What's Affecting Markets Today

Japan markets with a new record high

In Friday’s trading session, the stock markets in Hong Kong and China presented a mixed performance as investors processed the latest manufacturing data from China. Meanwhile, Japan’s Nikkei 225 index achieved a new record high, demonstrating robust investor confidence.

February’s official manufacturing PMI in China stood at 49.1, aligning with expectations from a Reuters Poll. The private sector’s Caixin manufacturing PMI slightly exceeded the previous month’s figures, registering at 50.9, indicating modest sectoral expansion.

Despite a shaky start, China’s CSI 300 index managed a slight recovery, closing up by 0.2% following a nearly 2% gain in the previous session. Conversely, the Hang Seng index in Hong Kong experienced a minor dip of 0.2%.

Japan’s market showed remarkable strength, with the Nikkei 225 surging by 1.8% to set a new benchmark, and the Topix index also saw a significant increase of 1.2%.

It’s important to note, South Korea’s markets remained closed in observance of the Movement Day holiday.

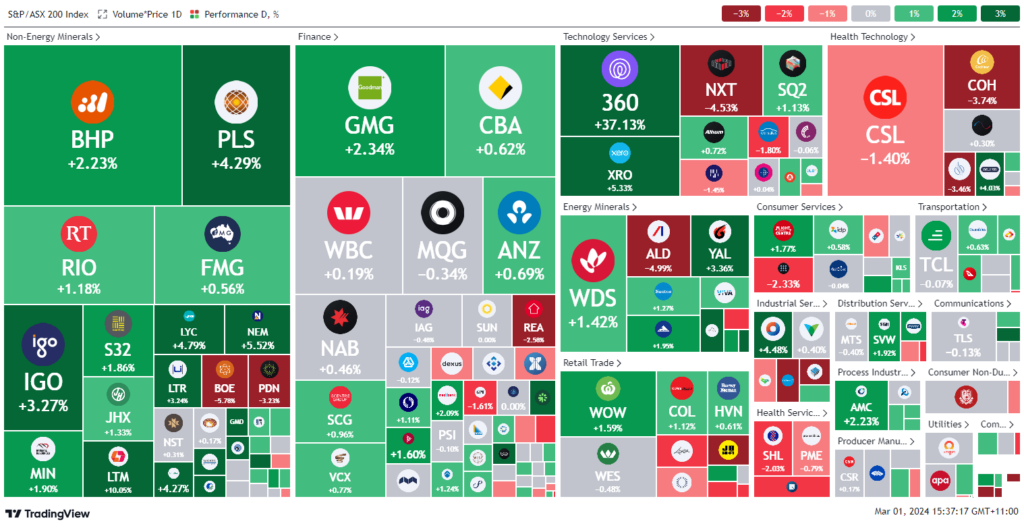

ASX Stocks

ASX 200 - 7,743.2 (+0.6%)

Key Highlights:

Australian stock market reached a new peak at 7733.2 points early Friday, marking its potential sixth advance in seven sessions amid investor optimism for central bank rate cuts this year. However, by midday, the index slightly retracted to 7708.5 points, with technology and resources gains balanced by declines in healthcare and retail sectors.

Notably, lithium miners experienced a surge, led by Pilbara Minerals with a 3.5% increase and IGO Ltd, which rose by 2%, buoyed by a week-long rebound in China’s benchmark lithium futures. Additionally, Life360, a mobile tracking application, saw a remarkable 21% jump following a report of significant user and sales growth, boasting over 61 million monthly active users in 2023. The company’s financial performance and optimistic revenue and EBITDA guidance exceeded market expectations, signaling strong future prospects.

Leaders

360 LIFE360 Inc 37.38%

LTM Arcadium Lithium Plc 10.05%

NIC Nickel Industries Ltd 8.51%

MAQ Macquarie Technology Group Ltd 6.32%

NEM Newmont Corporation 5.49%

Laggards

CKF Collins Foods Ltd -8.09%

DYL Deep Yellow Ltd -7.35%

AD8 Audinate Group Ltd -6.86%

ADT Adriatic Metals Plc -6.57%

BOE Boss Energy Ltd -5.78%