What's Affecting Markets Today

US markets mixed. Big week of earnings

U.S. stock futures faced declines overnight as investors geared up for a pivotal week dominated by major tech earnings and the Federal Reserve’s upcoming rate policy decision. Dow Jones Industrial Average futures slipped 0.2%, while S&P 500 and Nasdaq 100 futures saw marginal declines of 0.2% and 0.3%, respectively. Despite positive economic data last week, including robust Q4 growth and lower-than-expected core inflation, market enthusiasm was tempered by disappointing earnings from key players like Intel and Tesla. This week, mega-cap tech giants Microsoft, Apple, Meta, Amazon, and Alphabet will unveil their results, influencing market sentiment. Additionally, Dow components such as Boeing and Merck will report quarterly earnings. Amidst this, the Federal Open Market Committee’s two-day policy meeting commencing Tuesday is expected to maintain steady interest rates, with a nearly 97% probability according to the CME Group’s fed funds futures market.

ASX Stocks

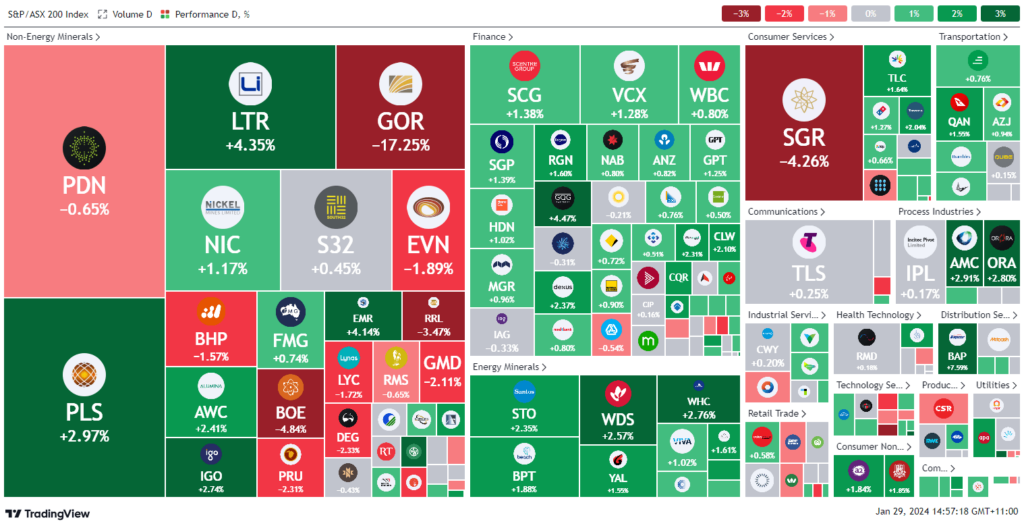

ASX 200 - 7575.7 (+0.3%)

Key Highlights:

The Australian stock market is poised for a sixth consecutive day of gains, spurred by heightened tensions in the Middle East that triggered a surge in oil prices, particularly benefiting energy producers. The S&P/ASX 200 has risen by 0.3%, gaining 23 points to reach 7579.6, coming close to its record high in August 2021. The All Ordinaries experienced a similar uptick. Energy stocks have outperformed, surging by 2.1% as the oil price hits two-month highs. Recent attacks by Iran-backed militants in the Middle East, causing concern over regional oil supply and global freight, have contributed to this rally. Conversely, tech stocks have declined by 1.2%, led by disappointing earnings from US tech giants, including a 13.6% drop in Tesla shares. Materials are down 0.4%, with BHP facing a 1.5% dip amid reports of a Brazilian federal judge ruling on a substantial fine related to its 2015 tailings dam disaster.

Leaders

BAP Bapcor Ltd 7.40%

ADT Adriatic Metals Plc 7.01%

IFT Infratil Ltd 4.36%

BGL Bellevue Gold Ltd 4.25%

EMR Emerald Resources NL 4.14%

Laggards

GOR Gold Road Resources Ltd -16.67%

ERA Energy Resources of Australia Ltd -7.69%

OCL Objective Corporation Ltd -5.62%

FCL Fineos Corporation Holdings Plc -5.12%

DYL Deep Yellow Ltd -5.02%