What's Affecting Markets Today

US markets worried about hot inflation gauge

U.S. equity markets concluded the week on a downward note, breaking a five-week rally as January’s producer price index (PPI) data surpassed expectations, signaling potential challenges in the battle against inflation. The S&P 500 declined by 0.48%, the Dow Jones Industrial Average by 0.37%, and the Nasdaq Composite by 0.82%. The PPI rose by 0.3% in January, its most significant increase since August and above the anticipated 0.1%, while core PPI, excluding food and energy, surged by 0.5%, exceeding forecasts. These figures, along with a recent unexpected rise in the consumer price index (CPI), have intensified concerns regarding persistent inflation and the Federal Reserve’s cautious stance on rate adjustments.

In corporate news, Sony faces declining profitability in its crucial gaming division, leading to a reduced sales outlook for the PlayStation 5 console, which resulted in a significant market value decrease. Additionally, former U.S. Secretary of State Hillary Clinton warned at the Munich Security Conference that Donald Trump might withdraw the U.S. from NATO if re-elected, advising attendees to take his statements seriously.

ASX Stocks

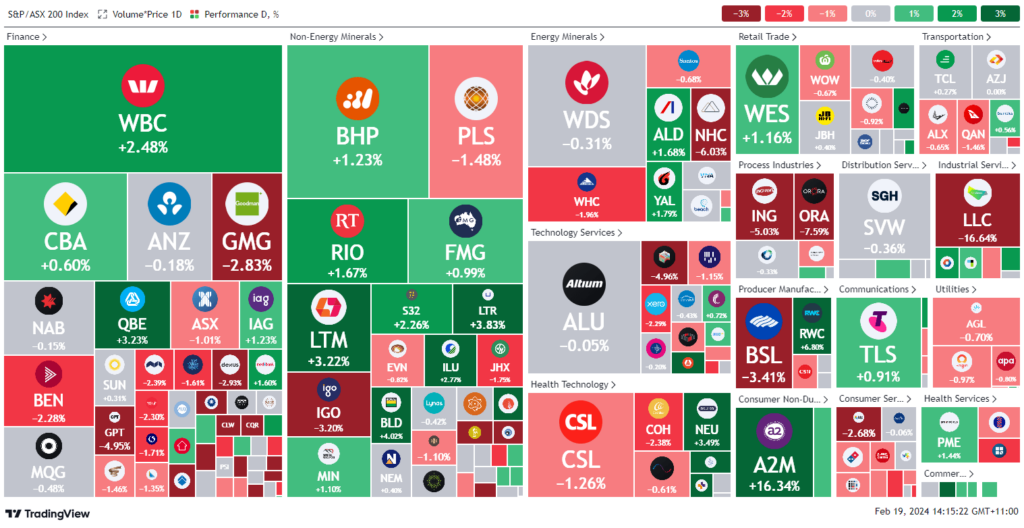

ASX 200 - 7,665.1 (+0.1%)

Key Highlights:

At midday, the ASX 200 edged up by 0.1% to 7,664.3, nearing its peak performance despite a subdued cue from Wall Street, which saw the S&P 500 drop by 0.5% due to rising U.S. producer prices tempering rate cut expectations. The mining sector, led by giants Rio Tinto, Fortescue, and BHP, showcased significant gains, each up over 1%, buoyed by increased iron ore demand as Chinese steelmakers resumed post-holiday operations. Conversely, the real estate segment lagged, dropping 2.8%, impacted by disappointing earnings from key players such as GPT Group, McGrath, and notably Lendlease, which plunged over 14%. Among other notable movements, A2 Milk’s shares surged 15.5% after reporting modest half-yearly growth, credited to its Chinese market. Meanwhile, Kerry Stokes’ Seven Group proposed acquiring the remaining shares of Boral, leading to a 2.9% rise in Boral’s shares. Westpac reported a 6% decline in quarterly cash profit, attributing the fall to heightened loan and deposit competition, with its shares dipping by 1.9%.

Leaders

APM APM Human Services Int Ltd 49.40%

IMD IMDEX Ltd 16.98%

A2M The a2 Milk Company Ltd 16.24%

RWC Reliance Worldwide Corp Ltd 7.26%

CUV Clinuvel Pharmaceuticals Ltd 5.90%

Laggards

LLC Lendlease Group -16.51%

ORA Orora Ltd -8.10%

NHC New Hope Corporation Ltd -5.73%

SQ2 Block Inc -5.04%

ING Inghams Group Ltd -5.03%