What's Affecting Markets Today

Stock futures decline during Asia session

Tuesday sees a decline in stock futures as Wall Street awaits crucial data and bank earnings, providing insights into the state of the American consumer. Dow Jones Industrial Average futures slip 0.1%, while S&P 500 futures and Nasdaq 100 futures dip over 0.1% and 0.2%, respectively.

Investors eagerly anticipate December retail sales data on Wednesday, poised to gauge potential recessionary concerns and impacts on economic growth if U.S. consumer spending cools. Economists forecast a 0.2% increase, slightly below November’s 0.3%.

The week brings a fresh wave of bank earnings, shedding light on consumer health, credit card payments, and delinquencies. Goldman Sachs, Morgan Stanley, and PNC Financial Services report on Tuesday, joined by Charles Schwab, M&T Bank, and regional banks later in the week.

Last Friday, JPMorgan, Citigroup, and Wells Fargo reported mixed results but strong annual profits, attributing success to a robust labor market, resilient consumers, and elevated interest rates.

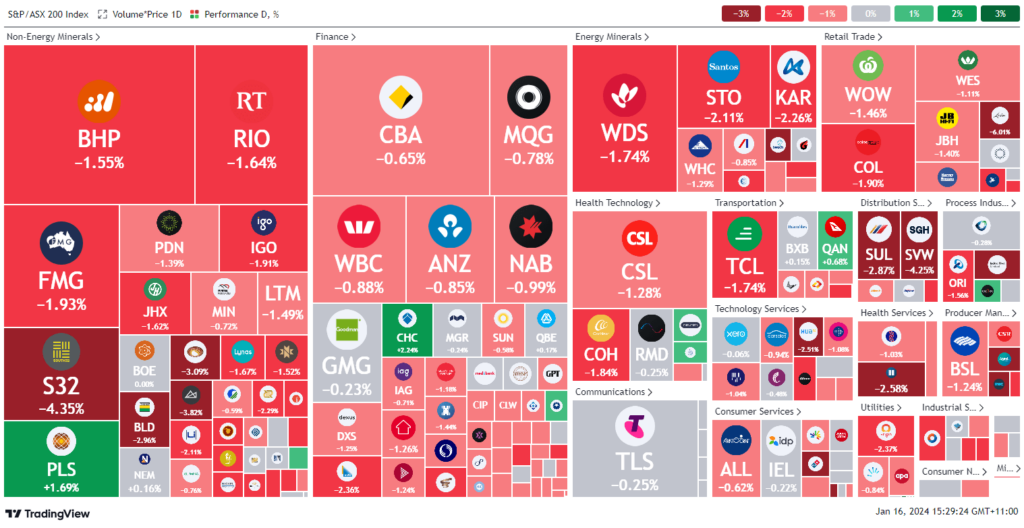

ASX Stocks

ASX 200 - 7,414.8 (-81.5, -1.1%)

Key Highlights:

Australian shares are experiencing a decline, mirroring European weakness due to confirmed economic challenges in Germany, reducing expectations of imminent rate cuts by the regional central bank. The S&P/ASX 200, records a 1.2% drop to 7422.4, its lowest since mid-December, with the All Ordinaries following a similar trend.

All sectors are in negative territory, with utilities, energy, and materials each down over 1.5%. European gas futures hit a five-month low due to surplus inventories and weak demand. Origin Energy falls 2.1%, while Santos and Woodside, major oil and gas players, are down over 1.7%.

Consumer staples, pulled by supermarket leaders Coles and Woolworths, decline 1.2%. Woolworths slips 1.5%, and Coles drops 1.7% after the competition regulator hints at legal action for potential consumer law breaches.

Poor performers include Lovisa, down 6.2%, and Core Lithium, 4.7% lower, reflecting a Goldman Sachs price target cut. Super Retail Group, after a previous surge, retreats 4.2% following a Jarden downgrade. Rio Tinto faces a 1.2% dip amid uncertainties with the Mongolian government over a new tax issue related to its copper mine. Investment platform HUB24 records a 3.5% decline despite a $4.5 billion inflow in the December quarter.

Leaders

ERA Energy Resources of Australia Ltd 18.64%

CEN Contact Energy Ltd 4.38%

WGX Westgold Resources Ltd 3.09%

HGH Heartland Group Holdings Ltd 2.26%

CHC Charter Hall Group 2.24%

Laggards

WC8 Wildcat Resources Ltd -12.90%

FCL Fineos Corporation Holdings Plc -6.28%

LOV Lovisa Holdings Ltd -6.01%

S32 SOUTH32 Ltd -4.21%

ANN Ansell Ltd -4.19%