What's Affecting Markets Today

US futures little changed after big losses overnight

U.S. stock futures remained mostly unchanged on Monday evening following a day of losses across major indexes. The Dow Jones Industrial Average futures dipped marginally by 2 points, or 0.01%, while S&P 500 and Nasdaq 100 futures hovered close to the flatline. This stability comes after a volatile trading session where the Dow fell by 248 points, marking its sixth consecutive day of losses and nearly wiping out its gains for the year. Meanwhile, the S&P 500 dropped by 1.2% and the Nasdaq Composite declined by 1.79%.

The market’s downturn coincides with rising yields, overshadowing positive earnings from Goldman Sachs and robust retail sales. The 10-year Treasury yield recently surpassed 4.6%, reaching a peak since last November. Additionally, increased geopolitical tensions in the Middle East have heightened investor caution, as reflected by a spike in the CBOE Volatility Index to its highest since October.

Looking ahead, key earnings reports from major banks and corporations such as Bank of America, Johnson & Johnson, and Morgan Stanley are expected. Market watchers will also focus on upcoming housing and industrial production data to assess the economic landscape.

ASX Stocks

ASX 200 - 7,612.5 (-1.8%)

Key Highlights:

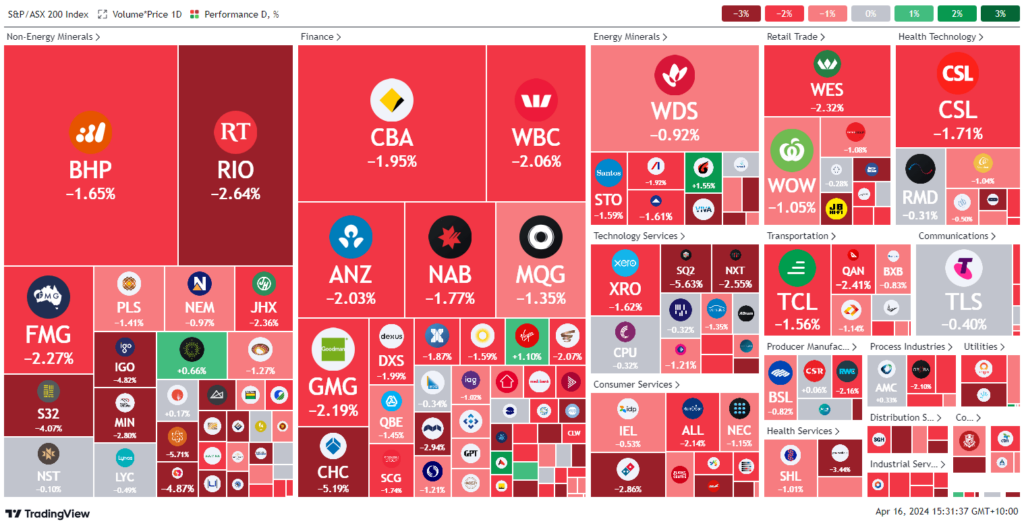

Australian stocks experienced their steepest decline since March of the previous year, with the S&P/ASX 200 index plummeting by 2% amidst a global sell-off triggered by unexpectedly strong U.S. retail sales data, which diminished prospects for imminent interest rate cuts. Heightened geopolitical tensions in the Middle East further pressured the market, affecting all 11 sectors and leading the All Ordinaries index to drop by 0.9%.

Despite positive economic growth reports from China, where GDP expanded 5.3% over the past year, surpassing the 4.6% prediction, Australian shares, particularly in the mining sector, faced significant losses. Major miners like Rio Tinto and BHP saw their stock prices fall by 3.4% and 2.3%, respectively, as iron ore prices decreased by 2.3%. The banking sector also suffered, with major banks each losing about 2%.

Notable movements included The Star Entertainment Group declining by 11%, while IDT Australia rose by 6.7% after securing a significant contract with Sanofi for vaccine development.

Leaders

CEN Contact Energy Ltd 4.18%

WA1 WA1 Resources Ltd 2.40%

MCY Mercury NZ Ltd 2.35%

MEZ Meridian Energy Ltd 2.30%

CU6 Clarity Pharmaceuticals Ltd 2.26%

Laggards

SGR The Star Entertainment Group -11.86%

ZIP ZIP Co Ltd -11.28%

RSG Resolute Mining Ltd -10.20%

DYL Deep Yellow Ltd -8.97%

LOT Lotus Resources Ltd -8.24%