What's Affecting Markets Today

FED officials see rate cuts in 2024, timing uncertain

In December, Federal Reserve officials, as per meeting minutes released Wednesday, anticipated interest rate cuts in 2024 without specifying the timing. The Federal Open Market Committee maintained the benchmark rate at 5.25%-5.5%. Members envisioned three quarter-point cuts by end-2024, but the summary highlighted considerable uncertainty surrounding the implementation of these adjustments. The business landscape faces potential shifts as the Federal Reserve navigates economic dynamics, with market participants closely monitoring developments for insights into the trajectory of monetary policy.

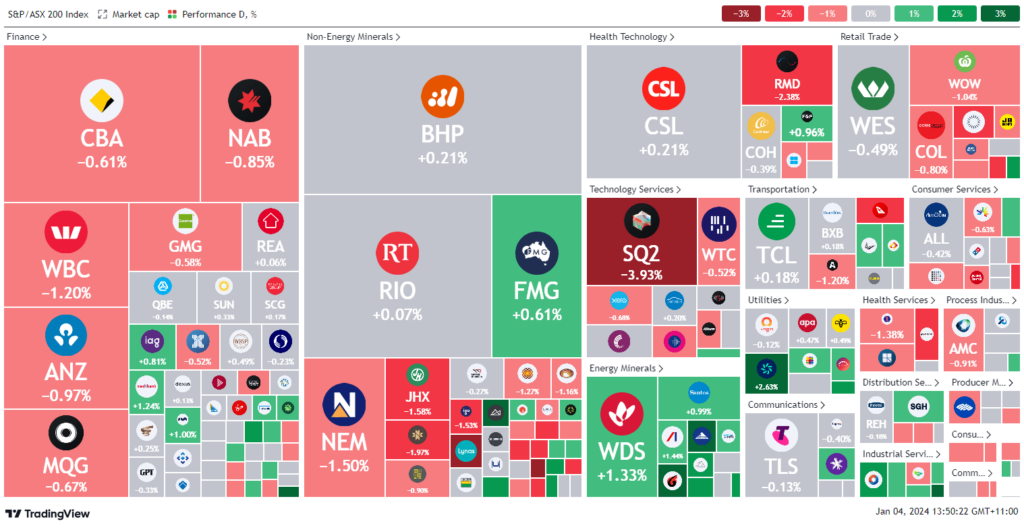

ASX Stocks

ASX 200 - 7,494.1 (-0.4%)

Key Highlights:

Australian shares experienced another decline, mirroring Wall Street’s continued losses, following indications from the Federal Reserve meeting minutes that interest rates might remain restrictive for an extended period. The S&P/ASX 200 index dropped 0.4% to 7494.1, with technology and real estate stocks, sensitive to interest rates, contributing to the downturn. Notably, Xero fell by 1%, Altium by 1.1%, and WiseTech by 0.8%.

The Australian dollar hovered around US67.23¢ against the US dollar. Meanwhile, the US dollar reached a two-week high on Wednesday, as investors, while questioning the market’s anticipation of six interest rate cuts by the Federal Reserve in 2024, continued profit-taking on short dollar positions.

In the commodities sector, energy stocks followed the uptick in crude oil prices, with Brent crude reaching nearly $78 a barrel. Supply disruptions in Libya, heightened tensions in the Middle East, and an OPEC statement emphasizing commitment to price stability fueled bullish sentiments. Woodside Energy surged by 1.4%, Santos gained 1.2%, and Ampol rose by 1.5%. Market participants closely monitored these developments, navigating uncertainties stemming from global economic shifts and central bank policy cues.

Leaders

IFL Insignia Financial Ltd 4.89%

JLG Johns LYNG Group Ltd 4.71%

YAL Yancoal Australia Ltd 3.60%

WHC Whitehaven Coal Ltd 3.12%

WBT Weebit Nano Ltd 2.93%

Laggards

LTM Arcadium Lithium Plc -6.35%

LRS Latin Resources Ltd -5.56%

RED RED 5 Ltd -5.00%

HGH Heartland Group Holdings Ltd -4.68%

IMU Imugene Ltd -4.17%