What's Affecting Markets Today

Asian markets mixed

Asian-Pacific stock markets displayed mixed results following a significant sell-off on Tuesday. Investors closely monitored fresh trade data from Japan and Singapore, contributing to market volatility. Singapore’s non-oil domestic exports saw a sharp decline of 20.7% in March, far exceeding economists’ forecasts of a 7% drop, according to a Reuters poll.

U.S. Federal Reserve Chair Jerome Powell’s recent comments indicated no immediate changes to monetary policy until inflation approaches the 2% target, affecting global market sentiment. In Japan, the Nikkei 225 declined by 0.61% and the broader Topix index fell 1.03% as business optimism waned, per the Reuters Tankan index for April.

In South Korea, the Kospi index dropped 0.49%, continuing its downward trajectory from the previous day, while the smaller Kosdaq index managed a 0.47% gain. Hong Kong’s Hang Seng index saw marginal gains, whereas the CSI 300 in mainland China dipped slightly by 0.17%.

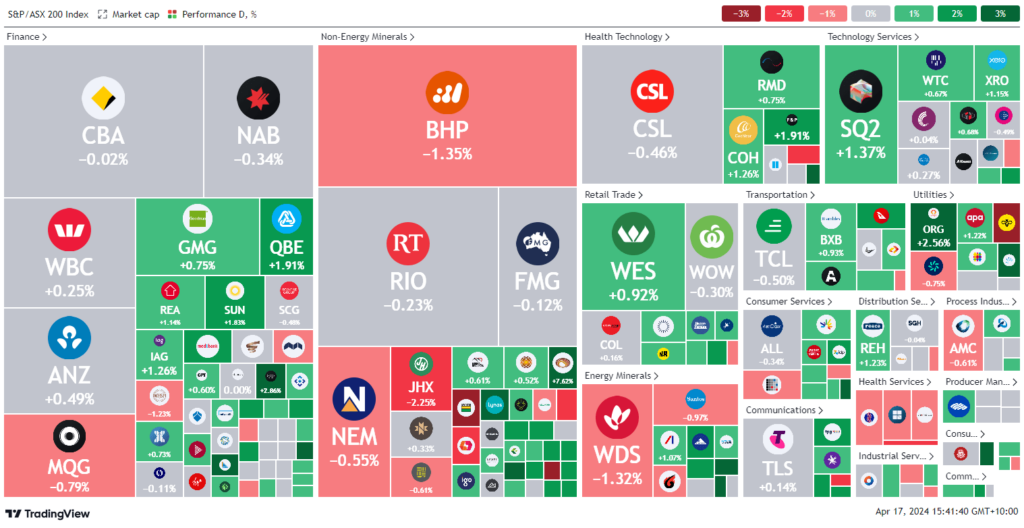

ASX Stocks

ASX 200 - 7,605.6 (-0.10%)

Key Highlights:

Australian stocks showed modest gains, with the S&P/ASX 200 up 0.2% to 7,625.3, recovering slightly after a 2% drop earlier in the week. The market’s mixed performance saw big banks varying in response, while leading miners experienced a decline. In the US, Federal Reserve Chair Jerome Powell indicated delayed interest rate cuts due to persistent high inflation, impacting global markets.

The Australian dollar weakened to a near six-month low of US63.88¢ before slightly recovering. In contrast, New Zealand reported a decrease in its inflation rate to 4% for Q1, the lowest since June 2021.

Gold stocks surged as geopolitical tensions heightened demand for safe-haven assets, with Evolution Mining and other gold miners witnessing significant stock price increases. Other notable movements included the Bank of Queensland and Lynas Rare Earths, benefiting from positive earnings and strategic investments, respectively. Meanwhile, Droneshield and Renascor Resources saw substantial gains following significant contract wins and government funding announcements.

Leaders

EVN Evolution Mining Ltd 8.14%

A4N Alpha Hpa Ltd 6.62%

LYC Lynas Rare EARTHS Ltd 6.49%

SMR Stanmore Resources Ltd 6.41%

ERA Energy Resources of Australia Ltd 6.12%

Laggards

MCY Mercury NZ Ltd -5.56%

BLD Boral Ltd -4.26%

VSL Vulcan Steel Ltd -3.27%

BOE Boss Energy Ltd -3.00%

SFR Sandfire Resources Ltd -2.51%