Closing Bell

What's Affecting Markets Today

$A Tumbles Amid Oil Rally

and Bond Market Sell-Off

The Australian Dollar fell below US63.4¢ as oil prices surged and US bond yields reached new highs, intensifying fears of a prolonged high-rate environment. The 10-year Treasury yield surpassed 4.6%, influencing Australian government bonds and prompting a sell-off in the $A. The oil price increase was triggered by a drop in US crude stockpiles, indicating a tightening market.

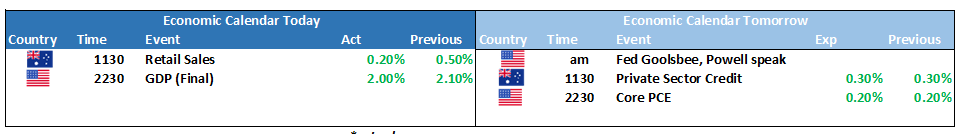

Retail Sales Rise Below

Forecast, Impacting RBA Decisions

August saw a modest 0.2% increase in retail sales to $35.4 million, falling below the expected 0.3% gain and July’s 0.5% rise. This slowdown suggests that the Reserve Bank of Australia’s recent rate hikes may be impacting consumer spending. The RBA, aiming to balance inflation control and economic stability, will consider these figures in its upcoming meeting under new governor Michele Bullock.

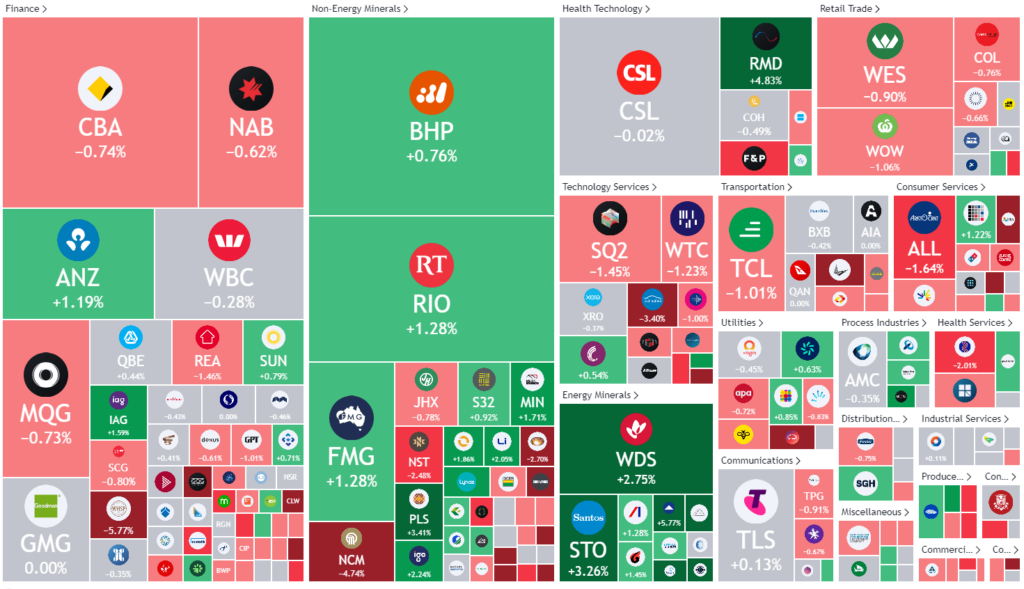

ASX Stocks

ASX 200 - 7024.8 -5.5 (-0.08%)

Key Highlights:

The ASX is experiencing a downward trend, particularly in consumer stocks, following unexpected falls in monthly retail sales. The S&P/ASX 200 index and the All Ordinaries both declined by 0.3%. Despite this, the energy sector saw significant gains with WTI crude reaching new highs and companies like Santos and Karoon experiencing surges. The Australian Dollar continued its decline, influenced by rising oil prices and bond yields. Notable stock movements included Brickworks’ 7.2% fall after a profit drop, Washington H Soul Pattinson’s 7.1% slump, and Premier Investments’ slight decline amidst a challenging economic environment. These movements reflect the market’s varied responses to company performances and broader economic conditions.

Leader

RNU-Renascor Resources Ltd (+9.52%)

COE-Cooper Energy Ltd (+8.70%)

SM1-Synlait Milk Ltd (+7.44%)

LKE-Lake Resources N.L. (+6.25%)

MAH-Macmahon Holdings Ltd (+6.25%)

Laggards

BCB-Bowen Coking Coal Ltd (-14.52%)

LRS-Latin Resources Ltd (-11.54%)

A4N-Alpha Hpa Ltd (-9.58%)

PAC-Pacific Current Group Ltd (-8.66%)

IMU-Imugene Ltd (-8.00%)