Closing Bell

What's Affecting Markets Today

Oil on the Rise Due to OPEC+ Decisions

OPEC+ extended supply cuts, leading to a weekly oil gain. West Texas Intermediate (WTI) hovered around $US87 a barrel, with US crude stockpiles dropping significantly. However, JPMorgan remains cautious about reaching $US100 a barrel this year.

Potential Strikes at Chevron’s LNG Facilities

Chevron and Australian labor unions resumed talks amidst looming strike threats at the Gorgon and Wheatstone LNG projects. Unions are dissatisfied with Chevron’s current offer. These facilities are crucial, having supplied 7% of global LNG last year.

Dip in Crypto Trading Volumes

Cryptocurrency trading volumes in August hit their lowest for the year. Data from CCData showed a combined volume drop of 11.5% to $US2.09 trillion. Bitcoin remained stable around $US25,800, a significant drop from its $US69,000 peak in 2021. Binance’s market share also decreased.

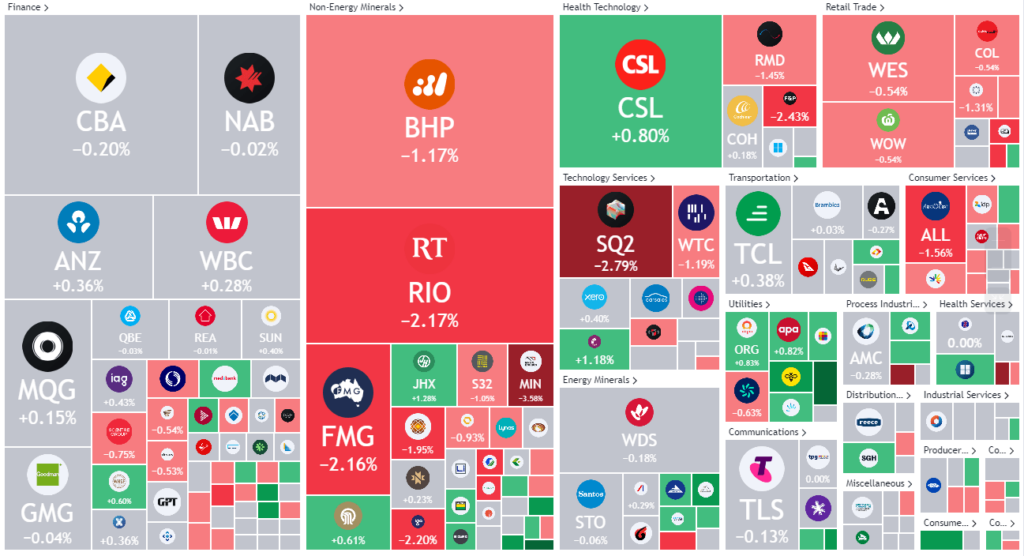

ASX Stocks

ASX 200 - 7156.7 -14.3 (-0.2%)

Key Highlights:

the materials sector experiencing the most significant decline. Major mining companies such as Fortescue Metals, BHP, and Rio Tinto have all seen a drop of over 1%. This decline aligns with the falling iron ore prices, which are currently priced at $US113.75 a tonne, a decrease from $US116 earlier in the week. In corporate updates, AMA Group shares plummeted by 47% following the conclusion of their $55 million equity raise. The shares were priced at 7.5¢, a notable 37.5% discount from the 12¢ price on August 30. Meanwhile, Orora shares have continued their downward trend, dropping by 2.9%. This decline comes after the company’s $1.3 billion equity raise intended to finance the acquisition of France’s Saverglass. Orora’s shares have decreased by 17.8% this week.

Platnium Fund Redemptions

Platinum Asset Management reported a net fund outflow of $912 million in August, coinciding with the resignation of CEO Andrew Clifford. By the end of August, their funds under management stood at $16.7 billion, down from $17.8 billion in July. Broker Barrenjoey criticized the company’s performance, setting a share price target of $1, down from its last closing at $1.37.

Leader

- A1N – Arn Media Ltd (8.55%)

- QAL – Qualitas Ltd (8.23%)

- WR1 – Winsome Resources Ltd (6.73%)

- SWM – Seven West Media Ltd (6.25%)

- TIE – Tietto Minerals Ltd (5.63%)

Laggards

- AD8 – Audinate Group Ltd (-9.45%)

- HTA – Hutchison Telecom. Ltd (-7.14%)

- AGY – Argosy Minerals Ltd (-6.38%)

- MLX – Metals X Ltd (-5.83%)

- TBN – Tamboran Resources Ltd (-5.36%)