What's Affecting Markets Today

Asia weaker after strong US inflation

Asian-Pacific stock markets experienced declines following unexpectedly high U.S. inflation data for March, heightening concerns that the Federal Reserve may maintain elevated interest rates for an extended period. The U.S. Consumer Price Index (CPI) reported a year-over-year increase of 3.5% and a 0.4% rise from the previous month, surpassing economists’ projections of 0.3% monthly and 3.4% annually. Core CPI, which excludes food and energy prices, saw a monthly increase of 0.4% and a yearly rise of 3.8%, exceeding expectations of 0.3% and 3.7%, respectively. Meanwhile, China’s consumer inflation decelerated to 0.1% in March, below the anticipated 0.4%. The producer price index in China dropped by 2.8% year-over-year, aligning with forecasts. Hong Kong’s Hang Seng index and China’s CSI 300 showed marginal movements, while South Korea’s Kospi saw slight gains. Japan’s Nikkei 225 declined, but the Topix index made modest gains. This financial landscape reflects investors’ reactions to inflation dynamics and their implications for global monetary policy.

ASX Stocks

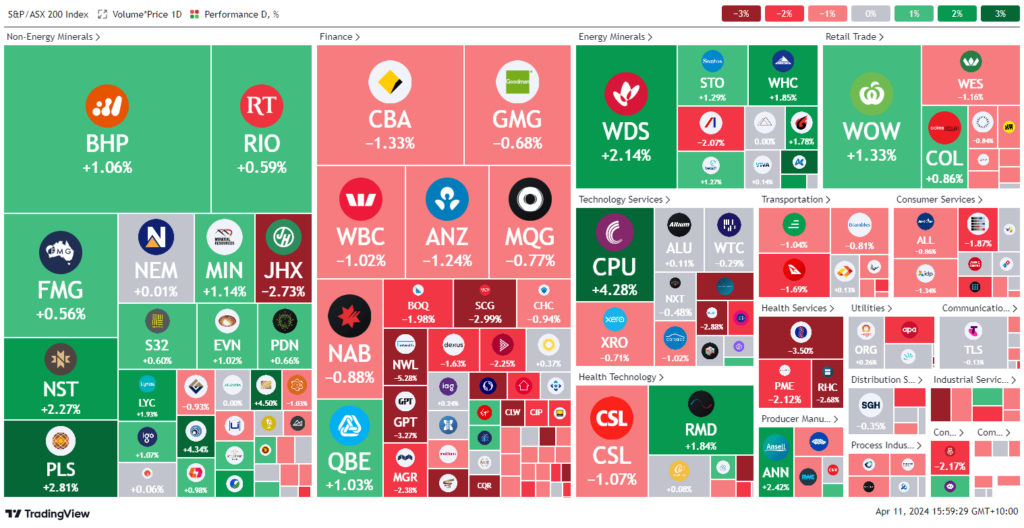

ASX 200 - 7,813.6 (-0.4%)

Key Highlights:

The S&P/ASX 200 Index modestly recovered from its initial dip, closing down 0.5% as investors withdrew from property, technology, and banking sectors due to postponed expectations for U.S. interest rate reductions to November. The energy sector saw a 0.6% increase, buoyed by Brent crude futures surpassing $US90 a barrel, notably with Woodside Petroleum climbing 2% to $30.57. In contrast, the real estate sector fell 3.3%, impacted by anticipations of sustained high borrowing costs affecting property valuations and yields, exemplified by Mirvac Group and Dexus dropping around 3.5%. Following the U.S.’s higher-than-anticipated inflation report, indicating a 3.8% increase, markets saw a sell-off in bonds and stocks, with the Dow Jones Index declining 1.1%. The Australian dollar weakened against the U.S. dollar, and the yield on the Australian 10-year government bond rose. Tech sector losses included a 3.1% decrease for Xero and a 2% fall for WiseTech. Amid geopolitical tensions and market movements, companies like Avita Medical and NextDC announced significant financial updates.

Leaders

A4N Alpha Hpa Ltd 7.85%

GOR Gold Road Resources Ltd 4.97%

KAR Karoon Energy Ltd 4.85%

CPU Computershare Ltd 4.41%

EMR Emerald Resources NL 4.34%

Laggards

WC8 Wildcat Resources Ltd -10.24%

NWL Netwealth Group Ltd -5.33%

ZIP ZIP Co Ltd -5.07%

HLS Healius Ltd -4.26%

PNV Polynovo Ltd -4.22%