Closing Bell

What's Affecting Markets Today

Economy at risk from sharp Chinese slowdown: RBA

The Reserve Bank of Australia (RBA) has raised concerns about the potential negative impacts of a sharp slowdown in the Chinese economy on Australia’s growth prospects. A significant decline in China’s economic performance could lead to a decrease in exports from Australia and a reduction in the number of international students. The RBA board’s decision to maintain interest rates at 4.1% on September 5 was influenced by these downside risks. The minutes from this meeting highlighted the RBA’s growing apprehension, noting the increased mentions of “China” or “Chinese” compared to previous months. A significant downturn in China’s economy could affect Australian services exports, resulting in fewer tourists and international students, and lead to lower export prices. However, the RBA also mentioned that any negative effects might be partially mitigated by a depreciation of the Australian dollar, which would stimulate exports and increase government revenue.

Strong oil prices lift energy shares

Energy stocks experienced a boost on Tuesday as oil prices reached a new 10-month high due to limited supply. Companies like Santos, Beach Energy, and Woodside saw their shares rise, while coal miners also benefited from a 0.4% increase in the Newcastle November contract. Whitehaven Coal and New Hope reported significant gains, with the latter announcing a $1 billion profit driven by robust coal demand and record prices. The global benchmark Brent touched $US95 a barrel, marking its highest point since the previous November. This surge in oil prices, which has been more than 30% since mid-June, is attributed to export curtailments by Saudi Arabia and Russia and an optimistic economic outlook in the US and China. However, the rising energy costs could intensify inflationary pressures, posing challenges for central banks worldwide.

Gold hits 2-week high as dollar eases ahead of Fed meet

Gold prices reached a two-week peak on Tuesday, with the US dollar retreating from its six-month highs achieved the previous week. Market attention is currently centered on the Federal Reserve’s two-day policy meeting. Spot gold remained stable at $US1932.79 per ounce, marking its highest level since September 5. Meanwhile, US gold futures experienced a slight increase to $US1954.30 per ounce. The Federal Open Markets Committee’s meeting is set to conclude on Wednesday, followed by a news conference, which is keenly awaited by market participants and analysts.

ASX Stocks

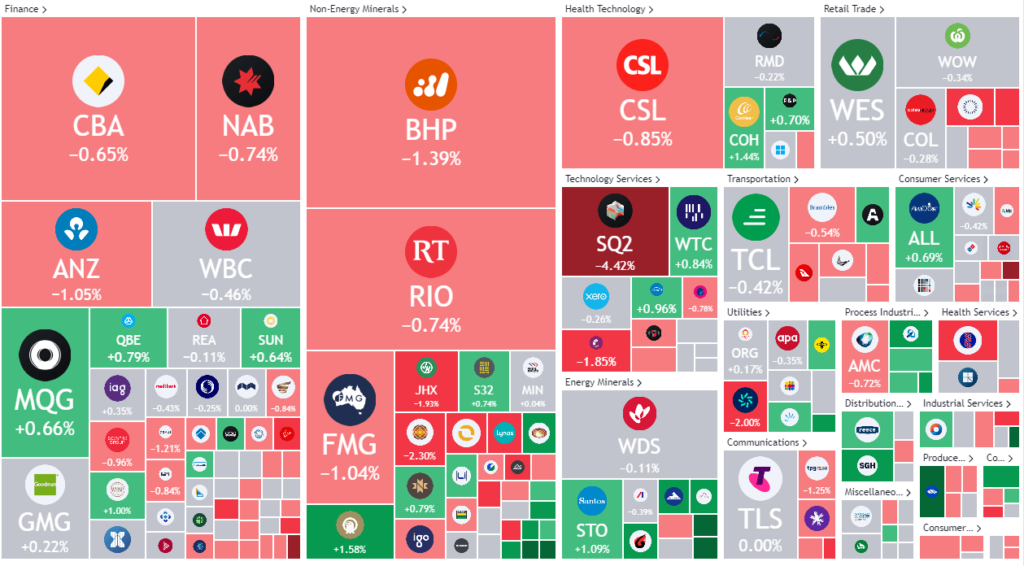

ASX 200 - 7196.6 -33.8 (-0.47%)

Key Highlights:

The sharemarket experienced a 0.5% decline by mid-day on Tuesday, with investors showing apprehension ahead of the US Federal Reserve’s upcoming policy meeting, anticipated to emphasize a prolonged stance on high interest rates. This cautious sentiment was further intensified by the Reserve Bank’s recent minutes, revealing contemplation over rate hikes. Although the RBA maintained the cash rate at 4.1% earlier this month, it signaled readiness to increase rates if inflation remains persistent. The Australian dollar remained stable at US64.34¢, despite hitting a 10-month low earlier. On the ASX, all sectors, barring energy, recorded losses, with property witnessing the most significant drop. Notable stock movements included New Hope’s 3.4% surge after announcing a $1 billion profit, Orica’s 1.2% rise due to its enhanced emissions reduction goals, and Newcrest’s 1.4% advancement following approval for Newmont Mining’s acquisition. Conversely, Qube Holdings and Pacific Current Group saw declines, while major banks and iron ore miners also faced setbacks.

Iron Ore Prices

Mining stocks declined on Tuesday due to falling iron ore prices. BHP, Fortescue Metals, and Rio Tinto saw drops of 1%, 0.8%, and 0.2% respectively. Concerns over China’s intensifying property crisis caused iron ore prices to recede from recent highs. The October iron ore futures contract in Singapore decreased by 1% to $US120.6. Additionally, a 7% year-on-year increase in China’s iron ore supply added downward pressure. China’s property crisis, with potential defaults among developers, poses risks to its economic stability. The Reserve Bank highlighted concerns about the impact of China’s economic challenges on Australia’s growth prospects.

Leader

Botanix Pharmaceuticals Ltd – BOT (+14.29%)

Meteoric Resources NL – MEI (+10.87%)

Tuas Ltd – TUA (+10.53%)

Tourism Holdings Rentals Ltd – THL (+9.17%)

Carnarvon Energy Ltd – CVN (+6.90%)

Laggards

Lindian Resources Ltd – LIN (-16.00%)

Lynch Group Holdings Ltd – LGL (-9.76%)

Weebit Nano Ltd – WBT (-9.40%)

Imugene Ltd – IMU (-9.32%)

Syrah Resources Ltd – SYR (-9.01%)