What's Affecting Markets Today

SGR, ANZ & SUN in the spotlight

Star Entertainment’s market value plummeted by over $300 million as its shares dropped more than 20% to 42¢, following the NSW casino regulator’s dissatisfaction with the company’s cultural reforms. The regulator’s decision to appoint Adam Bell, SC, for a second inquiry into Star halted trading and forced a delay in the financial update. Despite the setback, Star expressed optimism about utilizing the inquiry as an objective platform to prove its eligibility for regaining its casino license. CEO Robbie Cooke has not yet made a public statement regarding the 15-week investigation initiated by the Independent Casino Commission.

The Australian Competition Tribunal has greenlit ANZ’s acquisition of Suncorp’s banking division for $4.9 billion, overcoming initial opposition from the Australian Competition and Consumer Commission (ACCC). The Tribunal concluded that the merger would not adversely affect competition in the banking sector, highlighting the dynamic role of Macquarie as a “maverick” and the growing influence of brokers in enhancing consumer choice and mobility. Macquarie’s market share in home lending has doubled to 5.3% since early 2020, marking its rise as a significant player. The ANZ-Suncorp merger positions the entity as the third-largest home loan provider, reshaping Australia’s banking landscape.

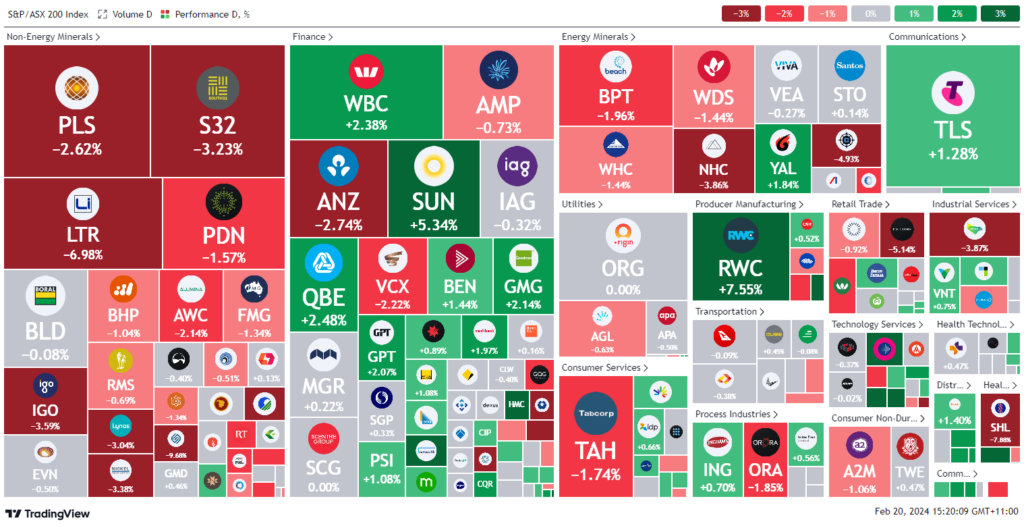

ASX Stocks

ASX 200 - 7,659.0 (-0.1%)

Key Highlights:

Leaders

MMS Mcmillan Shakespeare Ltd 11.69%

ARB ARB Corporation Ltd 10.20%

HMC HMC Capital Ltd 10.14%

RWC Reliance Worldwide Corporation 7.55%

PRN Perenti Ltd 7.35%

Laggards

STX Strike Energy Ltd -25.86%

SGR The Star Entertainment Group Ltd -22.32%

SGM Sims Ltd -9.79%

THL Tourism Holdings Rentals Ltd -8.05%

SHL Sonic Healthcare Ltd -7.92%