What's Affecting Markets Today

US markets lower, Nvidia drags down market

On Tuesday, stock markets experienced a decline, with the Dow Jones Industrial Average falling slightly by 0.17% to 38,563.80. The S&P 500 and the Nasdaq Composite also saw decreases, dropping 0.60% and 0.92% to close at 4,975.51 and 15,630.78, respectively. The downturn was led by Nvidia, which saw its shares dip nearly 4.4% ahead of its earnings report, amidst concerns over its valuation despite anticipated strong results. Tech giants like Amazon, Microsoft, and Meta also faced declines, contributing to the broader tech sector’s slump.

Despite this, the technology sector has shown resilience this year, gaining 6% and ranking as the third top performer in the market. Nvidia, in particular, has surged 40%, outpacing its peers. Meanwhile, notable movements in the financial sector included Capital One Financial’s acquisition of Discover Financial Services in a $35.3 billion all-stock deal and Walmart’s acquisition of Vizio for $2.3 billion, which led to significant stock gains for the involved companies.

These market movements come after a challenging week on Wall Street, with economic data suggesting potential delays in Federal Reserve rate cuts, adding to investors’ caution.

ASX Stocks

ASX 200 - 7,608.4 (-0.7%)

Key Highlights:

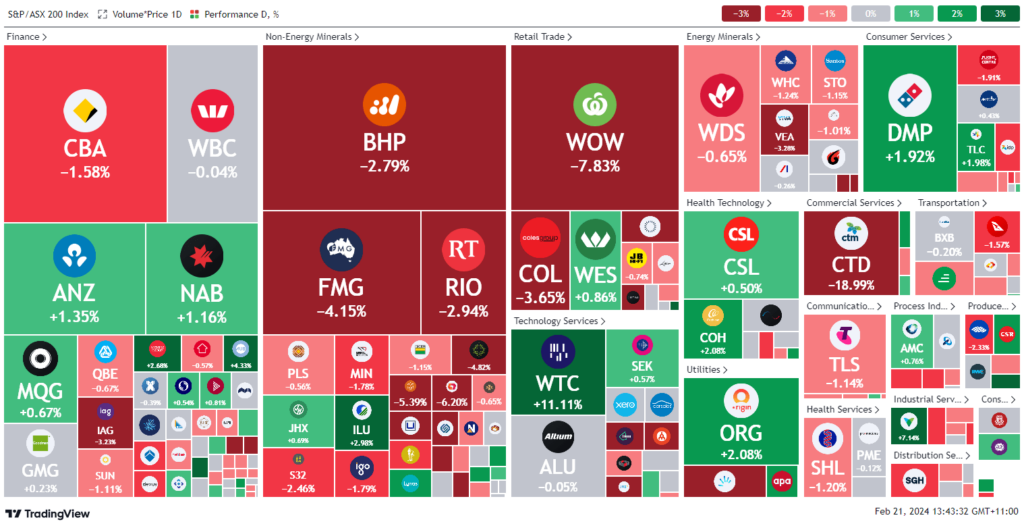

In today’s trading session, Australian markets experienced a decline, with the S&P/ASX 200 index falling by 0.7% to 7,608.4, influenced by drops in consumer staples and materials sectors. Notably, Woolworths saw an over 8% decrease after announcing CEO Brad Banducci’s departure, leading consumer staples to plummet by 5.2%. Mining giants BHP and Rio Tinto also faced downturns of 3.1% and 3.2%, respectively, amid falling iron ore prices, which impacted the sector significantly.

Despite these challenges, there were some positive movements. National Australia Bank saw a 0.7% increase even as it reported a 16.9% fall in cash earnings, while Domino’s Pizza Enterprises gained 3.6% despite a dividend cut, following a 9.2% drop in net profit. WiseTech Global stood out with a 10.1% surge after announcing a 5% rise in net profit and an increased dividend, reaffirming its fiscal 2024 outlook.

Scentre Group and Santos reported profit declines but managed to see some stock gains or dividend increases. The Lottery Corporation and Corporate Travel Management also made notable movements, with the former rising 3.3% amid profit growth and the latter plunging 18.9% due to underwhelming half-year results.

Leaders

CDA Codan Ltd 13.10%

WTC Wisetech Global Ltd 10.90%

MMS Mcmillan Shakespeare Ltd 8.41%

SGF SG Fleet Group Ltd 7.46%

VNT Ventia Services Group Ltd 7.14%

Laggards

CTD Corporate Travel Management Ltd -19.17%

HSN Hansen Technologies Ltd -10.38%

DYL Deep Yellow Ltd -8.14%

WOW Woolworths Group Ltd -7.81%

SGM Sims Ltd -7.56%