What's Affecting Markets Today

US payrolls much better than expected

In December, the job market exceeded expectations, with employers adding 216,000 jobs, maintaining the unemployment rate at 3.7%, beating estimates of 170,000 and 3.8% respectively. The upswing was driven by a surge of 52,000 government jobs and an additional 38,000 in healthcare sectors like ambulatory services and hospitals. Average hourly earnings saw a 0.4% monthly increase, surpassing the estimated 0.3%, and a 4.1% annual rise, outperforming the projected 3.9%. This positive employment report signals robust economic recovery, reflecting increased government and healthcare sector hiring, along with higher-than-expected wage growth.

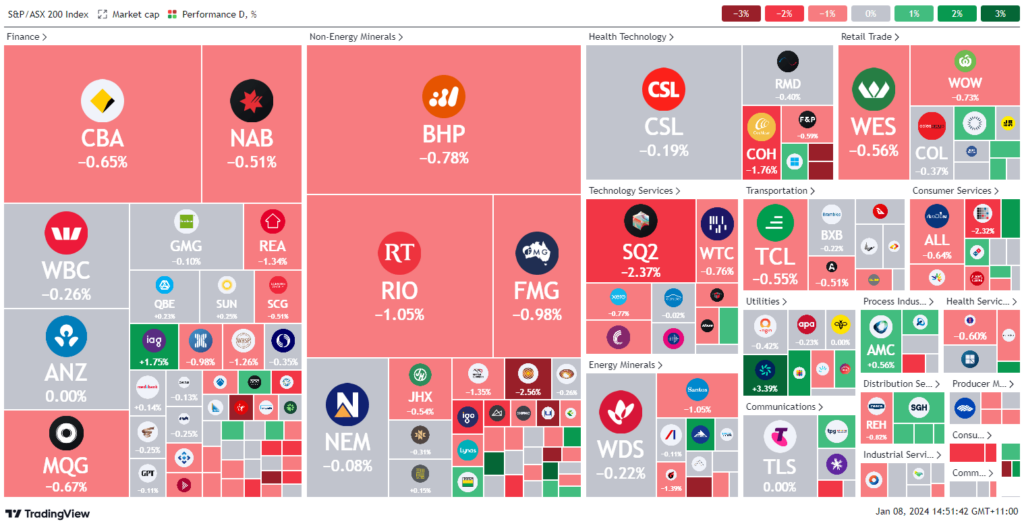

ASX Stocks

ASX 200 - 7,446.9 (-42.2 -0.60%)

Key Highlights:

Australian shares are experiencing a downturn in the final trading hours, extending the challenging start witnessed last week. The S&P/ASX 200 has declined by 0.2%, currently standing at 7472.2 points, with the All Ordinaries following suit with a 0.2% decrease. Amid a lackluster market, none of the ASX’s 11 sectors have recorded movements exceeding 0.5%. Energy stocks, initially supporting the benchmark, have retreated to a modest 0.3% gain. Notably, Kali Metals, a lithium hopeful, made a remarkable debut, surging approximately 75% from its IPO price of 25¢ per share. Uranium stocks are standout performers, with Boss Energy rising 8.4% to $4.58 and Paladin Energy up 4.1% to $1.06, driven partly by the UK government’s announcement of a £300 million investment in a new high-tech nuclear fuel plant. Red 5 has gained 3.6% at 29¢, affirming its alignment with FY24 production guidance. Metcash has appointed Richard Murray, former CEO of Premier Investments, as the CEO of Total Tools Holdings, resulting in a 1% increase in shares to $3.53 following Paul Dumbrell’s departure.

Leaders

BOE Boss Energy Ltd 9.57%

RED RED 5 Ltd 5.36%

PDN Paladin Energy Ltd 3.70%

MEZ Meridian Energy Ltd 3.39%

LTM Arcadium Lithium Plc 2.90%

Laggards

MFG Magellan Financial Group Ltd -7.36%

WBT Weebit Nano Ltd -5.16%

NEU Neuren Pharmaceuticals Ltd -4.60%

NAN Nanosonics Ltd -4.51%

WC8 Wildcat Resources Ltd -4.35%