What's Affecting Markets Today

Dow lower, Earnings season starts

On Friday, the Dow Jones Industrial Average experienced a slight downturn of 0.31%, closing at 37,592.98, as traders meticulously reviewed the initial wave of Q4 earnings and processed the second of two pivotal inflation reports this week. The broader market exhibited mixed performances, with the S&P 500 eking out a marginal 0.08% gain to reach 4,783.83, and the Nasdaq Composite settling just above flat, registering a minimal 0.02% increase to 14,972.76.

UnitedHealth notably dragged down the Dow, witnessing a nearly 3.4% decline despite reporting robust Q4 earnings and revenue surpassing expectations. Delta Air Lines also faced a substantial drop, falling nearly 9% even after exceeding quarterly earnings projections.

Major banks reported diverse outcomes: Bank of America incurred a 1.1% loss following a decline in Q4 profit, while Wells Fargo shares dipped 3.3% despite posting higher quarterly profits. JPMorgan Chase experienced a 0.7% decline despite announcing a 15% year-over-year slip in earnings.

Citigroup managed to gain just above 1%, albeit revealing a 10% reduction in its workforce and posting a $1.8 billion quarterly loss due to significant charges. Analysts noted a reversal in Q4’s strong trends, emphasizing a “wait-and-see mode” for market reactions to inflation and forthcoming earnings season developments in 2024.

Encouragingly, wholesale prices unexpectedly declined by 0.1% in December, following Thursday’s consumer prices data, which modestly exceeded economists’ forecasts. Analysts affirmed that the Producer Price Index (PPI) suggested the December Consumer Price Index (CPI) uptick was likely a one-time occurrence. This news contributes to a clearer path for the Federal Reserve to initiate interest rate cuts in 2024 and gradual balance sheet reduction.

For the week, major averages posted gains, with the Dow up 0.34%, the S&P 500 advancing 1.84%, and the Nasdaq outperforming, rising 3.09% by Friday’s close.

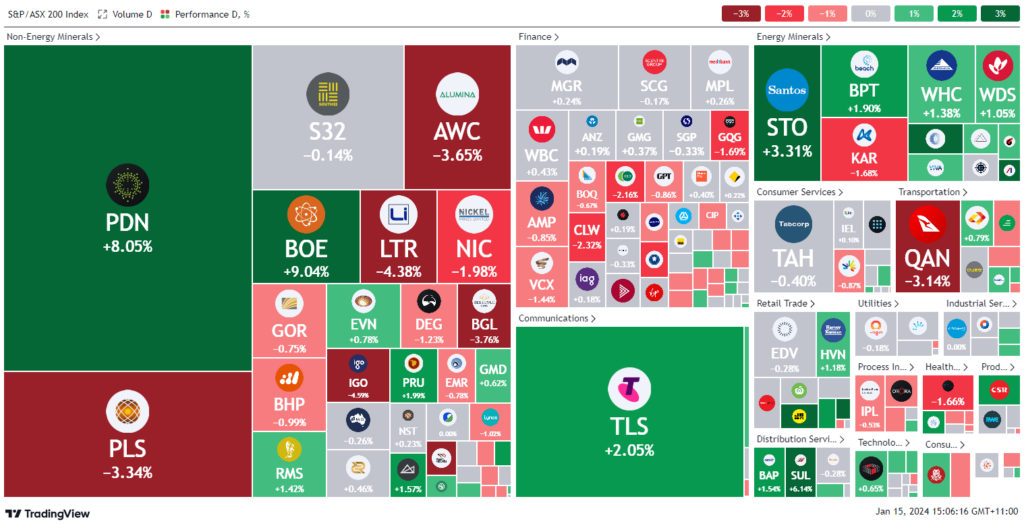

ASX Stocks

ASX 200 - 7,496.3 (-2.0, -0.05%)

Key Highlights:

In afternoon trading, the Australian share market saw a modest uptick, driven by a surge in energy stocks following regulatory approval for Santos’ Barossa gas field pipeline off the Northern Territory coast. The S&P/ASX 200 index gained 3.9 points, reaching 7502.2 by 2:47 pm, rebounding from a 0.2% dip at the opening influenced by Friday’s mixed Wall Street session. The All Ordinaries Index inched up by 0.1%. With the US market closed for Martin Luther King Jr. Day, subdued trading conditions are anticipated. Energy stocks led the way with a 2.1% sector rise, spearheaded by Santos’ 3.4% gain post the Federal Court’s approval of its $5.8 billion gas project. Uranium stocks, amid a prolonged sector rally, witnessed gains, with Boss Energy and Paladin Energy surging 9% and 8.1%, respectively. Retail stocks also flourished, buoyed by Super Retail Group’s robust Christmas sales, prompting a 6.1% rise in its shares, along with positive movements in JB Hi-Fi and Premier Investments, up 4% and 4.6%, respectively.

Leaders

ERA Energy Resources of Australia Ltd 29.55%

DYL Deep Yellow Ltd 11.38%

BOE Boss Energy Ltd 9.43%

SLX SILEX Systems Ltd 8.57%

PDN Paladin Energy Ltd 8.09%

Laggards

TUA Tuas Ltd -7.07%

SNZ Summerset Group Holdings Ltd -5.79%

HLS Healius Ltd -4.80%

LTR Liontown Resources Ltd -4.55%

IGO IGO Ltd -4.53%