What's Affecting Markets Today

US markets continue to rally

U.S. stock futures experienced slight gains Friday following record-high closes across the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite. Dow futures edged up by 39 points (0.1%), with similar increments observed in S&P 500 and Nasdaq 100 futures. After-hours trading saw FedEx’s shares surge by 13% due to earnings surpassing expectations, despite a revenue shortfall. Conversely, Lululemon’s shares declined by 11% after issuing disappointing growth forecasts for North America. This marks the second consecutive day of record highs for the major indexes, underpinned by optimism from the Federal Reserve’s indication of potential rate cuts amidst recent inflation data. The anticipation of these adjustments aligns investor expectations with the Fed’s projections, contributing to the market’s upward trajectory. Over the week, significant gains are noted, with the Dow leading with a near 2.8% increase, hinting at its strongest week since December, followed by the Nasdaq and S&P 500 with substantial rises.

ASX Stocks

ASX 200 - 7,739.5 (-0.5%)

Key Highlights:

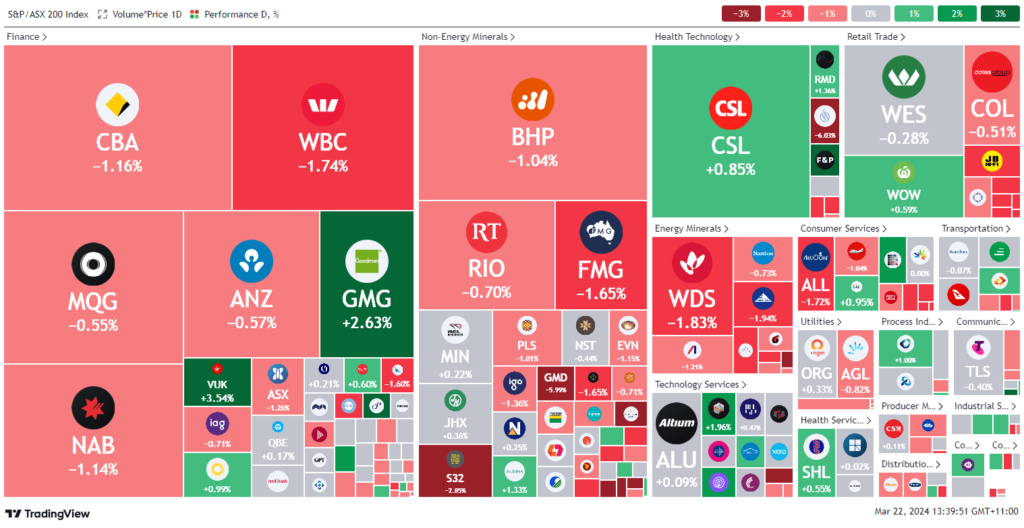

Australian equities saw a dip today, with the S&P/ASX 200 Index dropping by 0.3% to 7,758, influenced by a notable decrease in energy stocks amid declining crude oil prices. The index had previously closed up by 1.1% at 7,782. Energy sector losses were led by Woodside Energy and Santos, falling 1.5% and 1.1% respectively, as Brent crude settled below $86, affected by a strengthening US dollar despite forecasts of Federal Reserve rate cuts. Gold’s price slightly fell to $2,180 an ounce, following a recent peak, yet it remains significantly up from mid-February. Major gold companies like Bellevue Gold and Genesis Minerals experienced declines in stock prices. In global financial news, the Swiss National Bank executed an unexpected rate cut, while the Bank of England maintained its rates, observing a shift in stance by some policymakers. Fisher & Paykel Healthcare’s shares surged 5.8% after the company raised its FY2024 earnings guidance, anticipating net profits between NZ$260 million to NZ$265 million.

Leaders

FPH Fisher & Paykel Healthcare 6.01%

TUA Tuas Ltd 4.43%

VUK Virgin Money Uk Plc 3.67%

SGR The Star Entertainment Group Ltd 2.86%

GMG Goodman Group 2.74%

Laggards

TLX TELIX Pharmaceuticals Ltd -6.37%

GMD Genesis Minerals Ltd -5.86%

CTT Cettire Ltd -4.85%

BGL Bellevue Gold Ltd -4.52%

RSG Resolute Mining Ltd -4.38%