Closing Bell

What's Affecting Markets Today

Governor Philip Lowe Last Speech

Philip Lowe, during his tenure as the governor of the Reserve Bank, faced unique challenges. Initially, he addressed concerns of potentially low inflation, a stark contrast to previous concerns of high inflation. Despite making over 30 public addresses, he didn’t adjust the cash rate from the 1.5% he inherited for a significant time. In 2019, he signaled a potential rate cut, emphasizing that banks should pass on the benefits to borrowers. As 2019 ended, Lowe’s concerns about low inflation were evident. In early 2020, he responded to the emerging virus in China, later unveiling a crisis package in response to the pandemic. Despite his optimism about inflation, Lowe faced challenges with rising inflation rates, leading to rate hikes. By 2022, the cash rate increased to 3.1%. After a controversial private appearance, the rate further rose to 4.1% by June. A review suggested changes in monetary policy, and Lowe’s term wasn’t renewed. His tenure was marked by initial inactivity followed by dramatic challenges.

RBA Rate Expectations

Bond traders have increased expectations for higher interest rates in Australia, mirroring a similar trend in the US due to positive economic data. Bond futures now suggest a 38% likelihood of the Reserve Bank raising the cash rate to 4.35%, up from 35% previously. The most significant shift is in the anticipated timing of this increase, now seen as equally likely between December of this year and May 2024. Meanwhile, the odds for rate cuts by the end of 2024 have been reduced from 70% to 50%. In the US, there’s a 48% chance of another rate hike by the Fed in November. Australian bond yields have also risen slightly.

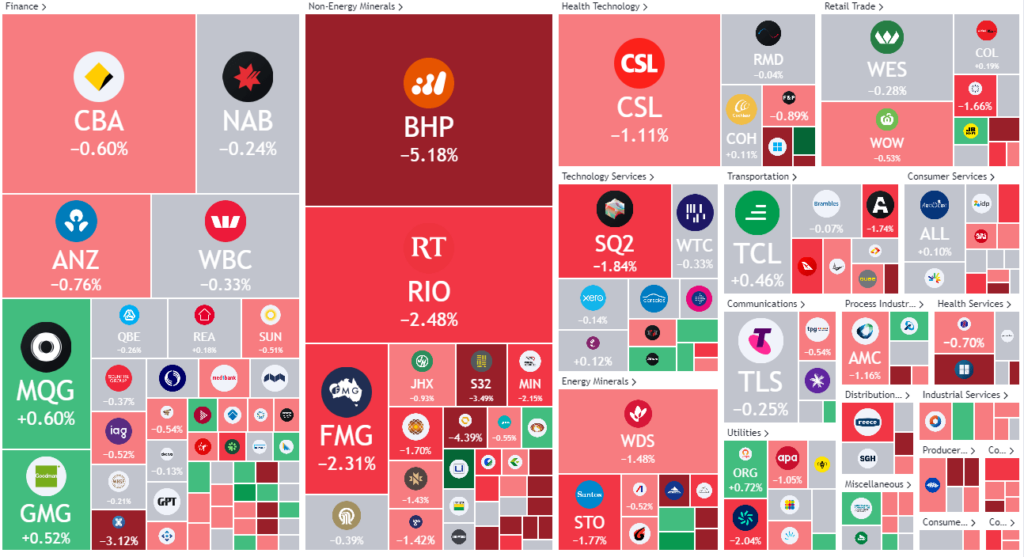

ASX Stocks

ASX 200 - 7171 -86.1 (-1.19%)

Key Highlights:

Leader

- CHN – Chalice Mining Ltd (8.79%)

- LTR – Liontown Resources Ltd (8.66%)

- WBT – Weebit Nano Ltd (6.28%)

- SM1 – Synlait Milk Ltd (5.53%)

- CVW – Clearview Wealth Ltd (4.85%)

Laggards

- ARU – Arafura Rare EARTHS Ltd (-11.4%)

- BCK – Brockman Mining Ltd (-9.43%)

- NVX – Novonix Ltd (-7.91%)

- SLX – SILEX Systems Ltd (-7.48%)

- RMC – Resimac Group Ltd (-7.31%)