What's Affecting Markets Today

Dow drops for third day in a row. Futures start to rebound

U.S. stock futures saw modest gains Wednesday evening following a downturn in the Dow Jones Industrial Average, marking its third consecutive decline. Dow futures climbed slightly by 0.1%, while S&P 500 and Nasdaq 100 futures rose by 0.2% and 0.3%, respectively. The marginal recovery comes amid investor apprehension over prolonged high Federal Reserve rates, influenced by Fed Chair Jerome Powell’s recent remarks on inflation targets and cautious signals from Fed officials on rate cuts. The likelihood of a rate reduction in the Fed’s June session has dipped to 62.3%, a decrease from previous expectations. Moreover, a robust employment report from ADP, surpassing forecasts, has intensified concerns over sustained rate hikes, pushing the 10-year Treasury yield to a 2024 peak. Financial analysts suggest a potential shift in market leadership away from dominant tech stocks towards sectors poised to benefit from solid economic indicators, ahead of upcoming reports on jobless claims, trade deficits, and nonfarm payrolls.

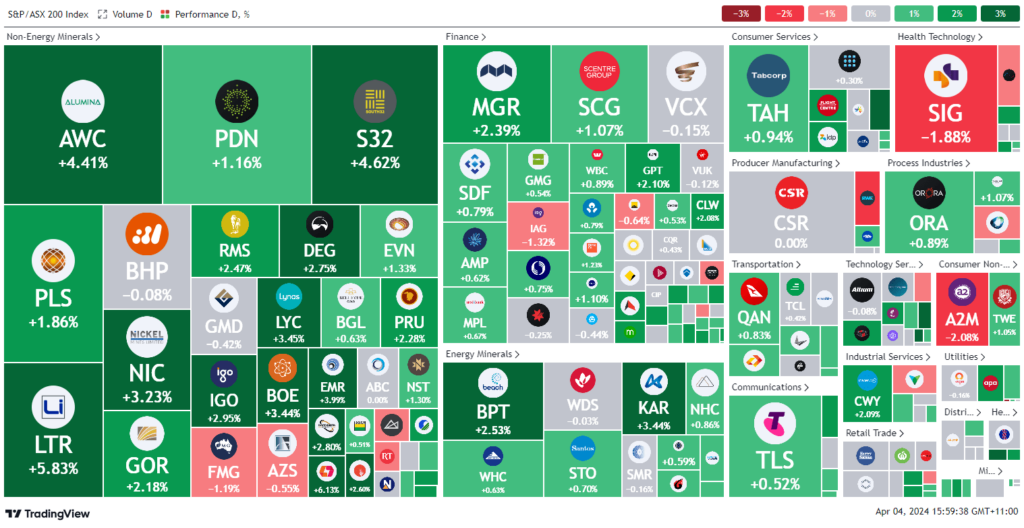

ASX Stocks

ASX 200 - 7,815.5 (+0.4%)

Key Highlights:

The S&P/ASX 200 Index saw a midday increase of 0.5% to 7,819.7 points, buoyed by a surge in gold mining stocks as gold prices breached the $US2300 mark for the first time. The market uplift was broadly supported across sectors, with ten of the ASX’s 11 industry groups trading higher. This positive movement followed Federal Reserve Chairman Jerome Powell’s remarks, which led to heightened expectations for an interest rate cut. Precious and industrial metals, alongside Brent crude oil, experienced price increases, with copper reaching its peak since January 2023, according to ANZ Bank. The tech sector witnessed a 1.4% recovery, with Xero up by 2%. Key stock movements included Cochlear’s potential acquisition of Oticon, supported by the ACCC, and Lendlease’s rise after addressing criticisms of its corporate culture. Boral shares also gained following an independent review of Seven’s acquisition bid, contrasting Seven’s critique of the report.

Leaders

WA1 WA1 Resources Ltd 15.22%

LTM Arcadium Lithium Plc 5.98%

LTR Liontown Resources Ltd 5.87%

ERA Energy Resources of Australia Ltd 5.46%

AWC Alumina Ltd 4.58%

Laggards

HGH Heartland Group Holdings Ltd -5.44%

MEZ Meridian Energy Ltd -3.41%

ASB Austal Ltd -3.36%

RIC Ridley Corporation Ltd -3.31%

CTT Cettire Ltd -3.26%