Closing Bell

What's Affecting Markets Today

Iron Ore Price Affects Miners

A 3.3% drop in iron ore futures to $US117.20 per tonne is impacting Australia’s materials sector, including major miners BHP, Fortescue Metals, and Rio Tinto. Despite China’s property crisis, iron ore prices had previously defied expectations with a six-week rally.

Oil Prices Rall

Oil prices continue to rise, with West Texas Intermediate futures trading above $US90 a barrel. Hedge funds are optimistic, contributing to predictions of an “oil supercycle.” OPEC’s policies, supply curbs, and positive economic outlooks in the US and China are factors in the surge.

Petrol Prices and Australian Inflation

Rising petrol prices are expected to drive Australian inflation to 5.2% for the 12 months to August. The RBA may increase rates, but is likely to view the inflation rebound as an anomaly due to supply cuts by Saudi Arabia and Russia.

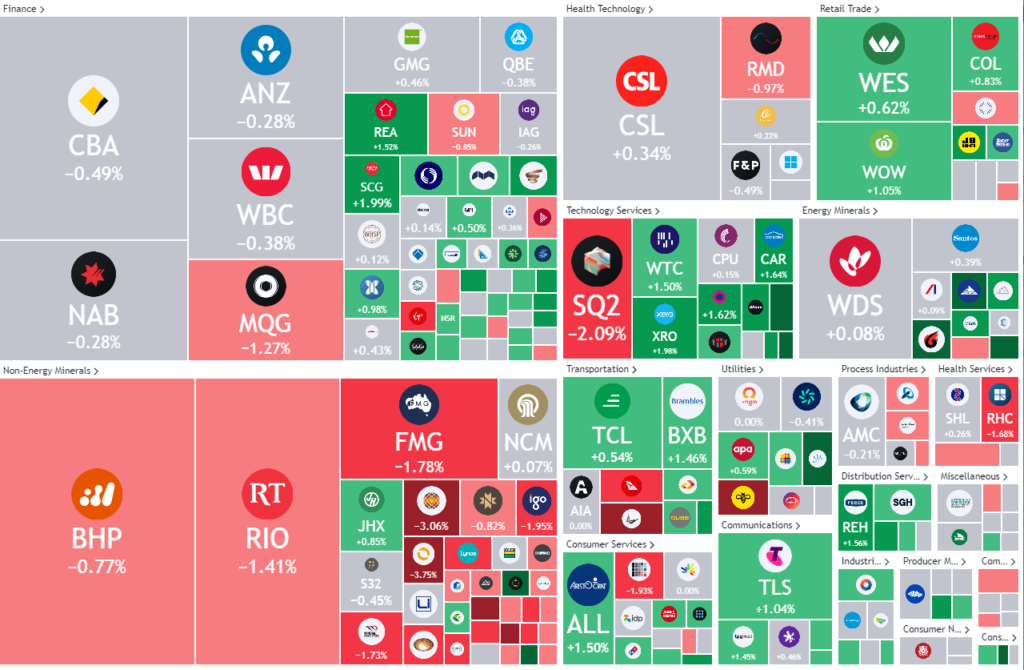

ASX Stocks

ASX 200 - 7076.5 +7.7 (0.11%)

Key Highlights:

The ASX/S&P 200 is experiencing a downturn in the morning and afternoon, extending the equity sell-off into a second week, primarily due to the struggles of materials companies and banks. However, it was able to make a recovery into the close. Major iron ore miners, including BHP, Fortescue Metals, and Rio Tinto, are facing declines between 0.7% and 1.7%. This downturn precedes Australia’s headline CPI figures release, which could potentially highlight the challenges of managing inflation in the country. Meanwhile, Qantas is grappling with challenges, facing an additional $80 million in customer improvement costs and an anticipated $200 million impact from escalating fuel costs, causing its stocks to trade near a one-year low. Despite these challenges, RBC Capital Markets maintains a neutral rating on Qantas, expressing confidence in the airline’s resilience. In contrast, stocks like health tech developer Polynovo are witnessing a surge, and others like Allkem and Synlait are experiencing varied movements.

Leader

DYL-Deep Yellow Ltd (+12.68%)

BMN-Bannerman Energy Ltd (+12.55%)

RHI-Red Hill Minerals Ltd (+10.11%)

IMU-Imugene Ltd (+8.00%)

SLX-SILEX Systems Ltd (+7.41%)

Laggards

NMT-Neometals Ltd (-10.37%)

BRN-Brainchip Holdings Ltd (-7.69%)

LRS-Latin Resources Ltd (-5.46%)

CXL-CALIX Ltd (-5.37%)

PNR-Pantoro Ltd (-4.88%)