What's Affecting Markets Today

US continue higher. Mag 7 lead the way again

On Monday, the S&P 500 achieved a new record high, closing at 4,927.93, propelled by optimism surrounding mega-cap tech earnings and the Federal Reserve’s impending rate policy decision. The 0.76% gain marked the sixth record close for the S&P 500 and the Dow, with the latter rising 0.59% to 38,333.45, while the Nasdaq Composite increased by 1.12% to settle at 15,628.04. This week, pivotal earnings reports from tech giants such as Microsoft, Apple, Meta, Amazon, and Alphabet are anticipated, influencing market sentiment. Additionally, Dow components like Boeing and Merck are set to reveal their quarterly results. As the Federal Open Market Committee embarks on its two-day policy meeting, a 97% probability exists in the fed funds futures market that the Fed will maintain current interest rates. The market’s sustainability hinges on avoiding Big Tech earnings disappointments, positive Fed signals, and solid yet moderate jobs figures. iRobot shares plummeted by nearly 9% after Amazon discontinued its pursuit of an acquisition deal.

ASX Stocks

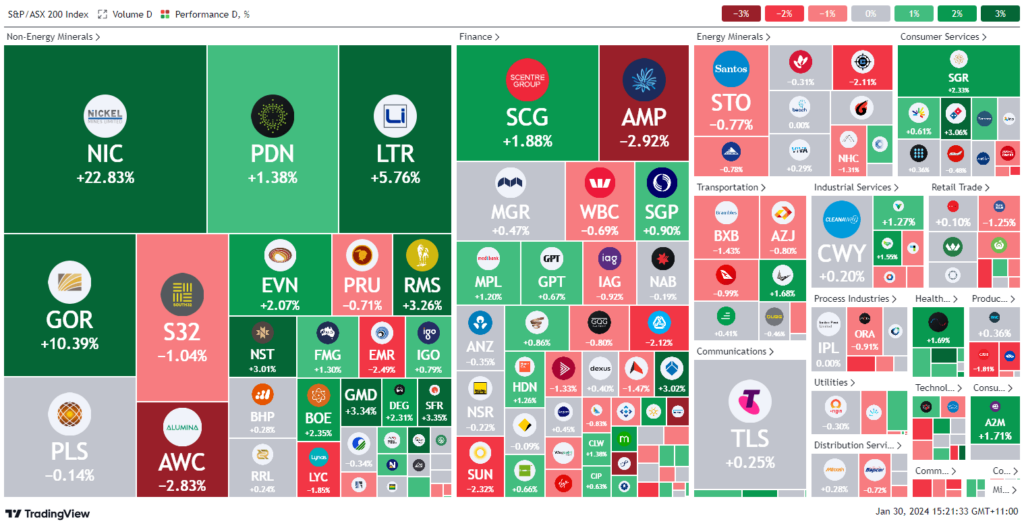

ASX 200 - 7600.2 (+0.3%)

Key Highlights:

In late afternoon trading, the Australian stock market saw a notable uptick, driven by substantial gains in the information technology and healthcare sectors. The S&P/ASX 200 index rose by 0.4%, or 30.4 points, reaching 7608.8. Seven out of the 11 sectors were in positive territory, briefly pushing the gauge above its previous record closing high to touch 7629.8. Although this is the highest point since August 2021, it remains slightly below the intraday high of 7632.8 set in the same month. Despite a 2.7% drop in December’s retail sales compared to November, indicating a shift in year-end spending patterns, the technology sector emerged as the top performer, climbing by 1.8%. Notable stock movements included Atlas Arteria, which rallied 2%, Sandfire Resources, up 3.4%, and Megaport, surging 28.6%, all reporting positive results in their respective quarterly updates.

Leaders

MP1 Megaport Ltd 29.86%

NIC Nickel Industries Ltd 23.33%

GOR Gold Road Resources Ltd 10.39%

SQ2 Block Inc 6.50%

DYL Deep Yellow Ltd 6.16%

Laggards

NWL Netwealth Group Ltd -5.54%

MAD Mader Group Ltd -5.26%

PPT Perpetual Ltd -3.51%

ADT Adriatic Metals Plc -3.31%

DJW Djerriwarrh Investments Ltd -3.27%