Closing Bell

What's Affecting Markets Today

Australia’s GDP Growth

Australia witnessed a promising economic uptick with its GDP growing by 0.4% in the second quarter, outpacing both the previous quarter’s 0.2% and the forecasted 0.3%. On an annual scale, the GDP rose by 2.1%, surpassing the expected 1.8%. Katherine Keenan of the ABS emphasized this as the seventh consecutive quarterly GDP rise, largely due to minimal COVID-19 disruptions in 2022-23. Capital investment and service exports were the primary growth drivers.

Oil Prices

The global oil market is experiencing a surge, with prices reaching their highest since last November. This comes after OPEC+ leaders, notably Saudi Arabia and Russia, decided to extend supply curbs throughout the year. The West Texas Intermediate is now trading near $US87 a barrel, a significant 1.3% increase. This move is anticipated to tighten the global market, especially as the International Energy Agency reports record global crude consumption.

NSW Coal Miners & Royalties

New South Wales’ coal sector saw a boost as the state government plans to hike coal royalties by 2.6% from July next year. Major coal producers like New Hope, Whitehaven Coal, and Yancoal experienced around a 2% rise in their stocks. This adjustment aims to ensure the state capitalizes fairly on its resources, especially as international coal prices have surged, partly due to geopolitical events like Russia’s invasion of Ukraine. The new royalty scheme is projected to bolster the NSW budget by over $2.7 billion from 2024-25 onwards.

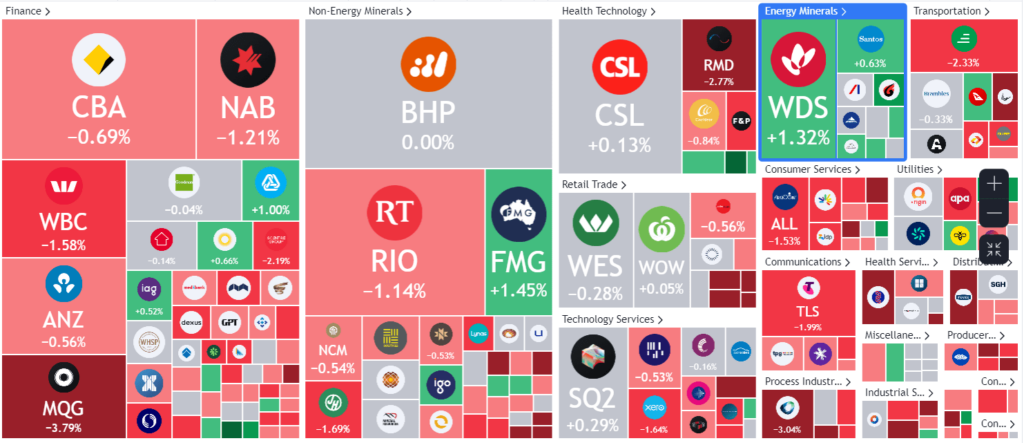

ASX Stocks

ASX 200 - 7265 -49.4 (-0.68%)

Key Highlights:

Leader

- PNR – Pantoro Ltd (11.11%)

- LOT – Lotus Resources Ltd (8.33%)

- ARU – Arafura Rare

- EARTHS Ltd (7.55%)

- PDI – Predictive Discovery Ltd (7.5%)

Laggards

- PBH – Pointsbet Holdings Ltd (-54.99%)

- ORA – Orora Ltd (-17.9%)

- LRS – Latin Resources Ltd (-9.72%)

- RED – RED 5 Ltd (-9.43%)

- CVW – Clearview Wealth Ltd (-9.09%)