after Israel carries out limited strike on Iran

On Friday, Taiwan’s Weighted Index led declines across major Asian markets, dropping 3.44% amid escalating Middle Eastern tensions. According to NBC News, Israel conducted a targeted strike in Iran, prompting a broad sell-off in Asian equities and risk assets, with investors turning towards safe havens. Consequently, gold prices reached a record high, the Japanese yen strengthened, and bitcoin values fell sharply.

Oil prices also surged, with Brent crude futures briefly topping $90 a barrel before settling just above $89. Meanwhile, U.S. stock futures fell over 1% but later saw modest recovery.

In Japan, the Nikkei 225 declined by 2.47% and the Topix index fell 1.8%, despite the release of March’s inflation data. The headline inflation rate slightly decreased to 2.7% from February’s 2.8%, while core inflation, excluding fresh food, met expectations at 2.6%.

South Korea’s Kospi and the Kosdaq also experienced declines, dropping 1.76% and 1.59%, respectively.

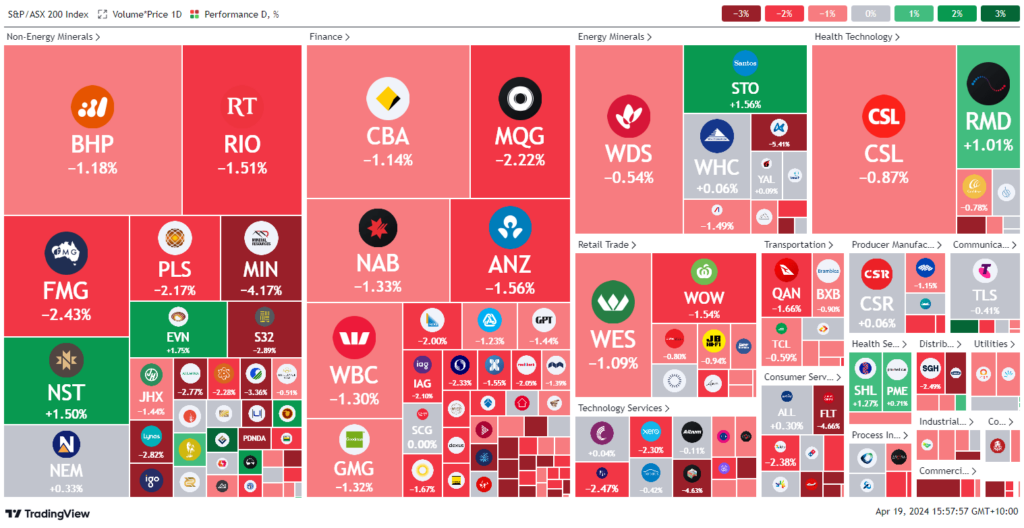

ASX Stocks

ASX 200 - 7,559.8 (-1.1%)

Key Highlights:

Australian shares are on track for their seventh decline in eight sessions as tensions in the Middle East drive investors towards bonds and gold. Following Israeli strikes on Iranian targets, oil prices surged nearly 3% to exceed $US90 a barrel. Shane Oliver, AMP’s chief economist, highlighted the strategic importance of the Strait of Hormuz, through which 20 million barrels of oil pass daily. He noted that any escalation could disrupt global oil supplies, significantly impacting markets already sensitive to geopolitical unrest.

Gold prices soared to $US2400 an ounce, while the Australian dollar dipped to a five-month low of $US63.7¢, losing 0.8%. In the bond market, yields on 10-year US treasuries fell 15 basis points to 4.5%, and Australian government bond yields also declined as investors sought safer assets.

The S&P/ASX 200 fell 1.7% to 7513.5 points, marking its lowest since January. Technology and real estate sectors led the losses, dropping 2.4% and 2.1%, respectively.

Leaders

MAQ Macquarie Technology Group Ltd 3.25%

GMD Genesis Minerals Ltd 2.88%

DEG De Grey Mining Ltd 1.69%

EVN Evolution Mining Ltd 1.63%

STO Santos Ltd 1.63%

Laggards

CUV Clinuvel Pharmaceuticals Ltd -5.56%

ERA Energy Resources of Australia Ltd -5.46%

ZIP ZIP Co Ltd -5.26%

KAR Karoon Energy Ltd -5.18%

PNV Polynovo Ltd -4.85%