What's Affecting Markets Today

Asia Markets Mixed

Asia-Pacific markets opened the new year with a mixed performance, as China stocks faced a decline due to a deepening contraction in the manufacturing sector, according to weekend official data. China’s manufacturing PMI revealed a contraction in December, signaling the potential need for additional policy support to revive the economy. Conversely, a Caixin survey indicated an expansion in manufacturing activity, with the PMI at 50.8 in December, up from 50.7 in November. The CSI 300 index in China opened 0.64% lower, and Hong Kong’s Hang Seng index dropped by 0.58%. Meanwhile, Japan assessed the aftermath of a powerful New Year’s Day earthquake.

ASX Stocks

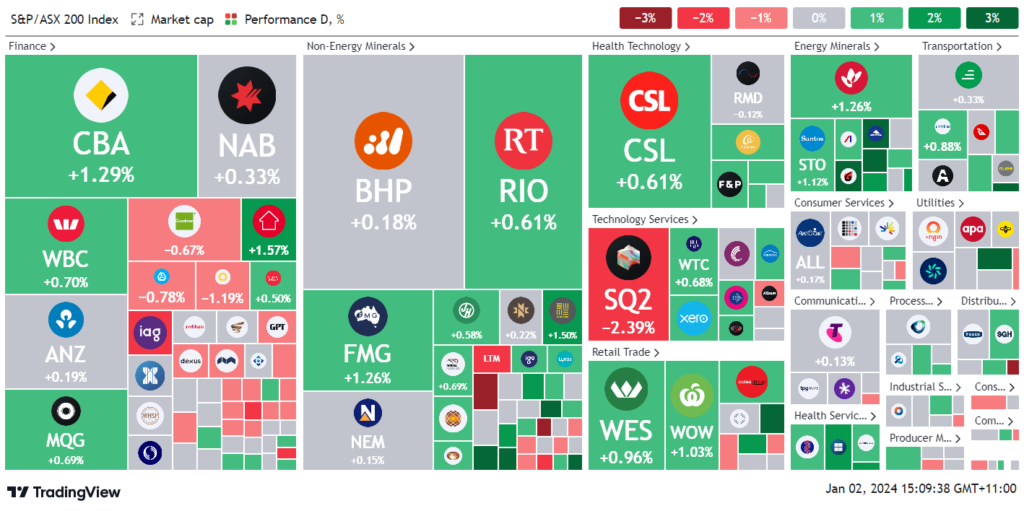

ASX 200 - 7,626.5 (0.50%)

Key Highlights:

Australian shares are making strides towards a record high in the initial trading session of 2024. The S&P/ASX 200 index saw a 0.5% increase, adding 34.5 points to reach 7625.3 at midday on Tuesday, positioning itself within a mere 10 points of the August 2021 record.

Leading the charge was the energy sector, buoyed by an uptick in crude oil prices. Ampol saw a 0.9% rally, Woodside Energy gained 0.9%, and Santos rose by 0.7%. The surge in commodity prices followed Iran’s dispatch of a warship to the Red Sea in response to the US Navy’s destruction of three Houthi boats over the weekend.

In other developments, Singapore iron ore futures experienced a 1.8% upswing, reaching $141.20 a tonne in late afternoon trading. Mining giants mirrored the positive trend in the steel-making commodity, with BHP posting a 0.2% increase to $50.51 per share. Fortescue Metals achieved a new intraday record at $29.48 per share, while Rio Tinto saw a 0.6% rise to $136.525.

The benchmark index closed out 2023 with a notable 7.8% annual gain, marking its strongest performance since 2021. The last time the benchmark reported a larger gain was in 2021 when it surged by 13%. Contrastingly, in 2022, the index experienced a 5.5% loss.

Leaders

THL Tourism Holdings Rentals Ltd -3.86%

ABG Abacus Group -3.04%

BAP Bapcor Ltd -2.80%

ADT Adriatic Metals Plc -2.74%

ASK Abacus Storage King -2.66%

Laggards

BOE Boss Energy Ltd 5.96%

YAL Yancoal Australia Ltd 4.55%

WHC Whitehaven Coal Ltd 3.70%

DYL Deep Yellow Ltd 3.44%

WAF West African Resources Ltd 3.44%