Closing Bell

What's Affecting Markets Today

RBA Inflation Battle

New Reserve Bank Governor Michele Bullock faces a challenging task as inflation figures reveal a rise to 5.2% in August, exceeding the central bank’s 2-3% target range. The increase, driven by robust wages growth and rising energy and labour costs, indicates persistent inflationary pressures affecting various sectors, including services.

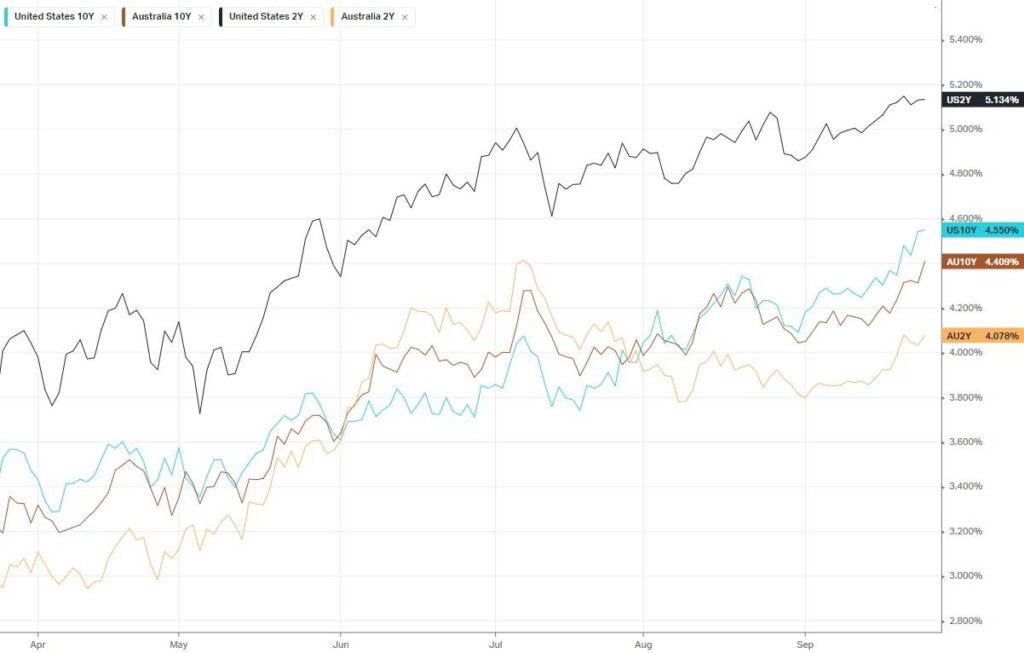

AUD and Bond Yields

Following the release of the consumer price index, the Australian Dollar (AUD) dipped below US64¢, settling at US63.9¢. This movement in currency value is reflective of the broader economic factors and inflationary pressures at play. Additionally, there was a slight slip in bond yields, with the 10-year yield at 4.3% and the two-year yield decreasing by 2 basis points to 4.03%. These shifts in currency and bond yields are indicative of market reactions to inflation data and have implications for international trade and investment.

Oil Market

Oil prices are on the rise, with West Texas Intermediate nearing $US91 a barrel, indicating a supply deficit. A 28% surge since June, attributed to supply curbs from OPEC+ leaders, has sparked discussions of $US100 a barrel crude. However, gains have plateaued recently, reflecting market uncertainties and varying factors influencing oil prices.

ASX Stocks

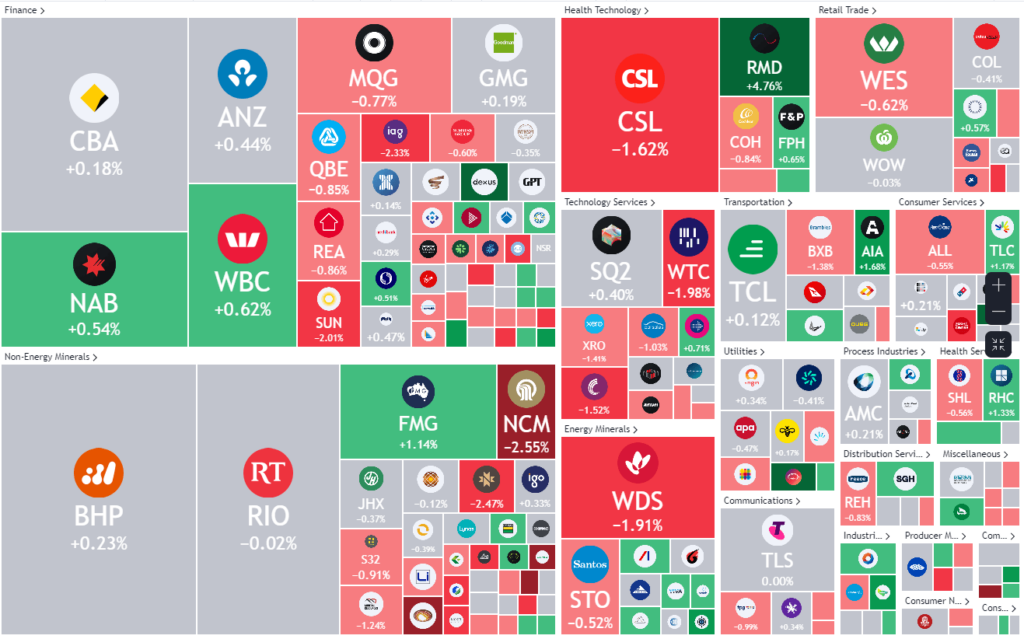

ASX 200 - 7027.8 -10.4 (-0.15%)

Key Highlights:

Despite a rise in the consumer price index, the Australian sharemarket traded just 0.3% lower, with the energy and technology sectors impacting the ASX 200. The tech sector, sensitive to interest rate prospects, saw declines in Life360 and WiseTech. Meanwhile, Star Entertainment’s tumble and ResMed’s rally were notable movements, reflecting the market’s diverse reactions to company-specific news.

Star Entertainment plummeted 16% after raising $565 million from institutional investors. Endeavour’s board recommended voting against the election of former Myer chairman Bill Wavish, causing fluctuations in its share price. Tamboran Resources experienced an 11.6% rally after estimating resources at a permit in the Northern Territory. ResMed saw over a 5% surge due to a favourable Goldman Sachs report on the sleep apnea market.

Leader

MSB-Mesoblast Ltd (+9.72%)

MEI-Meteoric Resources NL (+8.51%)

BMN-Bannerman Energy Ltd (+5.36%)

RMD-Resmed Inc (+4.79%)

SPR-Spartan Resources Ltd (+4.00%)

Laggards

SGR-The Star Entertainment Group Ltd (-14.33%)

FSF-Fonterra Shareholders’ Fund (-11.45%)

ERA-Energy Resources of Australia Ltd (-10.81%)

BOT-Botanix Pharmaceuticals Ltd (-10.71%)

BRN-Brainchip Holdings Ltd (-7.90%)