What's Affecting Markets Today

Dow tumbles 500 points after stronger inflation

Stocks experienced a significant downturn on Tuesday following the release of January’s inflation data, which exceeded expectations and triggered a spike in Treasury yields. This development cast doubts on the Federal Reserve’s capacity to implement multiple rate cuts this year, challenging the optimistic outlook for the equity market. The Dow Jones Industrial Average fell by 1.35%, marking its worst performance since March 2023 on a percentage basis, while the S&P 500 and Nasdaq Composite dropped by 1.37% and 1.8% respectively. The Russell 2000 index also saw a notable decline, falling nearly 4% in its most significant drop since June 2022.

January’s consumer price index (CPI) showed a 0.3% month-over-month increase and a 3.1% rise on an annual basis, surpassing the predictions of a 0.2% monthly and 2.9% yearly increase. Core CPI, excluding food and energy, rose by 0.4% monthly and 3.9% annually, also exceeding expectations.

This unexpected inflation data led to a surge in the 2-year and 10-year Treasury yields, adversely affecting tech stocks, which have been market leaders amid declining rates. In corporate news, certain companies saw significant stock movements due to various factors, including earnings reports and stakeholder announcements, reflecting the diverse impacts of market dynamics and investor reactions to financial performances and strategic developments.

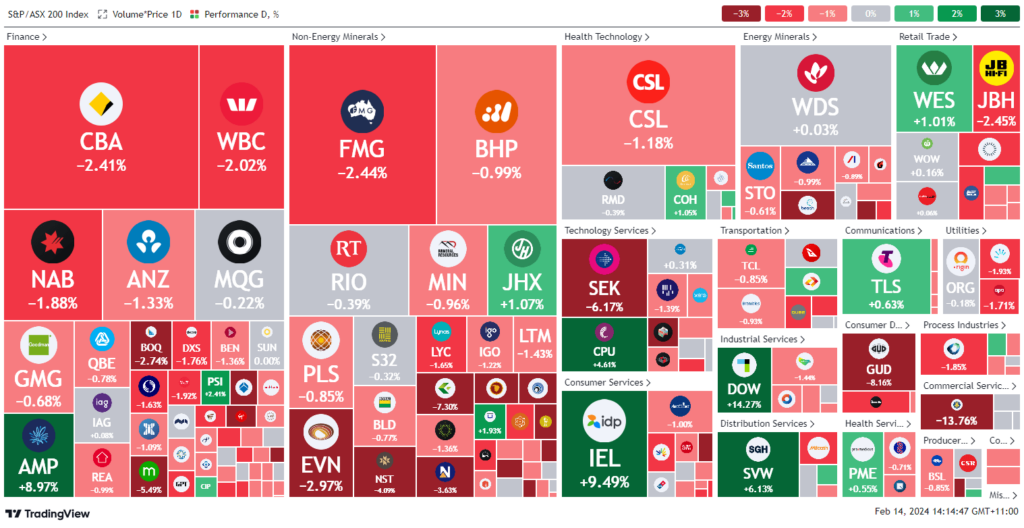

ASX Stocks

ASX 200 - 7,547.7 (-0.7%)

Key Highlights:

The S&P/ASX 200 index fell 1% to 7,530.6 on Wednesday, impacted by losses in materials and financials, following a U.S. CPI report that tempered Federal Reserve rate cut expectations. Australian bond futures now forecast the Reserve Bank’s first rate decrease in December, as U.S. inflation cooled less than expected in January. Commonwealth Bank’s shares declined by 2.2% after reporting a 3% drop in half-year cash profits to $5 billion, with a continued squeeze on profit margins. Nonetheless, a $2.15 dividend was announced. Seven Group’s shares surged 5.8% after raising its full-year EBIT growth forecast to mid to high teens, driven by its industrial services sector. AMP’s stock rose 9.8% on plans to return $295 million to shareholders. GrainCorp’s shares tumbled 13.5%, anticipating a significant profit decrease in FY24. Downer EDI’s shares increased 13.1%, with expectations of improved second-half profit margins. IDP Education’s shares climbed 9.6% following a 15% revenue increase and a significant profit rise.

Leaders

DOW Downer Edi Ltd 14.04%

IEL Idp Education Ltd 9.19%

AMP AMP Ltd 9.02%

SVW Seven Group Holdings Ltd 6.27%

ERA Energy Resources of Australia Ltd 5.36%

Laggards

GNC Graincorp Ltd -13.52%

GUD G.U.D. Holdings Ltd -8.20%

FBU Fletcher Building Ltd -7.30%

WAF West African Resources Ltd -6.29%

SEK Seek Ltd -6.28%