Closing Bell

3 Things Affecting Markets

- China’s trade sees a larger-than-expected drop, impacting recovery prospects.

- Goldman predicts iron ore will enter a bear market.

- AU Business conditions remained strong in July.

ASX Today

Today, the financial markets had a mostly quiet day with few economic announcements making waves. However, there were some notable exceptions. On the corporate front, James Hardie and Myer stood out with significant movements. Additionally, the market felt the ripples of recent Chinese trade data, which impacted Asian currencies.

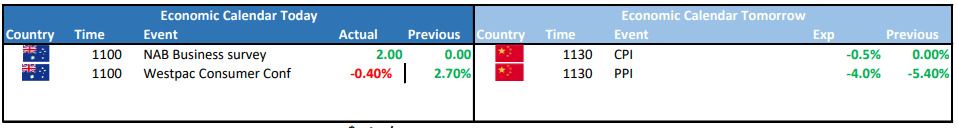

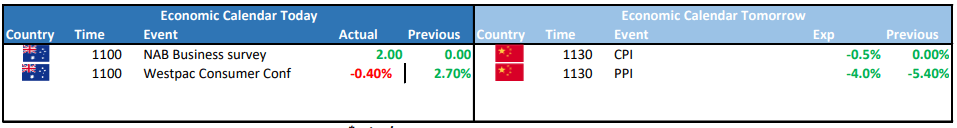

Broader Economic Landscape: Disappointing trade figures out of China showed a sharp contraction in both imports and exports – the most significant since the 2020 COVID-19 onslaught, signaling sustained frailty in Asia’s dominant economy. This data adversely impacted most Asian currencies, signaling caution about China’s trading conditions and its implications for the broader Asian economy. The dollar, however, found traction amidst uncertainties surrounding the Federal Reserve and impending inflation data. Interestingly, the Chinese yuan bucked the trend, gaining 0.3%, thanks to an optimistic daily midpoint fix from the People’s Bank of China. All eyes are now turned to the forthcoming Chinese inflation data, set to be unveiled tomorrow.

James Hardie Rises: James Hardie took center stage with its share price catapulting by 14.38%. This leap was a result of a strategic 12% price increase in Australasia during the June quarter. Impressively, this bolstered profit margins, even with declining sales volumes. However, the firm also announced a halt on its plans for a new $400 million factory in Truganina, revealing its pragmatic approach in light of the current unpredictable economic atmosphere.

Myer’s Stock Faces Headwinds: In contrast, Myer faced a daunting stock decline of 14.08%, puzzlingly coinciding with its upgraded profit predictions. The last six months posed challenges for Myer as sales growth dramatically decelerated, especially when compared to its robust performance in 2022. This could be partially attributed to a sequence of interest rate increases by the RBA, impacting retail momentum.

Leader

This leap was a result of a strategic 12% price increase in Australasia during the June quarter.

No Significant News.

No Significant News.

No Significant News.

No Significant News.

Laggards

No Significant News.

No Significant News.

No Significant News.

No Significant News.

No Significant News.