What's Affecting Markets Today

S&P slightly lower overnight

On Tuesday night, the S&P 500 mitigated earlier losses, propelled by gains in the technology sector, but ultimately concluded the day with modest declines. The broad market index closed 0.15% lower, settling at 4,756.50, having recovered from a 0.7% dip earlier in the session. The Dow Jones Industrial Average closed at 37,525.16, down 0.42%, rebounding from a 310-point drop at its session lows. The Nasdaq Composite turned around a nearly 0.9% decline, finishing with a marginal gain of 0.09% at 14,857.71. Notably, Nvidia reached a new all-time high with a 1.7% increase, while Amazon and Alphabet also saw gains exceeding 1.5%. Juniper Networks surged nearly 22% following reports of a potential $13 billion acquisition by Hewlett Packard Enterprise, contributing to tech’s overall resilience despite a challenging start in 2024, resulting in a year-to-date decline of over 1.1%.

ASX Stocks

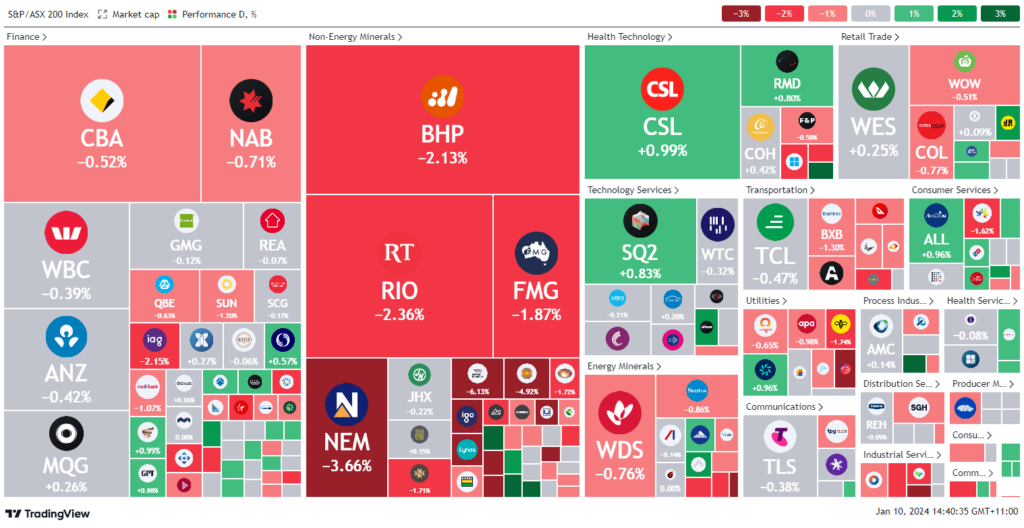

ASX 200 - 7,467.7 (-52.8 -0.70%)

Key Highlights:

Australian shares are experiencing a downward trend, influenced by a weak overnight session on Wall Street and despite the November inflation gauge showing a faster-than-expected cooling. The S&P/ASX 200 has declined by 0.3%, down 21 points to 7499, with the All Ordinaries also recording a 0.3% decrease. Among the 11 sectors, miners are the most adversely affected, experiencing a 1.4% drop, driven by prominent iron ore companies such as BHP, Rio Tinto, and Fortescue, which are down over 1.5% due to a prolonged decline in commodity prices. Conversely, uranium stocks are thriving, propelled by the US Department of Energy’s announcement of seeking a domestic enriched uranium supply. Paladin Energy has surged by 10.1% to $1.16, while Boss Energy is up 5.3% to $4.87. Inflationary pressures have moderated, with Australia’s November consumer price indicator easing to 4.3% annually, slightly below analysts’ expectations of 4.4%.

Leaders

SLX SILEX Systems Ltd 15.56%

AWC Alumina Ltd 14.80%

PDN Paladin Energy Ltd 10.61%

ERA Energy Resources of Australia Ltd 7.14%

DYL Deep Yellow Ltd 6.65%

Laggards

LTM Arcadium Lithium Plc -7.94%

WC8 Wildcat Resources Ltd -7.84%

IGO IGO Ltd -6.98%

MIN Mineral Resources Ltd -6.17%

IMU Imugene Ltd -5.77%