Closing Bell

What's Affecting Markets Today

Japan’s 10-year bond yield

The 10-year Japanese government bond yield surged to 0.7% on Monday, marking its highest since January 2014. This comes as Japan’s inflation rate remains above the Bank of Japan’s 2% target, sparking media speculation about a potential shift from the bank’s negative interest rate policy. Over the weekend, the rate was at 0.650%. BOJ Governor Kazuo Ueda hinted in an interview that a policy change might be considered if there’s confidence in rising prices. This, coupled with the possibility of the BOJ having sufficient data by year-end, has intensified speculation about an early policy shift. Concurrently, the yen strengthened against the dollar, reaching the upper 146 range.

Iron ore price trend

Iron ore futures have once again surged, contradicting some analysts’ expectations. October futures in Singapore rose by 2.4% to $116.05 per tonne, a significant increase from mid-August when they were priced below $100 a tonne. Morgan Stanley highlighted that the commodity has “exceeded expectations”, especially as anticipated steel cuts in China haven’t occurred. The note from Morgan Stanley suggests that their current $90 per tonne target might be too conservative. Major mining companies like BHP, Fortescue Metals, and Rio Tinto have seen stock increases between 0.8% and 1.2%.

Oil market dynamics

Oil prices have seen a decline after a nearly 10% rally in the past fortnight. Technical indicators hint that the recent gains might have been excessive. West Texas Intermediate (WTI) hovered around $US87 a barrel, following a 2.3% increase the previous week. Since mid-June, the WTI has risen by almost $US20 a barrel, driven by production cuts from Saudi Arabia and Russia, which will continue until the end of the year. Positive economic indicators include easing deflationary pressures in China and reduced recession odds in the US. OPEC+ leaders, Saudi Arabia and Russia, have prolonged their supply cuts, with Saudi Arabia’s 1 million barrel-a-day output cut set to last until year-end, complemented by Russia’s smaller export reduction.

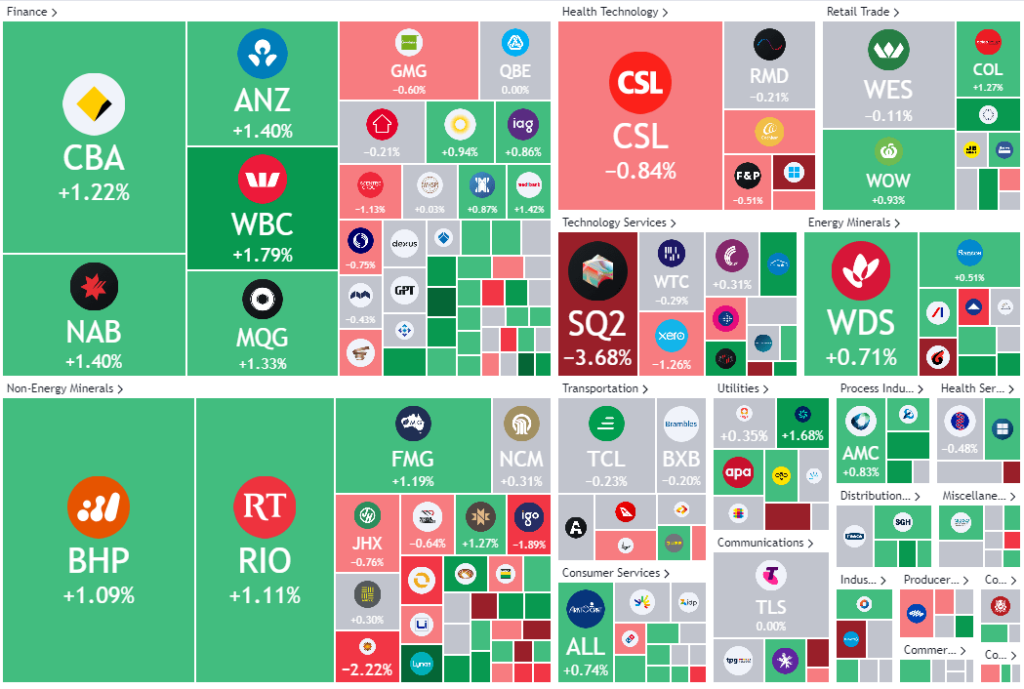

ASX Stocks

ASX 200 - 7188.2 -31.5 (0.44%)

Key Highlights:

Major tech companies, WiseTech and Xero, saw their stocks decrease by over 1% in the early trading hours. Sims, a scrap metal recycler, was among the hardest hit, plunging 12.5% due to anticipated break-even earnings in Q1 FY24, attributed to scrap price and demand challenges. In contrast, Atturra’s shares rose by 1.7% following news of its acquisition of Cirrus Networks, pushing Cirrus shares up by 31.7%. Tietto Minerals faced a 4.1% drop after retracting previous production outlook statements. Bendigo and Adelaide Bank rose by 1.1% after appointing David Foster as its new chairman. Lastly, Westar Resources surged by 8% after naming Jason Boladeras as its new exploration manager.

Sims Ltd (SGM:ASX)

Sims Ltd, a scrap metal recycling firm, has reported ongoing challenges with price and demand that are negatively impacting its current financial performance. Consequently, Sims is projecting its earnings to merely break even in the first quarter of FY24. The company’s recent market update highlighted that the demand for steel remains low, and the current scrap price isn’t adequate to encourage a strong scrap supply. As the accounts for August conclude, it’s evident that the unfavorable market conditions persist. Additionally, the US domestic market, which had previously shown resilience, is now also exhibiting signs of decline.

Leader

- AKP – Audio Pixels Holdings Ltd (19.19%)

- A11 – Atlantic Lithium Ltd (12.5%)

- PAR – Paradigm Biopharmaceuticals Ltd (7.58%)

- SVM – Sovereign Metals Ltd (7.14%)

- SYR – Syrah Resources Ltd (7.02%)

Laggards

- MEI – Meteoric Resources NL (-12.77%)

- TER – Terracom Ltd (-11.43%)

- SGM – Sims Ltd (-10.95%)

- TIE – Tietto Minerals Ltd (-9.46%)

- NVX – Novonix Ltd (-9.38%)