What's Affecting Markets Today

US Markets continue rally to new highs

Overnight the Dow surged over 100 points, breaching 38,000 for the first time, and the S&P 500 reached a new peak with a 0.2% increase, alongside the Nasdaq Composite, which gained 0.3%. These developments build on the S&P 500’s recent entry into bull market territory, surpassing its previous all-time highs from January 2022.

In after-hours trading, United Airlines experienced a robust 6% surge following the release of robust fourth-quarter results. Despite this positive performance, the airline anticipates a first-quarter setback due to the grounding of Boeing 737 Max 9 planes, implicated in the recent Alaska Airlines emergency. United is poised to address queries on the matter and potential compensation from Boeing during its Tuesday earnings call. Concurrently, shares of fellow airline operators, including American Airlines and Southwest Airlines, saw a collective uptick of approximately 3%, while Alaska Air Group and Delta Air Lines each witnessed a gain of around 2%.

ASX Stocks

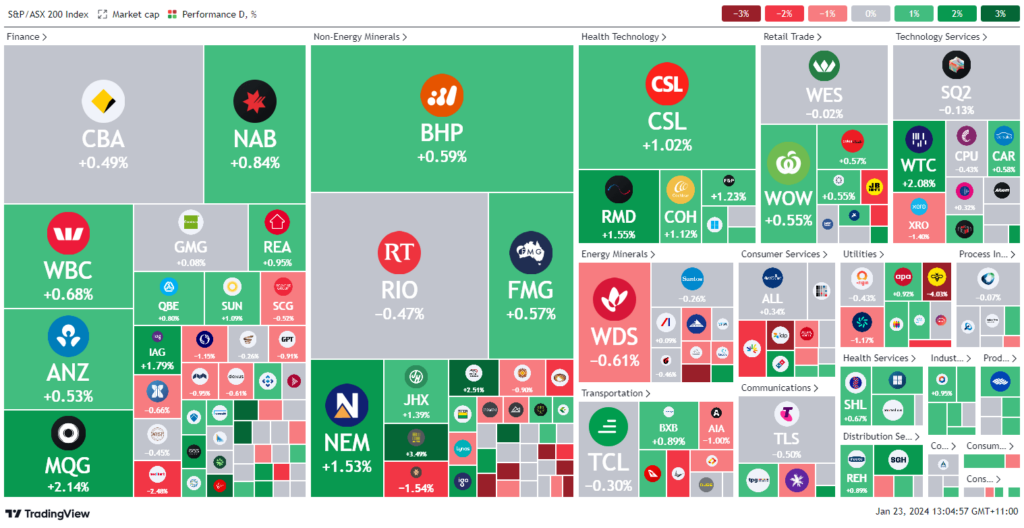

ASX 200 - 7514.2 (+0.5%)

Key Highlights:

The Australian stock market extended its gains, driven primarily by advancements in healthcare stocks. The benchmark S&P/ASX 200 index surged 0.7%, or 51.9 points, reaching 7528.5 midday, as eight of the 11 sectors turned positive. Healthcare stocks led the charge, rallying 1.5%, with CSL, Cochlear, and Resmed posting gains of 1.4%, 1.7%, and 1.9%, respectively. Analysts noted a cautious tone, with strategists warning of an “exuberant melt-up phase.” Brent crude surpassed $80 a barrel, while iron ore and gold dipped. The materials sector, however, rose 0.7%. The week features crucial central bank meetings, with focus on Bank of Japan’s policy decision and Bank of Canada’s announcement. Notable stock movements included Karoon Energy, Coronado Global Resources, IDP Education, Judo Bank, Perseus Mining, and Viva Energy.

Judo Bank witnessed a surge in volatility as Tuesday’s market opened, following its clarification on the margin impact arising from the conclusion of cost-effective, post-pandemic funding. The bank also announced a notable threefold increase in business lending volumes during its first half, outpacing the market average. The enhanced transparency on 2024 targets propelled the stock 13.6% higher to $1.06 within the first hour of trading. This uptick provided a degree of relief to concerned investors who had observed Judo’s 30% decline throughout the course of 2023. The market response reflects a positive reception to the bank’s strategic moves and financial performance, aligning with heightened investor confidence in the evolving landscape.

Leaders

JDO Judo Capital Holdings Ltd 17.33%

PNV Polynovo Ltd 8.05%

CTT Cettire Ltd 6.41%

LTM Arcadium Lithium Plc 4.40%

JIN Jumbo Interactive Ltd 4.40%

Laggards

IEL Idp Education Ltd -7.62%

ZIP ZIP Co Ltd -6.76%

STX Strike Energy Ltd -4.89%

ERA Energy Resources of Australia Ltd -4.76%

KAR Karoon Energy Ltd -4.30%