Closing Bell

What's Affecting Markets Today

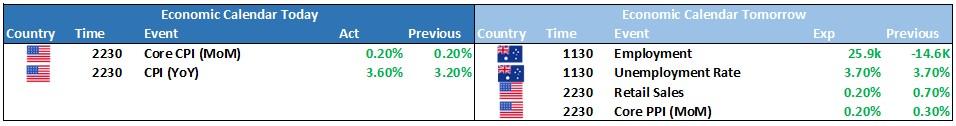

All Eyes on US CPI Tonight

Today’s US CPI report won’t significantly impact the FOMC meeting decisions for this year. Its influence will be on market confidence regarding the Fed’s plans for the first half of next year. Initially, traders anticipated a rate cut in March 2024. However, considering a rate cut for June 2024 now seems uncertain. This skepticism arises from the consistent strength of US economic data, particularly in consumption activity. As long as employment remains stable and inflation follows a moderate slowing trend, the Fed is likely to maintain higher interest rates for an extended period.

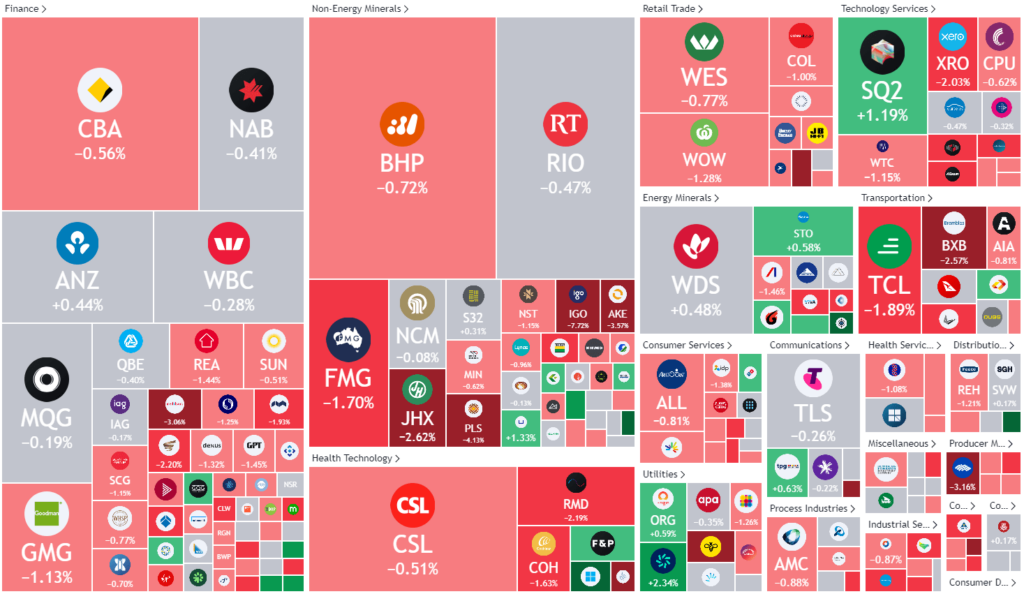

ASX Stocks

ASX 200 - 7153.9 53 (-0.74%)

Key Highlights:

The ASX sharemarket opened on a weaker note, reflecting Wall Street’s overnight downturn. The tech sector witnessed a notable 1.6% drop. Similarly, the All Ordinaries index also decreased by 0.4%. Among individual stocks, IGO, which began trading ex-dividend, experienced a 5.6% dip. In contrast, Dreadnought Resources enjoyed a 5.7% boost after revealing promising results from its Western Australia project. Monadelphous shares also rose by 1.3% on the back of a significant $100 million contract with Liontown Resources. Meanwhile, Pact Group’s shares surged by 5.2% following billionaire Raphael Geminder’s announcement to privatize the company. His firm, Kin Group, which already owns half of Pact Group, proposed a takeover bid for the remaining shares at 68¢ each, closely matching the recent market price. The shares were last seen trading at 71¢.

Leader

BDM – Burgundy Diamond Mines Ltd (12.9%)

IPG – Ipd Group Ltd (8.24%)

PGH – Pact Group Holdings Ltd (6.67%)

IPD – Impedimed Ltd (6.25%)

DLI – Delta Lithium Ltd (6.08%)

Laggards

NVX – Novonix Ltd (-10%)

NXL – NUIX Ltd (-9.49%)

VIT – Vitura Health Ltd (-9.09%)

AKP – Audio Pixels Holdings Ltd (-8.1%)

QOR – QORIA Ltd (-8%)