Closing Bell

What's Affecting Markets Today

China Stock Rebound

Chinese authorities recently reduced the stamp duty on sharemarket transactions, leading to an initial surge in the benchmark CSI 300 index by 5.5%. However, the enthusiasm was short-lived as investors expressed concerns about the ongoing issues in China’s real estate sector. Economists believe that transitioning to a consumer-driven growth model is essential for China’s economic revival. However, President Xi Jinping is hesitant about this Western-style growth model. He believes that such a model would necessitate a comprehensive social safety net, which goes against his fiscal discipline principles. Furthermore, Xi’s vision for China to lead in industries like AI, robotics, and renewable energy might be at odds with a consumption-led growth. The reluctance to make significant changes in the economic structure increases the risk of the real estate downturn affecting the shadow banking sector.

Strikes Spark Gas Price Surge

European natural gas prices witnessed a sharp increase after Chevron announced potential strikes at its liquefied natural gas export plants in Australia starting September 7. This announcement has heightened concerns in the market, especially with Europe approaching winter and needing stable gas supplies. Last week, another Australian exporter, Woodside Energy, managed to avoid strikes by reaching an agreement with unions. However, it remains uncertain if Chevron will achieve a similar resolution. If strikes do occur, it might lead to competition between Asian and European buyers for alternative gas supplies. The European region, already recovering from a severe energy crisis last year, is also monitoring gas flows from Norway, its primary gas supplier.

Australia Sends Barley to China as Tariffs End

Australia has resumed barley shipments to China after Beijing eliminated tariffs on the trade. Before the imposition of tariffs in 2020, China was Australia’s largest barley export market. The trade was valued at approximately $1.5 billion in 2017-18. The tariffs had forced Australian exporters to seek other markets, including Saudi Arabia, Japan, and Vietnam. With the recent removal of duties, there is optimism that exports to China might return to previous levels.

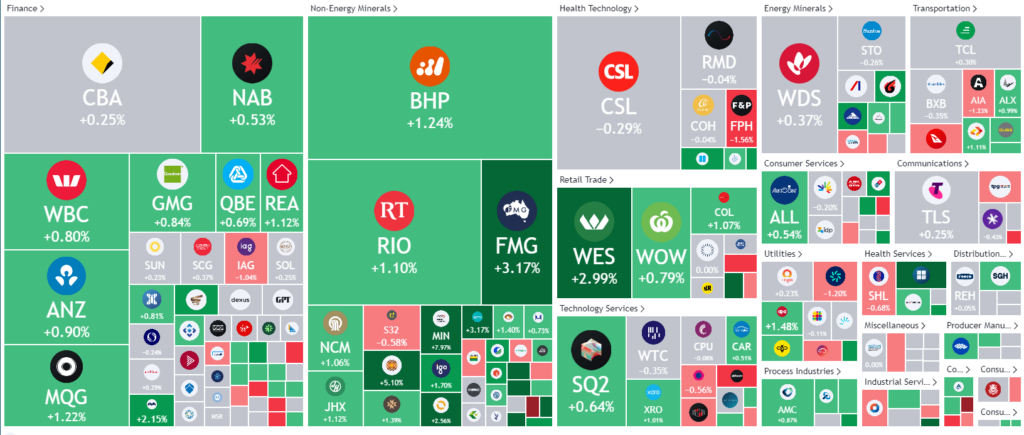

ASX Stocks

ASX 200 -7210.5 +50.7 (0.71%)

Key Highlights:

Earnings Releases:

For more detailed summary click the earnings calendar here.

Mineral Resources (MIN:ASX) experienced a surge in share price by 6.5% amidst discussions with car manufacturers about lithium partnerships. Despite a significant write-down on its iron ore operations, the company’s revenue grew by 40% to nearly $4.78 billion. Adbri Limited (ABC:ASX) reported a 3% profit increase to $49.7 million for the half-year but withheld its interim dividend to conserve capital for a plant upgrade. Star Entertainment Group (SGR:ASX) posted a $2.4 billion loss after significant write-offs from its major casinos, though revenues rose by 22%. Johns Lyng Group (JLG:ASX) anticipates a strong FY24 with a 43.2% revenue increase in 2023. Tyro Payments (TYR:ASX) achieved a record EBITDA of $42.3 million, and Zip Co (ZIP:ASX) reported record transaction volumes and a 16.1% revenue increase.