What's Affecting Markets Today

US markets continue to edge higher thanks to AI

U.S. equity futures showed minimal changes on Monday Asia, with investors gearing up for the Federal Reserve’s preferred inflation indicator and significant earnings reports. Dow Jones Industrial Average futures slightly declined by 0.04%, with S&P 500 and Nasdaq 100 futures dipping by 0.04% and 0.05% respectively. The stock market approaches the end of February on a positive note, buoyed by record-setting performances across major indexes, notably propelled by Nvidia’s impressive earnings. The Dow Jones concluded at an unprecedented 39,131.53, while the S&P 500 briefly surpassed 5,100, and the Nasdaq Composite hit a 52-week peak last Friday. Amidst sustained AI-driven optimism, investors remain cautious about economic and inflation uncertainties, keenly awaiting the monthly personal consumption expenditures index set for release on Thursday. Additional economic data, including January’s durable orders and wholesale inventories, are anticipated. The week also features crucial earnings from Salesforce, alongside updates from the restaurant sector, key retailers, and companies like Norwegian Cruise, AMC Entertainment, J.M. Smucker, Hormel, and Anheuser-Busch.

ASX Stocks

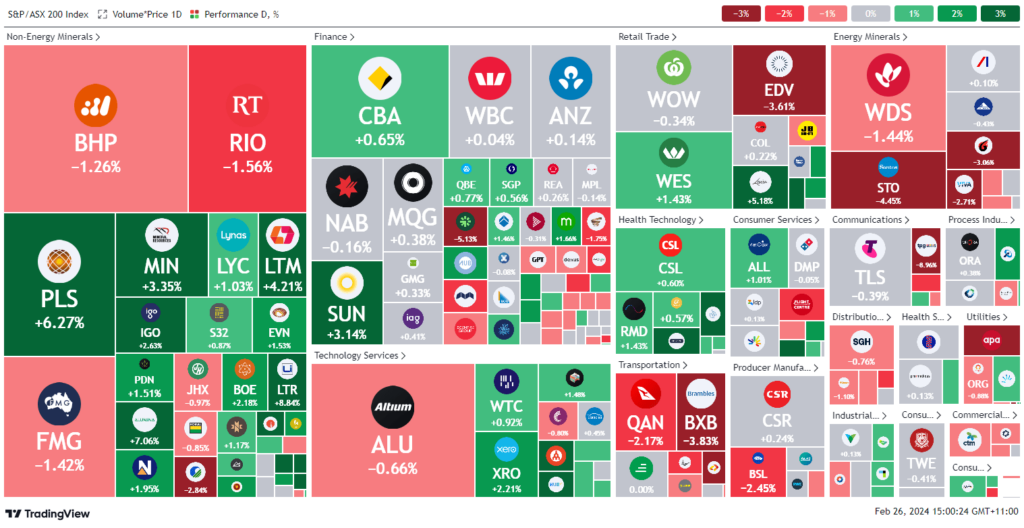

ASX 200 - 7,652.8 (+0.1%)

Key Highlights:

Australian stocks hovered around the break-even point in late trading, with the S&P/ASX 200 index barely moving, reflecting a mixed performance across sectors. Energy shares bore the brunt of the downturn, sliding 1.9% amid a decline in crude oil prices, which saw Santos and Woodside Energy recording significant losses of 4.5% and 1.5%, respectively. Conversely, the consumer discretionary sector showed resilience, climbing 1%, with notable gains in Wesfarmers, Lovisa, and Tabcorp. The market anticipates the Reserve Bank of New Zealand’s policy meeting, which could signal a shift in global interest rate trends. In other developments, Suncorp enjoyed a 3.6% gain following a 16% increase in insurance premiums, while TPG Telecom faced a steep 10.5% decline after reporting a significant drop in net profit due to rising costs. Additionally, Kogan rebounded with a 23% surge, reinstating dividends after returning to profitability, despite a dip in revenue. Aussie Broadband’s acquisition move towards Superloop highlighted strategic expansion efforts within the telecom sector.

Leaders

LTR Liontown Resources Ltd 8.61%

ZIP ZIP Co Ltd 8.05%

AWC Alumina Ltd 7.11%

PLS Pilbara Minerals Ltd 6.40%

SGR The Star Entertainment Group Ltd 6.18%

Laggards

NAN Nanosonics Ltd -11.82%

TPG TPG Telecom Ltd -8.58%

HGH Heartland Group Holdings Ltd -6.78%

AX1 Accent Group Ltd -5.65%

NHF Nib Holdings Ltd -5.20%