Closing Bell

What's Affecting Markets Today

Business Conditions Show Resilience in August

In August, business conditions witnessed a 2-point rise, showcasing the economy’s robustness even amidst a slowdown, as revealed by NAB’s monthly survey. Key indicators such as trading conditions, profitability, and employment experienced growth across various industries. However, the retail sector’s negative performance impacted the overall confidence and forward orders, which remained below average. Alan Oster, NAB’s chief economist, highlighted the significant role of car retailing and personal and household goods in this growth. The survey also indicated elevated cost and price growth measures, with labour cost growth at 3.2% and purchase cost growth at 2.9%.

Australian Dollar Records Significant Gain

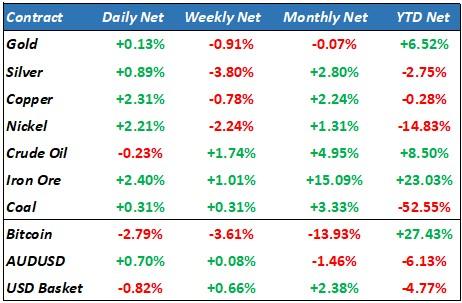

The Australian dollar experienced a notable rise of 0.9% to US64.31¢, marking its most significant daily increase in the past six weeks. This surge comes after the currency hit a 10-month low the previous week. The upliftment in the Australian dollar’s value can be attributed to the improved sentiment following the Chinese officials’ defense of the depreciating yuan. The People’s Bank of China warned against one-sided market bets, emphasizing their commitment to maintaining stability. Kristina Clifton, a senior economist at CBA, commented on the yuan’s current trading value and its estimated fair value. The Australian dollar’s performance is closely linked to the yuan due to China’s role as Australia’s primary commodities importer.

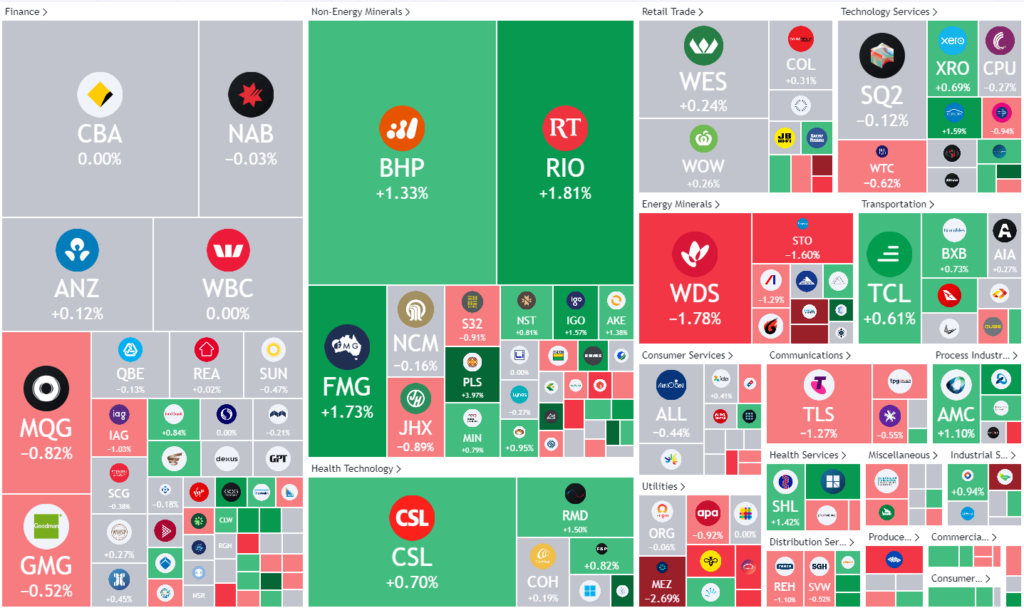

ASX Stocks

ASX 200 - 7205.3 13 (0.18%)

Key Highlights:

The ASX experienced a slight decline of 0.2% by mid-day, with gains in the mining sector being counterbalanced by drops in energy and banking. A Westpac-Melbourne Institute survey indicated a dip in consumer sentiment for September. Viva Energy saw a 6.7% decrease after reports of Swiss-based Vitol contemplating a stake sale. Liontown Resources marginally dropped by 0.2% amidst potential acquisition plans. Santos and Woodside fell by 1.7% and 1.6% respectively, while Novonix surged by 6.2%. Major mining firms like Rio Tinto and BHP witnessed gains, as did gold miners. However, major banks saw a retreat, while almond grower Select Harvest’s shares rose by 5.7%, projecting a promising 2024 crop outlook.

Leader

SHV – Select Harvests Ltd (10.17%)

LRS – Latin Resources Ltd (9.65%)

DLI – Delta Lithium Ltd (7.91%)

AGI – Ainsworth Game Technology Ltd (6.67%)

NEU – Neuren Pharmaceuticals Ltd (6.57%)

Laggards

RNU – Renascor Resources Ltd (-7.14%)

BRN – Brainchip Holdings Ltd (-6.78%)

VEA – Viva Energy Group Ltd (-6.65%)

SYR – Syrah Resources Ltd (-6.56%)

PTM – Platinum Asset Management Ltd (-6.48%)