Closing Bell

3 Things Affecting Markets

- Australian dollar falls below US65¢, its lowest in two months.

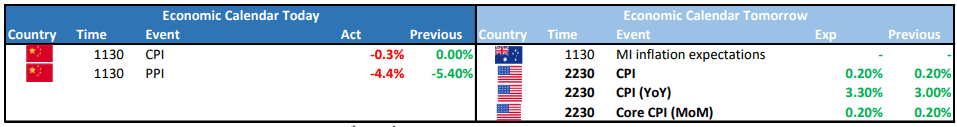

- China’s CPI drops by -0.3% YoY; PPI declines by -4.4% YoY.

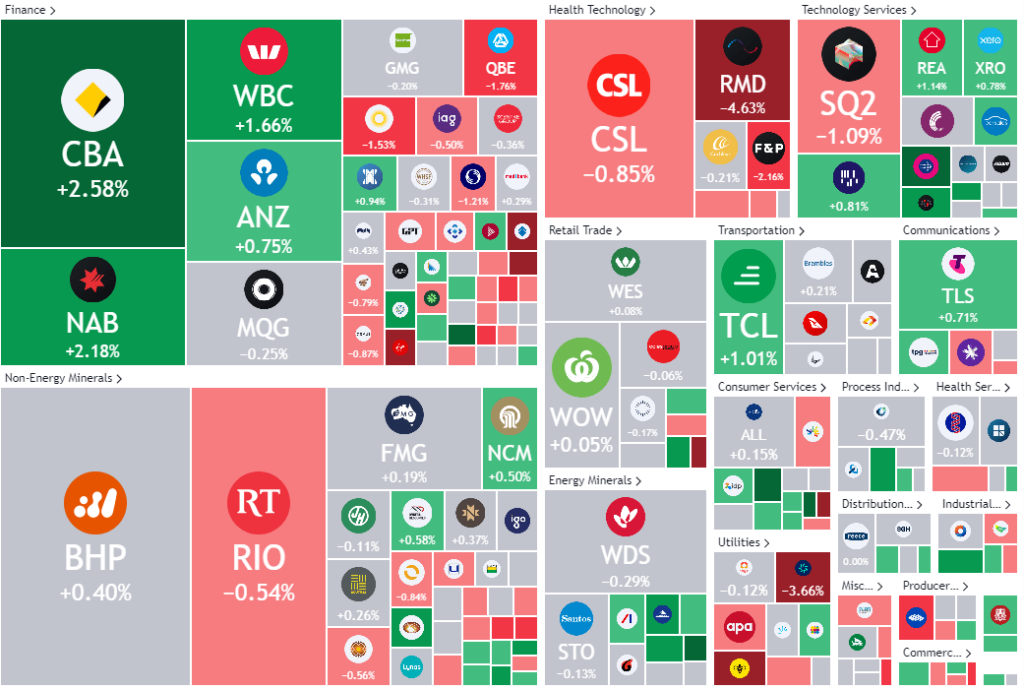

- CBA sees a 2.58% rise in shares following a reported profit of $10.2 billion.

ASX Today

Broader Economy

The overarching economic climate has flagged a few areas of concern. The Australian dollar, a vital economic indicator, plummeted below US65¢, its lowest in over two months. This considerable drop is attributed to disappointing Chinese trade data, Moody’s downgrade of US banks, and an unforeseen tax on Italian banking institutions, underscoring heightened apprehensions surrounding the global economic resilience and potential volatility within the banking realm.

China’s economic data has been erratic too. Both its consumer and producer prices dipped in July YoY, illustrating challenges in the global economic giant. Notably, China’s CPI for July recorded a YoY decrease of -0.3%. This downturn surpassed market projections, signifying its first since early 2021. The Producer Price Index (PPI) further contracted by -4.4% YoY, albeit better than June’s figure, it remained below expectations.

Notable Stock Movements

- CBA: Insights into its strategic direction, summarized as: “Larger, safer, lower profitability.” This sentiment shines a light on the evolving banking climate over the past decade, emphasizing a tilt towards enhanced safety and scale over profit margins. CBA was up 2.58% for the day.

- InvoCare: Experienced a significant upswing of 5.94% after its re-introduction to trading. The board has greenlighted a $1.8 billion takeover bid from TPG Capital.

- Coronado Global Resources: Managed to rally by 4.3% after previously reporting a 24% plunge in its revenues.

- Syrah Resources: Recorded an impressive 4.3% growth as it initiates discussions with Samsung SDI for a potential supply deal.

- Lovisa: Encountered headwinds, with a 7% dip in its valuation post Macquarie’s revised price target.

- Virgin Money UK: Declined by 4.4%, mainly due to a rating downgrade by BNP Paribas analysts.

Leader

Raised £25.1 million of new capital in a share placing to fund an expanded and accelerated exploration programme at Rupice and Rupice Northwest deposits in Bosnia and Herzegovina.

No significant news.

The board has greenlighted a $1.8 billion takeover bid from TPG Capital.

No Significant News.

No Significant News.

Laggards

No significant news.

No Significant News.

No Significant News.

No Significant News.

No Significant News.