What's Affecting Markets Today

US markets decline for second straight day

U.S. stock futures exhibited minimal changes on Tuesday evening following a second consecutive day of declines for the Dow Jones Industrial Average, marking a challenging onset for the quarter. Dow futures receded slightly by 60 points or 0.08%, with S&P 500 futures and Nasdaq 100 futures also witnessing dips of 0.17% and 0.2%, respectively. The downturn comes amid heightened investor concern over prolonged Federal Reserve rate cuts due to recent sticky inflation figures and robust economic indicators. Such concerns were further amplified by rising Treasury yields and a surge in oil prices to five-month peaks. Despite the day’s losses across major indices, some analysts maintain a positive outlook for equities, attributing the market’s pullback to normal consolidation after a strong yearly start. Looking ahead, Wednesday promises insights into the labor market through the ADP private payrolls report and the ISM services index, alongside speeches from several Fed officials, potentially influencing market sentiments.

ASX Stocks

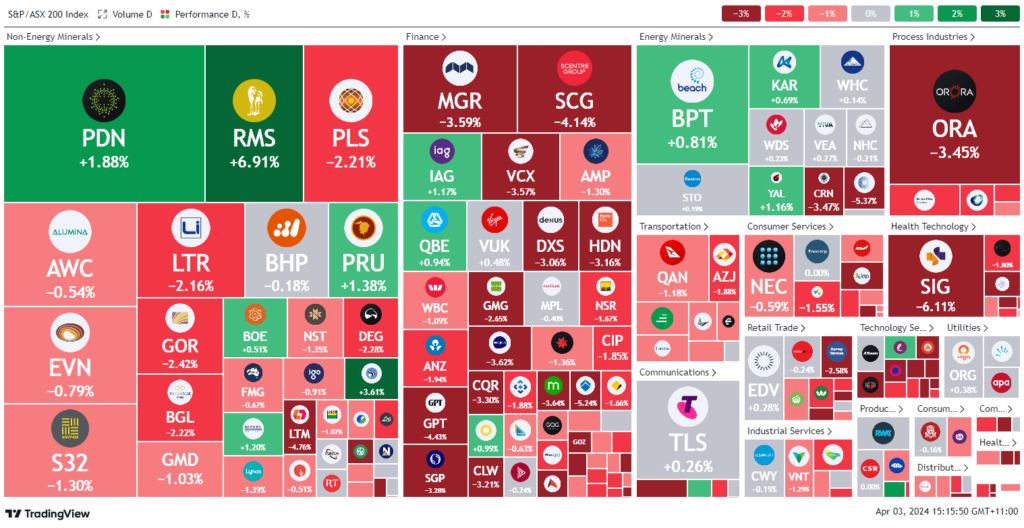

ASX 200 - 7,782.5 (-1.3%)

Key Highlights:

The Australian stock market faced a downturn, led by significant declines in technology and real estate stocks, closing the S&P/ASX 200 Index 1.3% lower at 7784.6. This move mirrored a cautious sentiment from Wall Street, as rising bond yields and strong U.S. economic data prompted a reassessment of Federal Reserve rate cut expectations. Technology leaders like WiseTech and Xero were notably affected, dropping 5.2% and 5.3% respectively, as investors recalibrated valuations in anticipation of persistently high interest rates. The real estate sector also experienced a setback, with notable firms such as Goodman, Scentre Group, and Mirvac registering over 3% losses. Meanwhile, the commodities market saw a silver lining, with oil surpassing $US89 a barrel due to escalating Middle East tensions and gold reaching new heights at $US2288 an ounce. In individual stock movements, Westgold’s shares plummeted over 10% following a production guidance downgrade, whereas Mighty Craft saw a 10% increase after divesting assets to alleviate debt pressures.

Leaders

RMS Ramelius Resources Ltd 6.91%

WAF West African Resources Ltd 4.31%

EMR Emerald Resources NL 3.61%

CUV Clinuvel Pharmaceuticals Ltd 2.56%

RSG Resolute Mining Ltd 2.27%

Laggards

WGX Westgold Resources Ltd -14.44%

MSB Mesoblast Ltd -9.74%

SIG Sigma Healthcare Ltd -6.11%

CCP Credit Corp Group Ltd -5.99%

SMR Stanmore Resources Ltd -5.68%