Closing Bell

What's Affecting Markets Today

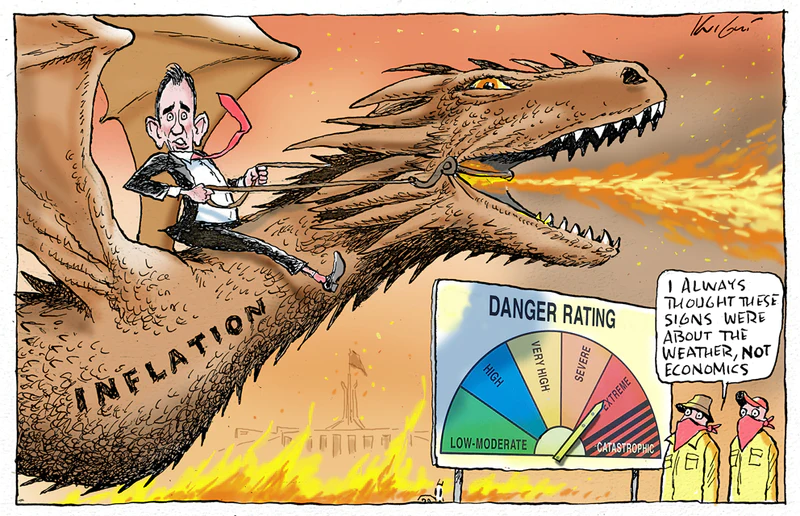

July Inflation Data

In July, Australia’s inflation rate decreased to 4.9% vs. 5.2% expected, down from the previous month’s 5.4%. This cooling of inflation has implications for the Reserve Bank’s decisions on interest rate adjustments and is likely to put future rate hikes on pause. Alongside this, the Australian dollar experienced a decline, falling by 0.4% to US64.54¢.

US Government Bond Yields

US Treasury yields have reached their lowest levels in over a week. This is attributed to larger-than-expected declines in job creation and consumer confidence. Notably, short-maturity yields, which are more sensitive to Federal Reserve rate changes, saw a significant drop, with the two-year rate descending below 4.87%.

Bitcoin and Cryptocurrency Market

The cryptocurrency market saw a surge, particularly Bitcoin, which increased by 6% in value. This was spurred by a US court ruling in favor of a Bitcoin exchange-traded-fund (ETF) launch. Following this news, other major digital currencies, such as Ethereum, Cardano, and Solana, also rose by over 5%.

ASX Stocks

ASX 200 -7297.7 +87.2 (1.21%)

Key Highlights:

Earnings Releases:

For more detailed summary click the earnings calendar here.

Today’s earnings reports from the ASX revealed diverse financial outcomes. Brambles Limited (BXB) saw a 19% rise in net profit, reaching $US703.3 million for the year, and increased its dividend. Flight Centre Travel Group Limited (FLT) experienced a significant turnaround in earnings, reaching $301.6 million, and announced a dividend for the first time since the pandemic. In contrast, Healius Limited (HLS) reported a substantial loss of $368 million, primarily due to impairments in its pathology business, and did not declare a dividend.