What's Affecting Markets Today

US mixed. Tech earnings disappoint

On Tuesday, U.S. stocks exhibited a mixed performance, with the S&P 500 closing nearly unchanged, the Dow Jones Industrial Average recording a 0.35% gain, and the Nasdaq Composite experiencing a 0.76% decline. Investors were closely monitoring the Federal Reserve’s impending interest rate decision.

Alphabet, the parent company of Google, reported its fastest quarter of revenue growth since early 2022, posting a 13% increase to $76.05 billion. However, disappointment ensued as the company’s ad revenue fell short of analysts’ expectations, leading to a significant drop in Alphabet’s shares during after-hours trading.

In contrast, software giant Microsoft exceeded expectations, with robust growth in its Azure cloud services contributing to a 17.6% year-over-year revenue increase for the quarter ending on Dec. 31. Microsoft’s acquisition of video game publisher Activision Blizzard, its largest-ever deal, further bolstered its performance.

In a significant development, a Delaware judge voided Tesla CEO Elon Musk’s $56 billion pay package, citing the failure of the company’s board of directors to demonstrate the plan’s fairness. Consequently, Tesla’s shares experienced a more than 2% decline in extended trading.

ASX Stocks

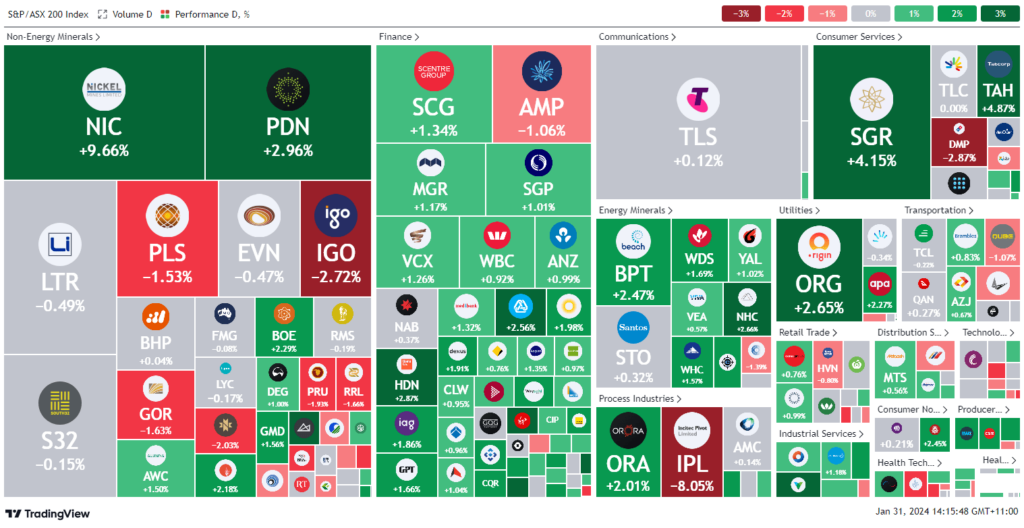

ASX 200 - 7680.7 (+1.1%)

Key Highlights:

Australian shares reached a new all-time high today, driven by a faster-than-expected cooling of inflation in the December quarter. The S&P/ASX 200 rose by 1.1%, or 80 points, reaching 7680.7, surpassing the previous record set in August 2021.

The market response followed a drop in the consumer price index to 0.6% in the December quarter from 1.2% in September, below the anticipated 0.8%. The annual CPI also eased to 4.1% from 5.4%, contrary to the Reserve Bank’s projection of a 1% increase. The Reserve Bank is now expected to maintain the 4.35% interest rate at its upcoming meeting, with futures fully pricing in potential rate cuts in August and nearly fully pricing a second cut by December.

Weebit Nano declined by 7.5% after reporting no royalty payments expected in 2024 due to clients’ production ramp-up. Sayona Mining dropped 7.1% on lower lithium concentrate sales, while Champion Iron’s shares rose 4.3% on robust December quarter results. Credit Corp fell 3.8%, aiming to meet the lower end of profit guidance, and Origin Energy, up 1.9%, emphasized investments in renewables. IGO climbed 1%, placing its Cosmos nickel project on care and maintenance amid deteriorating nickel prices. US policymakers’ federal funds rate decision is anticipated, contributing to market sentiment.

Leaders

NIC Nickel Industries Ltd 9.66%

ERA Energy Resources of Australia Ltd 7.14%

SIG Sigma Healthcare Ltd 5.30%

SLX SILEX Systems Ltd 5.01%

TAH Tabcorp Holdings Ltd 4.93%

Laggards

SDR Siteminder Ltd -8.21%

IPL Incitec Pivot Ltd -7.88%

WBT Weebit Nano Ltd -7.64%

AD8 Audinate Group Ltd -6.94%

PRN Perenti Ltd -6.73%