What's Affecting Markets Today

BOJ raises rates for first time in 17 years

The Bank of Japan (BOJ) has increased its short-term interest rates to between 0% and 0.1% from -0.1%, marking the end of its negative interest rates policy initiated in 2016, and the first rate hike since 2007. This decision, announced after its March policy meeting, aligns with early indications of significant wage growth. Furthermore, the BOJ is discontinuing its yield curve control policy and will phase out the purchase of exchange-traded funds, real estate investment trusts, and corporate bonds within the next year. Despite these changes, the BOJ will maintain its government bond purchases, signaling a major shift from its long-standing expansive monetary policy amid signs of domestically driven inflation surpassing its 2% target for an extended period.

Futures flat after weaker overnight markets

On Tuesday, stock futures showed minimal changes, with a notable uptick in technology shares, particularly ahead of Nvidia’s first AI conference. However, Nvidia shares experienced a slight decline in after-hours trading despite the company unveiling its advanced AI chip, Blackwell. This event occurred amidst anticipation for the Federal Reserve’s two-day policy meeting starting Tuesday. S&P 500 futures dropped by 0.12%, Dow Jones futures by a marginal 0.02%, and Nasdaq 100 futures decreased by 0.22%. This market movement follows a recovery from a recent downturn, with tech giants like Alphabet and Apple gaining momentum due to strategic discussions. Investors are now focusing on the Federal Reserve’s meeting, with concerns over persistent inflation possibly influencing future interest rate decisions. Despite these concerns, the probability of maintaining the current interest rates remains high at 99%, as predicted by fed funds futures on the CME FedWatch Tool.

ASX Stocks

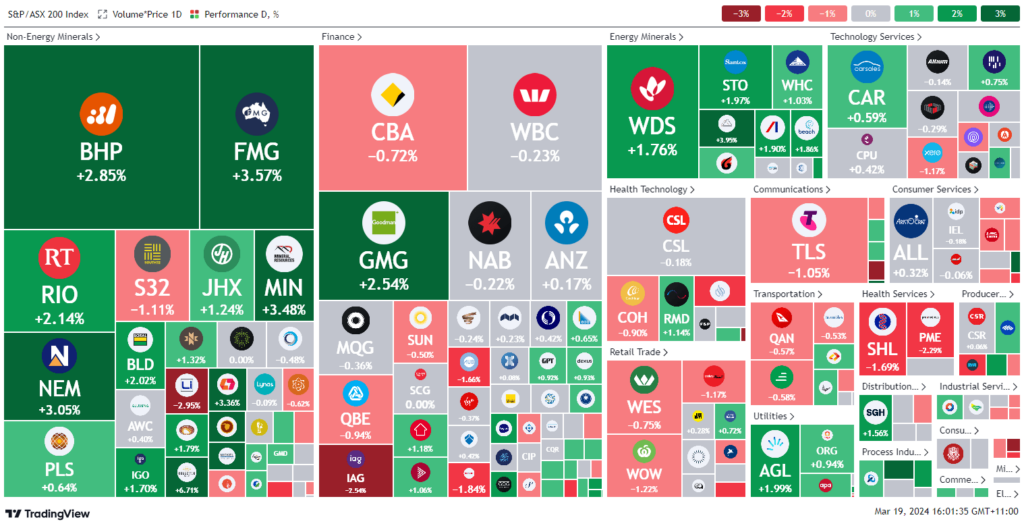

ASX 200 - 7,708 (+0.4%)

Key Highlights:

In late afternoon trading, Australian shares witnessed an uptick, with the S&P/ASX 200 Index climbing 0.4% to 7,703.4, following the Reserve Bank of Australia’s (RBA) decision to maintain the cash rate at 4.35%. The announcement led to a shift in investor attention towards Governor Michele Bullock’s forthcoming press conference. Despite the RBA’s stance, resulting in a slight depreciation of the Australian dollar by 0.3% to US65.4¢, the materials and energy sectors emerged as the day’s top performers, buoyed by a surge in oil prices to a four-month peak. Notably, Woodside Energy and Beach Energy experienced increases of 1.2% and 1.9%, respectively. In corporate developments, Boral advised shareholders to spurn Seven Group’s acquisition proposal, backed by an independent valuation deeming the bid as unfair. Meanwhile, New Hope Corporation declared a significant interim dividend following robust earnings, underscoring the diverse impacts of the RBA’s monetary policy decisions on the market.

Leaders

NIC Nickel Industries Ltd 7.43%

BGL Bellevue Gold Ltd 6.71%

APM APM Human Services Ltd 5.43%

PRN Perenti Ltd 5.14%

KAR Karoon Energy Ltd 4.15%

Laggards

PNV Polynovo Ltd -7.23%

A4N Alpha Hpa Ltd -6.15%

MCY Mercury NZ Ltd -4.58%

MAQ Macquarie Technology Group Ltd -4.28%

NAN Nanosonics Ltd -3.08%