What's Affecting Markets Today

Nasdaq rebounds with a 2% rally

On Monday, major indices rebounded, driven by a tech sector resurgence, as Wall Street aimed to recover from recent losses. The S&P 500 surged 1.41% to close at 4,763.54, and the Nasdaq Composite posted a 2.2% gain, reaching 14,843.77, its strongest performance since November 14. The Dow Jones Industrial Average settled at 37,683.01, up 216.90 points or 0.58%. Investors seized opportunities in the technology sector, which had experienced a 4% decline the previous week. Nvidia reached an all-time high with a 6.4% rise, Amazon climbed 2.7%, Alphabet advanced 2.3%, and Apple, following Evercore ISI’s advice, added 2.4%. The VanEck Semiconductor ETF soared 3.5%, marking its best day since November. The 10-year Treasury yield dropped approximately 3 basis points to 4.012%.

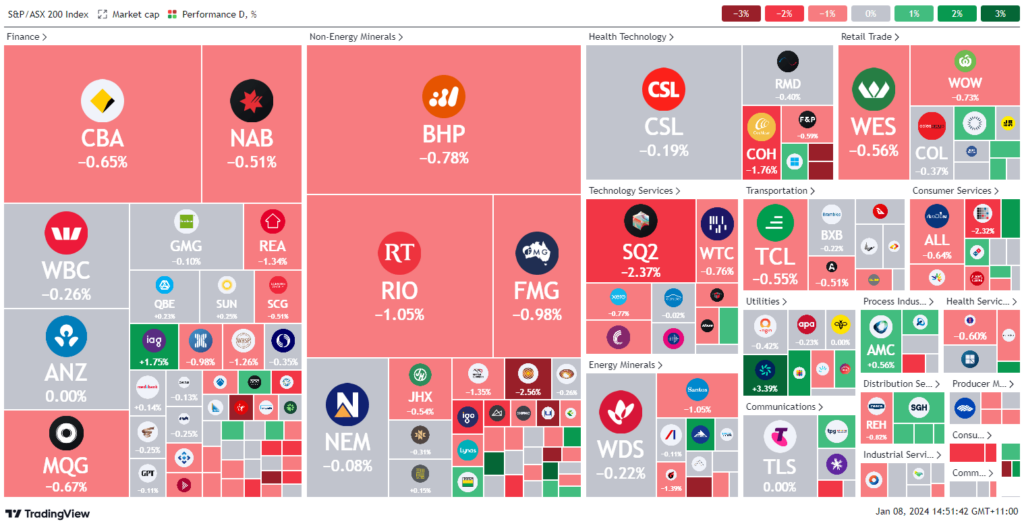

ASX Stocks

ASX 200 - 7,523.7 (+72.2 +1.0%)

Key Highlights:

Australian shares surged 1.2% today, fueled by a robust Wall Street session and the most robust monthly retail sales report in three years. The S&P/ASX 200 soared 90.4 points, or 1.2%, reaching 7541.9, led by tech stocks following the Nasdaq’s over 2% gain, driven by Nvidia’s performance. The All Ordinaries also climbed 1.1%. Notable performers include Zip, rising 5.7%, and Block and Megaport, both up 4%. Major banks saw up to a 1.3% increase. In the mining sector, BHP gained 0.8%, Rio Tinto edged up 0.3%, and Fortescue rallied 1.4%. Energy was the sole declining sector, albeit modestly, affected by Monday’s oil price slump. Australian retail trade marked a significant 2% increase in November, beating market expectations, driven by Black Friday sales. Retail sales for November surged 2.2% YoY, the largest monthly change since November 2021. Building approvals also surprised, rising 1.6% in November, defying expectations of a 2% drop. The Australian dollar edged up 0.1% to US67.24¢. Corporate news includes Worley on trading halt amid allegations from an Ecuadorean tribunal, and Alumina’s 1.1% rise after confirming production curtailment at its Kwinana refinery for cost-cutting.

Leaders

IMU Imugene Ltd 8.33%

ELD Elders Ltd 7.14%

AWC Alumina Ltd 6.04%

THL Tourism Holdings Rentals Ltd 5.94%

RMD Resmed Inc 5.88%

Laggards

STX Strike Energy Ltd -6.12%

WBT Weebit Nano Ltd -2.81%

LTM Arcadium Lithium Plc -2.79%

PTM Platinum Asset Management Ltd -1.76%

ASB Austal Ltd -1.66%