What's Affecting Markets Today

US markets reach a new peak

U.S. equities closed significantly higher in Friday’s session, with the Nasdaq Composite reaching a new peak, surpassing its 2021 high by over 1%. The S&P 500 also set a new record, increasing by 0.80% to close above 5,100 for the first time, while the Dow Jones Industrial Average gained approximately 91 points. Meanwhile, global investors are turning their attention to China’s upcoming annual parliamentary meetings, anticipating potential economic stimulus announcements amid concerns over the country’s real estate downturn and slow growth. In energy news, OPEC+ members, including major players Saudi Arabia and Russia, agreed to extend their voluntary crude supply reductions until the end of the second quarter, driving U.S. crude prices to $80 a barrel, a level not seen since November. Additionally, the U.S. national debt has accelerated, reaching $34 trillion in early January, highlighting a rapid increase of around $1 trillion every 100 days, according to the U.S. Department of the Treasury.

ASX Stocks

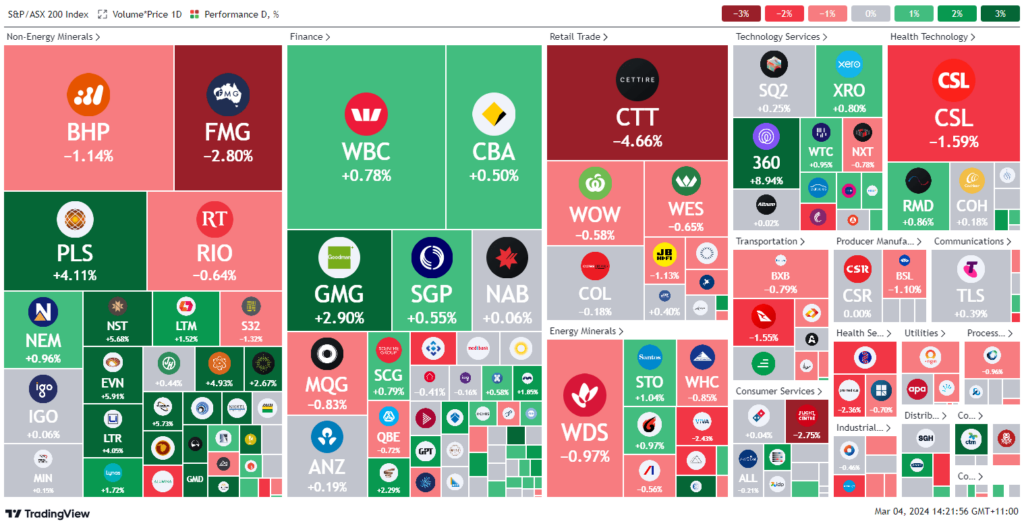

ASX 200 - 7,747.3 (+0.1%)

Key Highlights:

The Australian Securities Exchange (ASX) made another new intraday high but has pulled back, with the S&P/ASX 200 index falling 10 points or 0.1% to 7,735.8 and the All Ordinaries index also declining 0.1%. Driving the surge, Real Estate and Technology sectors outperformed, each gaining approximately 0.6%, buoyed by the Nasdaq Composite and S&P 500 reaching new highs. U.S. manufacturing data indicating a slowdown has fueled optimism for a potential Federal Reserve rate cut in the coming months, contributing to a 2% increase in gold prices, largely attributed to short covering. Leading gold producers such as Evolution Mining, Emerald Resources, and Perseus Mining topped the performance charts. Meanwhile, Fletcher Building’s chairman Bruce Hassall accelerates his departure amidst the company’s struggles, with shares falling 0.8%. NextDC eyes expansion, exploring the acquisition of data centers from Global Switch, and Downer EDI addresses impending legal challenges over accounting practices, impacting their share value. Additionally, Genex Power’s shares surged 32.4% following a significant acquisition offer from J-Power.

Leaders

BRN Brainchip Holdings Ltd 15.79%

WGX Westgold Resources Ltd 13.27%

360 LIFE360 Inc 9.38%

ERA Energy Resources of Australia Ltd 8.16%

GMD Genesis Minerals Ltd 7.60%

Laggards

CTT Cettire Ltd -4.76%

APM APM Human Services Int Ltd -3.74%

MAD Mader Group Ltd -3.62%

OML Ooh!Media Ltd -3.42%

HGH Heartland Group Holdings Ltd -3.39%