What's Affecting Markets Today

US at record highs led by Meta and Amazon

The S&P 500 achieved a new record high on Friday, propelled by robust quarterly performances from technology giants like Meta, surpassing expectations. Closing at 4,958.61, the index surged by 1.1%, surpassing its previous record close of 4,927.93 earlier in the week. The Dow Jones Industrial Average also reached a record close, adding 0.4% to 38,654.42, while the Nasdaq Composite climbed 1.7% to 15,628.95. Meta’s shares soared over 20% following an earnings beat, and Amazon experienced a 7.9% jump on a strong fourth-quarter performance. Despite a substantial rise in the 10-year Treasury yield to 4.02% due to an impressive January jobs report, tech stocks demonstrated resilience, emphasizing their ability to detach from interest rate fluctuations and trade based on fundamentals. The positive market sentiment was underscored by investors focusing on the economy’s resilience and its potential impact on sustained profit growth. The week concluded with the S&P 500 gaining 1.4%, the Nasdaq Composite rising 1.1%, and the Dow increasing by 1.4%, marking the fourth consecutive week of gains after a shaky start to 2024. Despite escalating rates, the market shrugged off Apple’s lackluster quarter, with its shares remaining essentially flat as the tech giant reported a 13% sales decline in China.

ASX Stocks

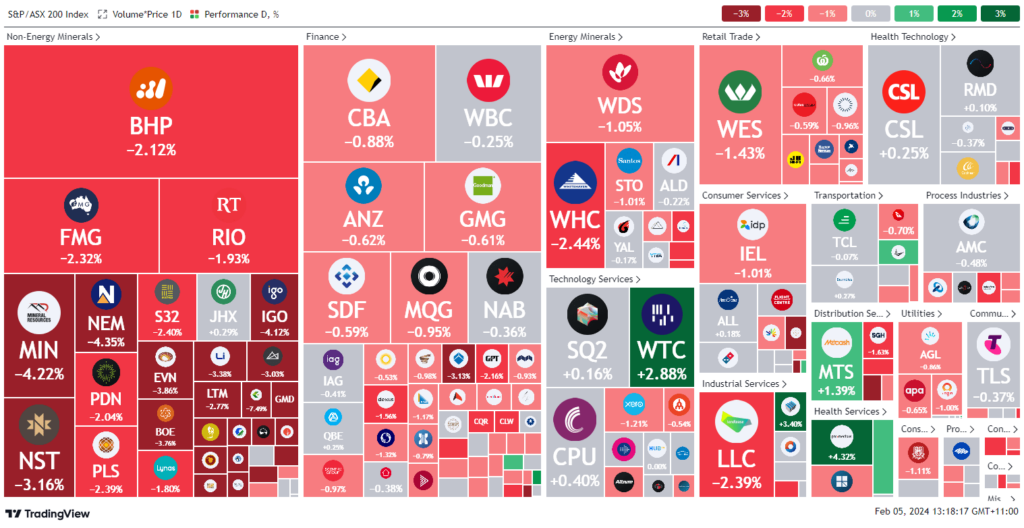

ASX 200 - 7625.9 (-1.0%)

Key Highlights:

Today witnessed a broad market decline as the sharemarket retreated from the previous week’s record high, with miners and energy companies leading the downturn. The benchmark S&P/ASX 200 Index recorded a 1.0% drop, equivalent to 73.5 points, marking one the larger falls since January 1. The All Ordinaries mirrored this decline. All sectors showed negative trends, particularly impacting miners, influenced by a 4% drop in iron ore prices on Friday. Key mining players, including BHP Group, South32, Rio Tinto, and Fortescue, each experienced over 2% losses. Commodity stocks, spanning gold, lithium, and uranium, faced a collective downturn. Energy producers, such as Whitehaven Coal, also declined over 2%, while Beach Energy fell 1.8%, and Santos and Woodside were in negative territory. Major banks shed around 1% each. Analysts noted a potential profit-taking scenario after the ASX 200’s outperformance compared to US shares the previous week. Investor caution increased in Asia amid heightened geopolitical tensions in the Middle East involving the US and UK. The S&P/ASX 200 had rallied almost 2% the previous week, reaching a record intraday high on Friday, driven by expectations of the Reserve Bank of Australia considering interest rate cuts, potentially starting in August. Bond futures indicated a 36% chance of a rate cut as early as May.

Leaders

PME Pro Medicus Ltd 4.46%

JLG Johns LYNG Group Ltd 3.33%

WTC Wisetech Global Ltd 2.96%

REG Regis Healthcare Ltd 2.44%

CIN Carlton Investments Ltd 2.18%

Laggards

SLR Silver Lake Resources Ltd -12.45%

FBU Fletcher Building Ltd -7.49%

RSG Resolute Mining Ltd -7.05%

WAF West African Resources Ltd -6.44%

RMS Ramelius Resources Ltd -5.76%